By Darren Parkin

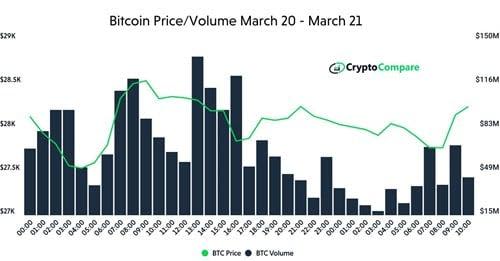

Data from CryptoCompare shows the price of Bitcoin mostly moved sideways throughout the week, starting it at around $28,000 and now trading at $27,300. Throughout the week, there was a significant drop to $26,500, but BTC recovered from it in a few hours.

Ethereum’s Ether, the second-largest cryptocurrency by market cap, moved similarly to BTC, trading between $1,750 and $1,800 throughout the week, with a dip to $1,700 and a jump to $1,850 both occurring and quickly being erased.

Since the fallout of Silicon Valley Bank (SVB), Bitcoin has been seeing an astounding performance, rising over 38% to be up over 66% year-to-date, at a time in which equity prices struggle and investors flee to safety amid a banking crisis.

This week was marked by the US Securities and Exchange Commission (SEC) targeting various cryptocurrency market players in what has been seen by some in the industry as a crackdown on the space.

Nasdaq-listed cryptocurrency exchange Coinbase, the largest exchange in the US, announced over the week it received a Wells notice from the regulator, signaling upcoming enforcement action against it.

The notice, according to the exchange, comes after a brief investigation into unspecified digital assets listed on the exchange and its staking service Coinbase Earn, Coinbase Prime, and Coinbase Wallet.

Coinbase has made it clear its products and services will keep operating as usual, and said the SEC provided little information on the potential violations of securities laws, despite it repeatedly asking the regulator to clarify which assets on the platform may be considered securities.

Over the week, the SEC charged cryptocurrency entrepreneur, along with Tron Foundation Limited, BitTorrent Foundation Ltd., and Rainberry Inc.(formerly known as BitTorrent), over the unregistered offer and sale of Tronix and BitTorrent digital asset securities.

Sun and his companies are also accused of fraudulently manipulating the secondary market for TRX and orchestrating a scheme to pay celebrities to promote TRX and BTT without disclosing they were being paid for it.

The week also saw the SEC issue an alert asking investors to “be cautious if considering an investment involving crypto asset securities,” saying these “ can be exceptionally volatile and speculative, and the platforms where investors buy, sell, borrow, or lend these securities may lack important protections for investors.

Popular multi-chain decentralized exchange SushiSwap also disclosed it received a subpoena from the SEC, indicating regulatory enforcement action may be forthcoming. The subpoena was revealed in a proposal submitted by the Sushi decentralized autonomous organization (DAO) looking to establish a legal defense fund of up to $3 million in Tether’s USDT stablecoin to cover potential legal costs.

On top of all this, a recently published report from the White House criticized digital assets for failing to deliver on their initial promises and raising risks for consumers and the US financial system.

The report raises questions about the benefits of digital assets as a distribution tool for intellectual property and financial value, an improved payment mechanism, and an avenue for increased financial inclusion. It suggests that despite the hype around cryptocurrencies, they have brought “none of these benefits” so far.

FTX gets $500 million for refunds

Meanwhile, collapsed cryptocurrency exchange FTX appears to have secured $500 million to reimburse creditors by selling off assets it had invested in, including a transfer of about $404 million to investment fund Modulo Capital, and $95 million from the sale of its stake in Mysten Labs, the company behind the Sui blockchain.

Modulo Capital, run by Xiaoyun “Lily” Zhang and Duncan Rheingans-Yoo, received $475m from FTX before its collapse. A proposed settlement would prevent a costly cash lawsuit between Modulo and FTX. The exchange valued the settlement at $460 million, as it required Zhang and Rheingans-Yoo to withdraw their claims against the company for $56 million. it

The US has also moved against the founder of Terraform Labs, Do Kwon, who was arrested over the week in Montenegro. In a court filing signed by United States Attorney Damian Williams, Kwon is charged with eight separate counts, including commodities fraud, securities fraud, wire fraud, and conspiracy to defraud and engage in market manipulation.

Crypto AM reported that Kwon could face charges from the state’s Prosecution Office for allegedly utilizing falsified travel documents from Costa Rica, which were initially flagged by Interpol.

Francisco Memoria is a content creator at CryptoCompare who’s in love with technology and focuses on helping people see the value digital currencies have. His work has been published in numerous reputable industry publications. Francisco holds various cryptocurrencies.

Featured image via Unsplash.

The post SEC targets crypto space after stablecoins’ de-pegging event, while FTX recovers $500 million for refunds appeared first on CityAM.