Market experts are optimistic that Ethereum is on track to flip Bitcoin in the coming years.

Q4 2022 hedge fund letters, conferences and more

However, as history has demonstrated, if the bullish sentiment is to remain strong, it will largely depend on the continued performance of ETH and BTC. These market leaders account for approximately 60% of the total crypto marketcap and act as a beacon for many altcoins.

So where are Ethereum and Bitcoin headed, and which is likely to lead the way?

The Flippening

Investors and speculators have long debated which market-dominant cryptocurrency is more important to the space and which will perform best over the coming years.

With a marketcap of about $450 billion, Bitcoin still accounts for over twice the market share of Ethereum. However, with the Merge upgrade complete, causing ETH to become a deflationary asset and further upgrades, including Sharding in development, the debate has again been sparked about if and when the Flippening will occur.

What is the Flippening?

“The Flippening” is a popularized crypto term that refers to the hypothetical moment when Ethereum's market capitalization surpasses that of Bitcoin.

To help gauge where we're at in the current market cycle and where we're headed in the coming months and years, we interviewed Finder's panel of 56 crypto experts.

Expert predictions

The majority of the analysts interviewed have a firm conviction that the crypto market is making a sustainable rebound, with 56% of panelists agreeing that now was a good time to buy ETH. 28% believe holding the asset through these current market conditions is best, while 16% recommend selling ETH now.

Many also expressed their views on why ETH has a stronger value proposition than BTC and why the Flippening may happen sooner than expected.

Josh Fraser, a co-founder of Origin Protocol, stated that it was hard to overlook what Ethereum brings to the crypto space in acting as a base layer of innovation for many DeFi and NFT projects.

If adoption continues at current rates and dApps continue to build on Ethereum's network, Josh has high hopes for ETH.

"As scaling solutions gain mass adoption, Ethereum will be used for less financially driven data, such as identity and social coordination. It's at this point we could see Ether become a 6-figure asset."

Pedro Febrero, VP of Web3 at RealFevr, is also optimistic, pointing out that many people are turning to Ethereum staking as an additional revenue stream.

"Ethereum is the protocol that consumes the most fees," says Febrero. "It generates the most revenue for its validators."

While some experts foresee the future price of Ethereum rising drastically as more and more dApps are built on its network and the supply continues to decrease, others are less confident.

Several analysts, including Atte-Ville Pentikäinen, OTC Trader at CoinMotion and Damian Chmiel, Senior Analyst and Editor at Finance Magnates, made the point that Ethereum’s price is closely correlated to that of Bitcoin’s. As such, we won’t see ETH rebound until BTC starts to rise.

Analysis

Subjective opinions aside, it's hard to deny that the functionality and utility of Ethereum are superior to that of Bitcoin.

Bitcoin remains the king of cryptocurrencies, even being coined digital gold. That said, it is often seen as a store of value rather than the advanced global payment network that it was initially intended to be used for.

Ethereum and its smart contract functionality allow users to securely store information such as medical records, intellectual property rights and personal data. In addition, over 3,800 dApps are currently operating on its blockchain, all using ETH to pay for transactions.

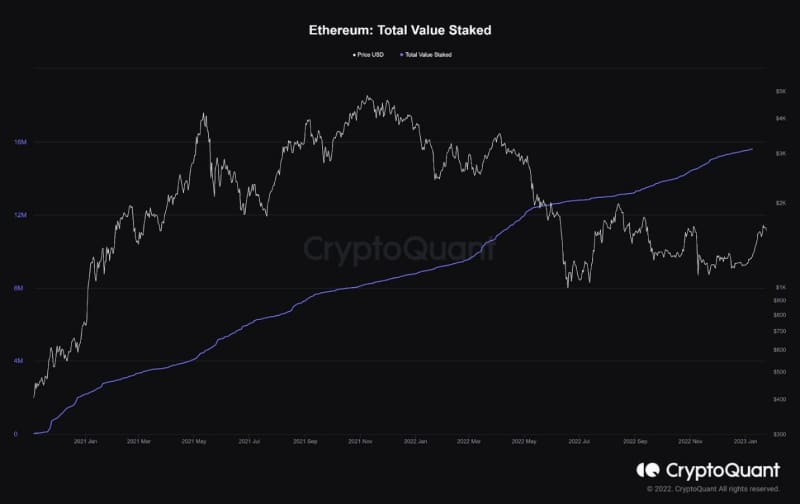

Since the Merge upgrade was completed in September last year, Ethereum has been operating as a proof-of-stake (PoS) blockchain. During this period, the amount of ETH locked in staking has continued to rise, with over 15.5 million ETH (over 12% of the circulating supply) currently staked.

Image: Ethereum: Total Value Staked | Source: CryptoQuant

In addition, the annual ETH issuance rate has plummeted from about 4% to -0.45%, with over 11.7 million ETH being removed from circulation since the upgrade.

Image: Ethereum: Annual Growth Rate | Source: Ultrasound.money

With a growing demand for AI and decentralized storage, more successful dApps will inevitably be built upon the Ethereum blockchain, increasing transaction fees and, in turn, burn rates.

If the supply of Ethereum continues to drop and the total value locked in staking continues to rise at current rates, a supply imbalance will likely occur, causing a spike in the price of ETH.

While it's difficult to say if and when the Flippening will occur, signs look positive. Finder's panel of experts are also generally optimistic, with 24% agreeing that Ethereum will overtake Bitcoin by 2025 and a further 18% by 2030.

If all goes well, it could be a big couple of years for the world's second-largest cryptocurrency, and +$10,000 ETH is not out of the question.