Financial giants have made a conspicuous bullish move on Sea. Our analysis of options history for Sea (NYSE:SE) revealed 27 unusual trades.

Delving into the details, we found 55% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $116,735, and 23 were calls, valued at $2,162,926.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $35.0 to $75.0 for Sea over the recent three months.

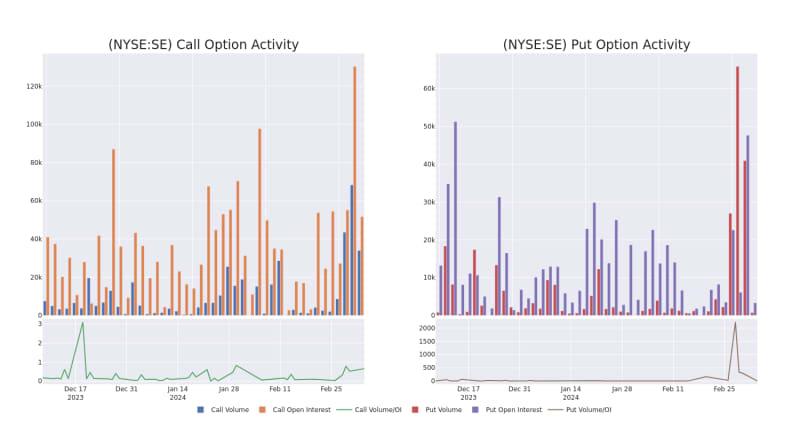

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Sea's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Sea's significant trades, within a strike price range of $35.0 to $75.0, over the past month.

Sea Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

About Sea

Sea operates Southeast Asia's largest e-commerce company, Shopee, in terms of gross merchandise value and number of transactions. Sea started as a gaming business, Garena, but in 2015 expanded into e-commerce, which is now the main growth driver. Shopee is a hybrid C2C and B2C marketplace platform operating in eight core markets. Indonesia accounts for 35% of GMV, with the rest split mainly among Taiwan, Vietnam, Thailand, Malaysia, and the Philippines. For Garena, Free Fire was the most downloaded game in January 2022 and accounted for 74% of gaming revenue in 2021. Sea's third business, SeaMoney, provides mostly credit lending.

After a thorough review of the options trading surrounding Sea, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Sea

- With a volume of 9,082,229, the price of SE is up 1.04% at $54.46.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 70 days.

What The Experts Say On Sea

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $66.2.

- An analyst from Benchmark persists with their Buy rating on Sea, maintaining a target price of $78.

- Showing optimism, an analyst from JP Morgan upgrades its rating to Overweight with a revised price target of $70.

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Sea with a target price of $68.

- An analyst from JP Morgan has decided to maintain their Neutral rating on Sea, which currently sits at a price target of $43.

- An analyst from Wedbush has decided to maintain their Outperform rating on Sea, which currently sits at a price target of $72.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Sea options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.