By Chris Dorrell

Artificial intelligence and machine learning is set to transform trading over the next three years, a JP Morgan survey shows, as traders anticipate the potential for new technologies to shake up trading floors.

Over half of traders surveyed in JP Morgan’s eTrading survey predicted that AI and machine learning will be the most influential technology over the next three years, up from 25 per cent last year.

This was a dramatic change from last year when mobile trading applications topped the survey with 29 per cent and blockchain technology scored 25 per cent.

AI and machine learning has transformed the landscape for traders in the last few years as it can analyse and process huge amounts of data far more accurately than humans, identifying patterns and flagging opportunities.

“Machine learning is already having a big impact on the trading landscape and that will only grow with the increase in data that electronic trading brings,” Scott Waker Head of FICC e-commerce sales at JP Morgan said.

“It is being applied to more products across the trading industry, and can be used for a range of purposes to optimise outcomes for clients,” Waker continued.

The survey of 835 professional traders from 60 different countries, also found increasing pessimism towards crypto.

Some 72 per cent of traders surveyed said they have no plans to trade crypto and digital assets with only eight per cent currently doing so. In fact 43 per cent of traders said their institution will decrease their work with crypto.

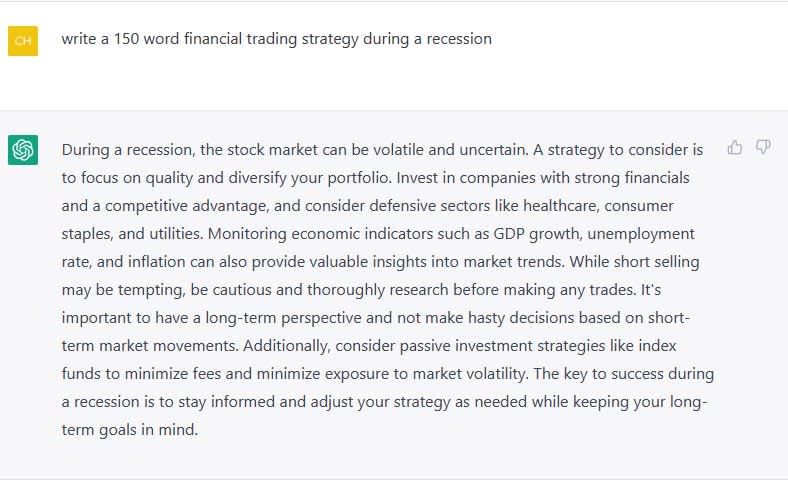

City A.M. asked ChatGPT to create a trading strategy during a recession. This is what it happened.

The post AI and machine learning to shake up trading floors, JP Morgan survey shows appeared first on CityAM.