Why is this, and how does the average American in each state plan to use their tax refunds this year?

The pandemic benefits the US government designed to help Americans weather the storm of COVID-19 and its unpredictable lasting effects expired this year. And although the tax deadline (April 18th, 2023) has passed, more than 5 million taxpayers said they haven’t filed their taxes yet, and another 5% plan to file for an extension this year.

What does that mean for the 3 in 10 Americans who rely on getting a tax refund just to make ends meet? 80% of Americans believe the government should have given additional tax credits this year due to the mass layoffs and in the wake of the intense inflation.

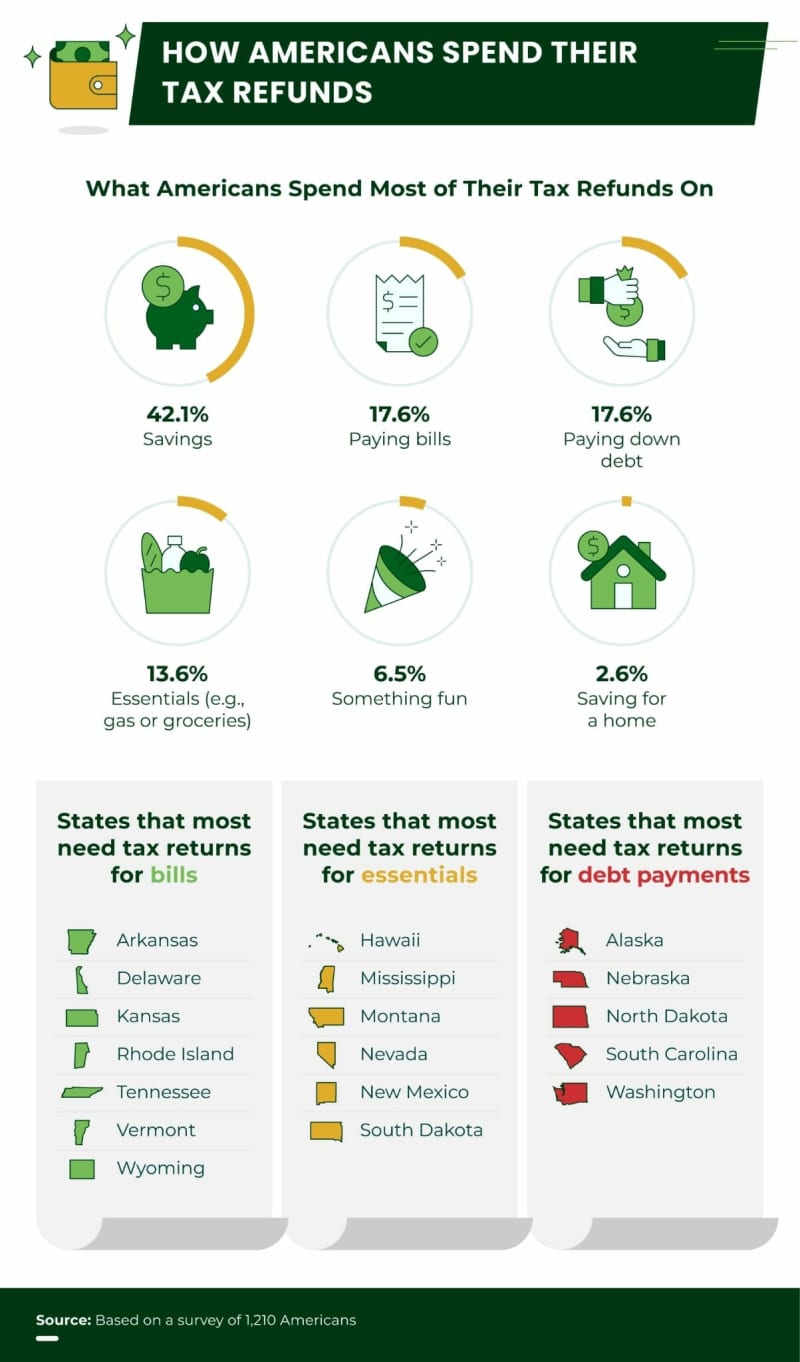

How Americans Spend Their Tax Refunds

According to arecent survey about how Americans spend their tax refunds and what they’ve already received this year, only eight states received a larger tax refund than what they received last year.

Residents of Washington, Idaho, Montana, Wyoming, New Mexico, Arkansas, and Maine all reported a larger refund in the 2022 tax season than they received in the year prior. That leaves the people who live in the 42 other states receiving a smaller refund this year.

In fact, 72% of Americans have received, or expect to receive, a significantly smaller tax refund compared with years prior.

IRS data shows that most people will or have received a 10% decrease in their refunds, with major chains like Walmart commenting that the lower tax refunds are linked to consumer spending which is also tied to an increase in the lack of affordability of the lifestyle many are accustomed to.

For those who rely on their refunds to make ends meet or to pay for bills, debt, and essentials… What does that mean?

For many, 50% of Americans actually, receiving their tax refund means that they can pay down debt, cover bills, or be able to pay for essentials like groceries and gas without going paycheck to paycheck.

Stretching their refunds will be complicated this year, especially with reports showing that refunds will be significantly lower than years before due to a slowing economy.

Although 42.1% of Americans say that they use their tax refunds for savings overall, the way people use that money varies by state.

Arkansas, Delaware, Kansas, Rhode Island, Tennessee, Vermont, and Wyoming residents report that they use their tax refunds for bills more than anything else. Bills would include payments for cars and their mortgage and similar recurring payments.

People who live in Hawaii, Mississippi, Montana, Nevada, New Mexico, and South Dakota rely on their tax refunds in order to pay for essentials like gas and groceries.

For paying down debt, folks in Alaska, Nebraska, North Dakota, South Carolina, and Washington state rely on their tax refunds.

What’s interesting is that of all the states in and outside the continental U.S., only those in Iowa plan to use their tax refunds for something fun and recreational like a vacation, a night out, or attending concerts.

Perhaps it’s because Iowa is known as a tax-friendly state, so people living in the state aren’t having to pay as much on goods, services, property, and other sorts of taxes which means they can save for a rainy day or they can use their tax refunds for fun.

Relief in 2023

Even though Americans might save on taxes due to the historically large inflation adjustments set by the IRS, as many as 52 million Americans will be planning on using their tax refunds just to make ends meet.

However, upcoming tax changes for the 2023 filing year mean that some taxpayers will be provided with relief at a time when people are struggling with the economic issues of the last several years like supply disturbances and record-high inflation. But that relief won’t come until the 2023 tax filing season.

So What Does That Look Like For The Average Taxpayer In 2023?

The historically significant inflation adjustments by the IRS make it so Americans might get some kind of financial reprieve. Married couples who are filing jointly for the tax year 2023 will see a standard deduction increase of $1,800 more than years prior.

Those who are filing separately will see a standard deduction rise of $900. For those who are filing as the heads of households, they’ll see a standard deduction increase of $1,400.

The tax deadline of April 18th has already passed, but over 5% of Americans plan to file for an extension. With that being the case, the extension deadline for the 2022 tax year is October 16th. Depending on your location, that deadline may be variable. See what that looks like where you live here.