By Jack Barnett

London’s FTSE 100 was pulled higher by banks clawing back losses yet again today, with Barclays and Standard Chartered initially leading the charge before running out of steam heading into the close.

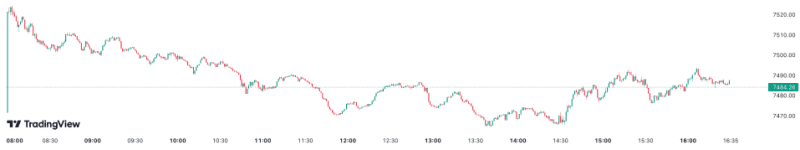

The capital’s premier index jumped 0.17 per cent to 7,484.26 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, slipped 0.72 per cent to 18,396.69 points.

Britain’s biggest lenders once again charged the FTSE 100 higher during opening exchanges, marking the second successive day of decent gains for the UK banking sector, although that rally petered out in the afternoon.

Barclays scaled around half a percentage point, as did Asia-focused lender Standard Chartered, and the country’s largest bank HSBC added a shade over 0.1 per cent.

FTSE 100 crept higher today after an early surge

Continental lenders clocked a similar day to their London counterparts, with early advances fizzling out and actually swinging into tough losses.

Last Friday, Deutsche Bank shed as much as 14 per cent, but retraced some of those losses yesterday. The German slipped back into the red again today, shedding around 1.5 per cent.

In France, Societe Generale slipped around one per cent, while in Madrid, Santander was a bright spot, kicking nearly two per cent higher. France’s BNP Paribas was also up marginally.

French authorities raided the offices of several European lenders over suspicions they have dodged tax.

“There still appears to be an abundance of caution when it comes to driving prices higher, in the wake of the turmoil of last week, with outperformance from the basic resources and energy sector offsetting weakness in commercial real estate, helping to keep the FTSE100 in positive territory,” Michael Hewson, chief market analyst at CMC Markets, said.

The pound strengthened about 0.4 per cent against the US dollar today after Bank of England Governor Andrew Bailey last night signalled the central bank will look through banking sector volatility and press on with rate hikes if inflation sticks around.

Speaking at an event at the London School of Economics, Bailey said he and his team of rate setters remain very “alert” to inflationary pressures, but signalled borrowing will not reach pre-financial crisis levels of around five per cent.

Bailey, in response to a grilling by MPs on the treasury committee, today also backed the underlying robustness of the UK’s banking sector.

Oil prices gained about halve a percentage point.

The post FTSE 100 close: Barclays charge runs out of steam as Deutsche Bank swings to losses appeared first on CityAM.