By Crypto AM: Taking a Byte Out of Digital Assets with Jonny Fry

Assets that cannot be issued by central banks and which are created out of thin air have long been heralded as a potential way to avoid the ravages of inflation. The results are mixed but, given record purchases of gold and rising geopolitical uncertainty, if investors begin to buy such assets then surely they will then do so digitally? After all, decentralised assets can be traded 24/7 and transported securely on a USB stick.

The concerns over inflation and thus the need to raise interest rates has to some extent abated, whereby leading to stock markets rallying as well as cryptocurrencies – the S&P 500 is up by 6% since January 1 2023 and Bitcoin is rallying by 39%. However, Morgan Stanley believes that there are three factors that could cause inflation to persist in 2023:

- the cost of energy – oil to rise from $80 to $1027 by Q3 2023.

- a weakening US$ – the short term prospects of the Fed not raising interest rates could lead to the $ weaking and so the price of imports rising in the US.

- inflation in the services sector could persist – “While airline costs fell in the latest CPI report, other factors could slow recent progress in curbing price pressures. These include structural labor shortages, strong owner-occupied housing and rent inflation, and resurgent medical services costs.”

A major concern has to be the sheer volume of debt that governments have, and continue to create. In the US, total debt is now a massive $31 trillion, equating to $250,000 for every US tax payer, and US government debt accounts for over 121% of the entire US economy.

Looked at in a different way, for every dollar the US has, it owes a $1.21. In the UK the situation is no better, with inflation reported at over 10% in January 2023 coupled with the UK government announcing that it had borrowed the most in a month since 1993 as (borrowing rose to a record £27.4bn in December).

A common definition of inflation is ‘too much money chasing too few goods’ and the trouble is that, with governments continuing to borrow more the cost of servicing government debts keep rising. Whilst interest rates remain high, the cost of serving these debt piles gets ever more expensive. Meanwhile, assuming that inflation persists, some are arguing that decentralised assets, which are assets are not issued by central banks and include silver, gold, certain cryptocurrencies (such as Bitcoin) and collectables, i.e., art, ought to be considered as a possible safe haven during these uncertain times.

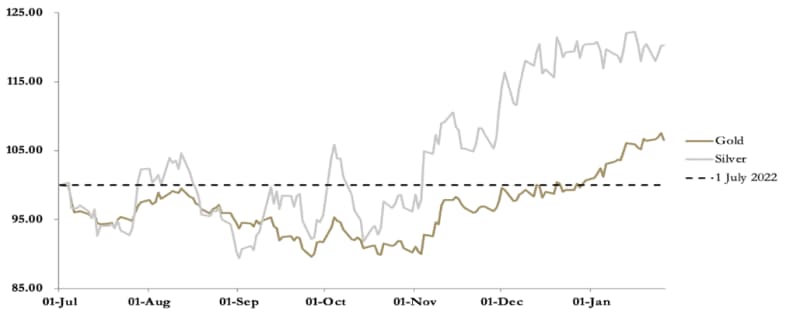

Gold and silver prices in US$ 2023-2023…

Source: Goldmoney

The price of silver and gold has indeed risen and central banks have continued to buy gold at least on a consistent basis during 2022, with China buying 35 tons in November 2022 alone.

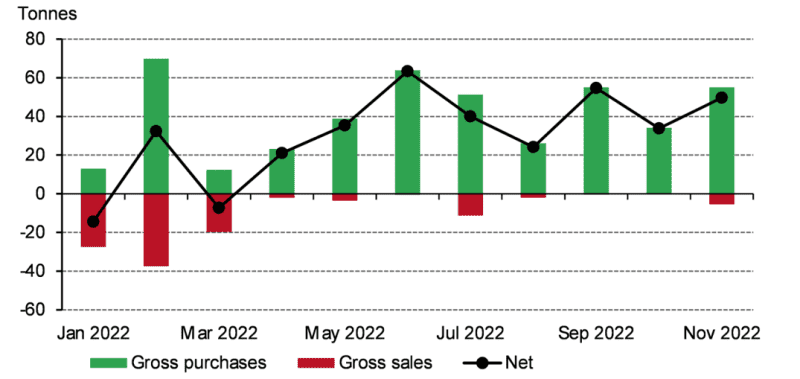

Central banks’ gold purchases…

Source: IMF IFS, Respective Central Banks, World Gold Council

This buying spree could potentially persist, as reported by Goldmoney: “Russia is now aggressively accumulating gold, and according to President Putin’s chief economist, production is being ramped up to 500 tonnes.” The same man, Sergey Glazyev, has revealed that “in future Russia will settle its trade balances in gold,” and that he expects” all members, associates, and dialog partners of the Shanghai Cooperation Organisation to do so as well.” The World Gold Council (WGC), reported that the global central banks had bought nearly 400 metric tonnes in Q3 2022, more than double the amount compared to the previous quarter and a new quarterly record. This means the year-to-date total for 2022 was 673 tonnes, higher than any other year since 1967. Demand for gold does not seem to be limited to central bankers as demand for American Buffalos and American Eagles (see below) rose to their highest levels since 1999.

Demand for gold from US retail…

Source: US Funds.com

There are a variety of ways to gain exposure to gold via a digital asset:

Alternatively, you can gain exposure to silver via a digital asset:

Another decentralised asset is offered by TheStandard.io project which creats a unique trust-less digital asset in order to provide users with a stable means of storing value. Through the use of an over-collateralized stablecoin, the asset will be linked to fiat currency such as the EURO or US dollar however it will be backed by a value greater than the face value through locking up tokenised gold, silver and top cryptocurrencies such as Bitcoin and Ethereum.

This system of borrowing stablecoin against one’s collateral but not paying any interest or having any payments due means it is an attractive option for those expecting high inflation as they will effectively be paying back much less value than they borrowed. The smart contracts used by the project allow borrowers to be the only party to access the collateral making the transaction remain trust-less and secure.

Joshua Scigala, who is the CEO of The Standard.io when asked told us: “This is effectively how the wealthy have become wealthier over hyperinflationary cycles. They would borrow at fixed interest for, let’s say, a million dollars, and then in a few years’ time when one million dollars buys only a carton of milk, they have effectively purchased properties for the value of a carton of milk. Only this time it is done without a bank, users will borrow from themselves”.

Meanwhile, the verdict as to whether Bitcoin will prove to be a hedge against inflation is uncertain. Private financial and investing advice company, The Motley Fool, summarise this thesis with: “If current trends continue, there should be increased demand for the world’s most valuable cryptocurrency. And with limited growth in supply, that price increase should outpace inflation. So yes in the short term, Bitcoin has not been a good hedge against inflation, but when we evaluate over a longer period, that narrative shifts.”

Interestingly, as for silver and gold to be a hedge, Science Direct reports in an analysis looking back to 1791 that “gold can at least fully hedge headline, expected and core CPI in the long-run. This ability tends to be stronger when we allow for the long term dynamics to vary over time. The inflation hedging ability of gold is on average higher in the US compared to the UK. Silver does not hedge US consumer prices albeit evidence emerges in favor of a time-varying long-run relationship in the UK.”

When looking back at financial markets over the last 40 years, has there ever been a time when there were not some concerns faced by investors – whether that be rising/falling interest rates, soaring inflation or not? There are currently, without a doubt, geo-political hot spots such as Ukraine the potential for some form of military conflict in Taiwan or North Korea.

However, given the levels of global debt that currently exist one does wonder if governments really have the fire power, or indeed the actual current leadership, to bolster investor confidence were there to be some external shock.

So, maybe we will witness decentralised assets proving to be popular as a way for investors to diversify their capital away from traditional assets such as bonds, stocks real estate and even cash. If this proves to be the case, then surely investors will want to own such assets in a digital format which can then be traded 24/7 and transported via a USB?

The post Decentralised assets – gold, silver, Bitcoin – has their time come? appeared first on CityAM.