By Nicholas Earl

The UK’s water regulator is prepared to place Thames Water under protective measures, which would effectively nationalise the company, if the supplier collapses under its £14bn debt pile.

Ofwat chief executive David Black told MPs today the regulator is “ready to employ” a special administration regime for Thames Water if it fails to secure the investment it needs.

This would be comparable to the fate Bulb Energy during the energy crisis nearly two years ago, when it was placed under de-facto nationalisation for nearly a year.

Ofwat’s chair, Iain Coucher, who joined Black in front of the Environment Food and Rural Affairs Committee, confirmed the regulator is working with the government to ensure measures are in place in case Thames Water collapses.

However, both Ofwat officials played down the prospect of any imminent breakdown for Thames Water, which Coucher said was “unlikely”, while Black said a special administration regime “won’t be needed.”

They are now confident its £4.4bn liquidity position and recent £750m reprieve from shareholders will ensure the supplier stays afloat, provided the funds are secured.

“The money has not yet arrived at the company, and so at that point we will feel more confident,” Black said.

He also confirmed that Ofwat has been engaged in discussions with Thames Water for months over its need to improve its financial resilience and operational performance amid a five year high in sewage spills and over £30m accrued in fines.

Coucher warned that even if the supplier survives it funding challenges, the problems at Thames Water are “deep-rooted” and the function of “cost overruns and poor performance,” which if not fixed, will mean they “have the same problems in the future.”

I won’t apologise, says former Ofwat boss

The Ofwat officials were questioned by MPs over the state of the water industry following an earlier session with Thames Water’s interim co-chief executive Cathryn Ross.

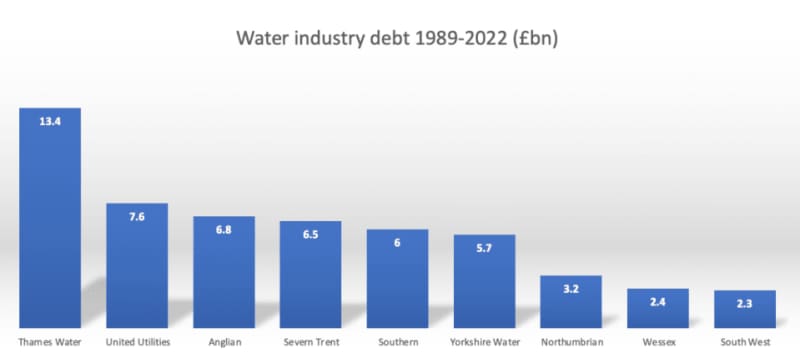

Ross, who used to be the head of Ofwat, earlier refused to apologise for the state of the water industry, which is now being weighed down by £65bn of collective debt.

“I won’t apologise for my role as chief executive of Ofwat, no,” she said, when asked by Labour MP Darren Jones.

Former Thames Water owner Macquarie ramped up the supplier’s debt from £3bn to over £10bn before selling the company in 2017, while it also extracted nearly £3bn in dividends, at a higher rate than the profits it made on an annual basis.

This was enabled through the 2014 price review, which was approved when she was chief executive of the regulator.