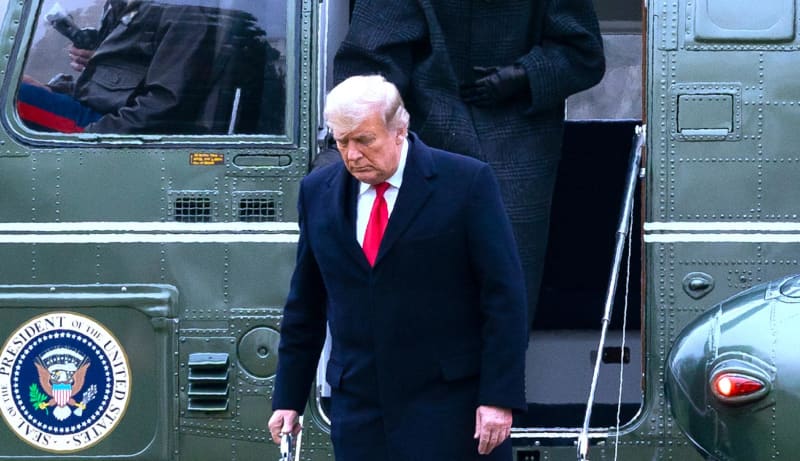

Former President Donald Trump's latest business venture is continuing its rapid descent since the debut of its initial public offering (IPO) in late March. The stock's slide has also significantly impacted the net worth of its majority stakeholder.

Ever since trading at a high of roughly $80 per share, the Trump Media and Technology Group (TMTG) stock, which is trading on the Nasdaq Composite using the former president's initials $DJT, closed on Friday afternoon at $40.42 per share according to CNN. That marks a new record low for the stock as investors continue to sour on the parent company of Trump's Truth Social microblogging app.

The 45th president of the United States, who owns approximately 78 million shares of $DJT, initially saw the value of his shares boom to approximately $4.9 billion when the stock was soaring after the IPO. However, the stock's continued slide has been a significant financial hit for Trump, whose shares are now worth around $3.2 billion.

READ MORE: 'Stupid' : Billionaire investor says people buying 'scam' Trump media stock are 'dopes'

Friday's new low for $DJT comes a day after business magnate Barry Diller — the chairman of Expedia Group worth more than $4 billion — called the former president's stock a "scam" that only "dopes" are buying. He likened TMTG's initially strong performance to "meme stocks" like Gamestop and AMC, which saw their values sharply increase despite investor sentiment due entirely to the whims of amateur investors online.

""I mean, it's ridiculous. The company has no revenue," Diller told CNBC. "It’s a scam, just like everything he’s ever been involved in is some sort of con."

TMTG's value started cratering after a filing submitted to financial regulators showed that the company suffered more than $50 million in losses in 2023, and needed the funding of Digital World Acquisition Group (the company it merged with to go public) to stay operational. That filing, combined with ongoing litigation between Trump and the two men he tasked with taking the company public, may continue to wreak havoc on $DJT's share price when its third week of trading begins next week.

In February, Andy Litinsky and Wes Moss — who facilitated the IPO and own a combined 8.6% in TMTG stock — sued Trump in Delaware Chancery Court. They accused him of "11th hour, pre-merger corporate maneuvering" to "drastically increase" the number of share to one billion, thereby reducing their stake to les than 1% of the company. Trump, who owns 78 million shares, was accused of creating the new shares to potentially give to himself and members of his family.

READ MORE: 'No legitimate business purpose': Trump sued by Truth Social business partners

Trump, in turn, sued Litinsky and Moss in Florida, after TMTG lost $3 billion in value in its first week of trading. Trump accused his business partners of botching the merger with Digital World Acquisition Group and mishandling the setup of TMTG's corporate governance structure. Delaware Chancery Court Judge Sam Glasscock III was reportedly "gobsmacked" that Trump sued Litinsky and Moss in the Sunshine State rather than countersuing them in his court, and may sanction the former president over the Florida suit.

TMTG is the first time Trump has taken one of his companies public since Trump Hotels and Casino Resorts in the 1990s. That company went from trading at a high of nearly $40 per share to a penny stock in less than a decade.

READ MORE: Here's what happened the last time Trump tried to take one of his companies public