Financial giants have made a conspicuous bearish move on Nucor. Our analysis of options history for Nucor (NYSE:NUE) revealed 8 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $79,000, and 6 were calls, valued at $211,860.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $130.0 to $250.0 for Nucor during the past quarter.

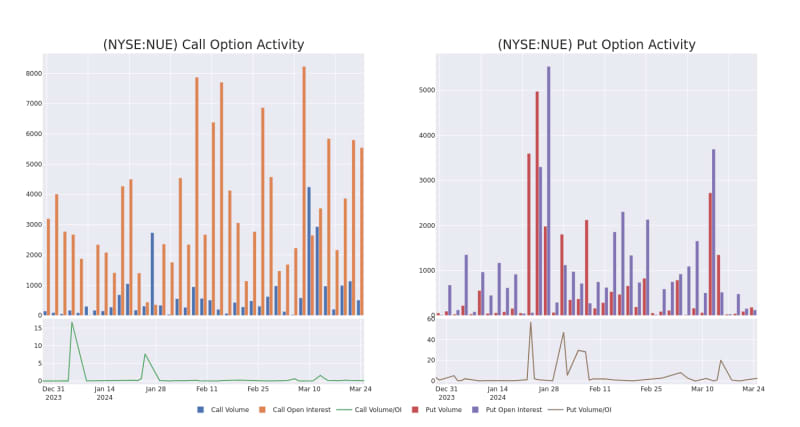

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Nucor's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Nucor's substantial trades, within a strike price spectrum from $130.0 to $250.0 over the preceding 30 days.

Nucor Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

About Nucor

Nucor Corp manufactures steel and steel products. The company also produces direct reduced iron for use in its steel mills. The operations include international trading and sales companies that buy and sell steel and steel products manufactured by the company and others. The operating business segments are: steel mills, steel products, and raw materials, the steel mills segment derives maximum revenue. The steel mills segment includes carbon and alloy steel in sheet, bars, structural and plate; steel trading businesses; rebar distribution businesses; and Nucor's equity method investments in NuMit and NJSM.

Having examined the options trading patterns of Nucor, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Nucor Standing Right Now?

- With a trading volume of 402,240, the price of NUE is up by 0.29%, reaching $195.01.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 28 days from now.

Expert Opinions on Nucor

In the last month, 1 experts released ratings on this stock with an average target price of $240.0.

- In a positive move, an analyst from Citigroup has upgraded their rating to Buy and adjusted the price target to $240.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Nucor options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.