Many people, especially America's wealthiest, try to avoid paying taxes, but one billionaire has a bit of a different take on the concept.

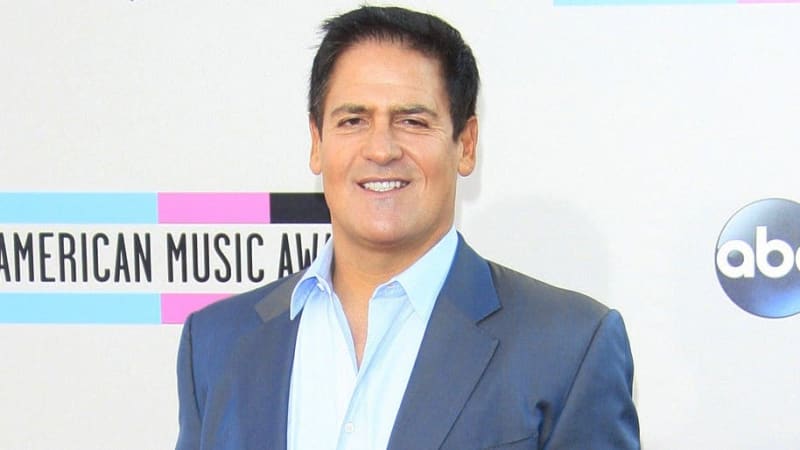

Entrepreneur Mark Cuban, known for investing in some of the most innovative small businesses in America and his outspoken views and dynamic business acumen, recently took to X to announce a significant payment to the U.S. Treasury, affirming his belief in fiscal responsibility as a form of patriotism. Cuban revealed he had transferred $288 million to the IRS, correcting an earlier figure he had shared online.

Don't Miss:

- Join the elite. Invest in Epic Games andown a piece of the $17 billion Fortnite empire.

- This ‘Future of Gaming’ startup disrupting a $272 billion industry isnow letting anyone invest for a limited time.

“I pay what I owe,” Cuban posted, emphasizing his commitment to contributing to the nation’s welfare. “This country has done so much for me, I'm proud to pay my taxes every single year.”

The Dallas Mavericks owner and “Shark Tank” star has long said that "after military service, paying your taxes is the most patriotic thing we can do.” His recent posts not only underscore his principles but also seem to critique others, particularly notable figures who might not share his enthusiasm for tax compliance, even taking a brief swipe at former President Donald Trump.

Cuban’s public declarations reflect a broader socio-political stance that intertwines wealth, responsibility and patriotism. Cuban, despite critiquing the platform regularly, often uses X to defend and back up his political stances.

Trending: Invest alongside execs from Uber, Facebook and Apple in thiswellness app Transforming a $5.6 TRILLION dollar industry.

Cuban has not shied away from political discourse, often addressing economic policies and their impact on entrepreneurs and average citizens. His engagement ranges from commenting on social issues to critiquing political figures, positioning himself as an advocate for transparent and responsible governance.

Historical Context Of Taxation And Patriotism

Taxation as a patriotic duty has deep roots in American history, albeit not as significant and outspoken as avoiding or rebelling against taxes. During the early 20th century, paying taxes was often portrayed as a civic duty integral to national solidarity and success. This sentiment was pronounced during both World Wars when taxes were framed as a direct contribution to the national effort.

Before establishing the modern tax system, the U.S. relied heavily on tariffs and excise taxes. It wasn’t until the 16th Amendment in 1913 that the federal income tax was permanently set as a cornerstone of U.S. fiscal policy. During these times, wealthy industrialists like Andrew Carnegie and John D. Rockefeller often engaged in philanthropy, which was seen as a way to give back to society — a precursor to today’s discussions about the role of wealth in public service.

Carnegie and Rockefeller shifted the role of ultra-high-net-worth individuals in American society. Rather than hoarding wealth for generations, they made it a trend among the wealthy to give money to building libraries and great works that benefit society. This trend, while not as pronounced in today’s society, still can be seen over a hundred years later. For example, notable figures like Bill Gates and Warren Buffett have pledged to give the majority of their fortunes to charitable causes.

Keep Reading About Startups:

- Invest like a millionaire. Exclusive opportunity toinvest in Epic Games $17 billion gaming empire.

Cuban’s actions highlight a continuing conversation about the obligations of the wealthy in American society. As debates around wealth inequality intensify, figures like Cuban, who openly embrace their tax obligations, challenge others in similar financial brackets to demonstrate their commitment to the country’s well-being.

This movement poses some issues among Americans. Alongside a deeply rooted ideology around avoiding taxes, many don't want to pay into a tax system in which they don't believe their money is going to good use. In 2023, $658 billion was paid on interest to the national debt. Cuban would need to pay his tax bill more than 2,384 times just to cover the interest bill on the debt, a number expected to skyrocket in 2024.

As the United States navigates complex social and economic challenges, the perspectives and actions of influential entrepreneurs like Cuban will likely play a critical role in shaping public discourse around wealth, responsibility and patriotism.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.