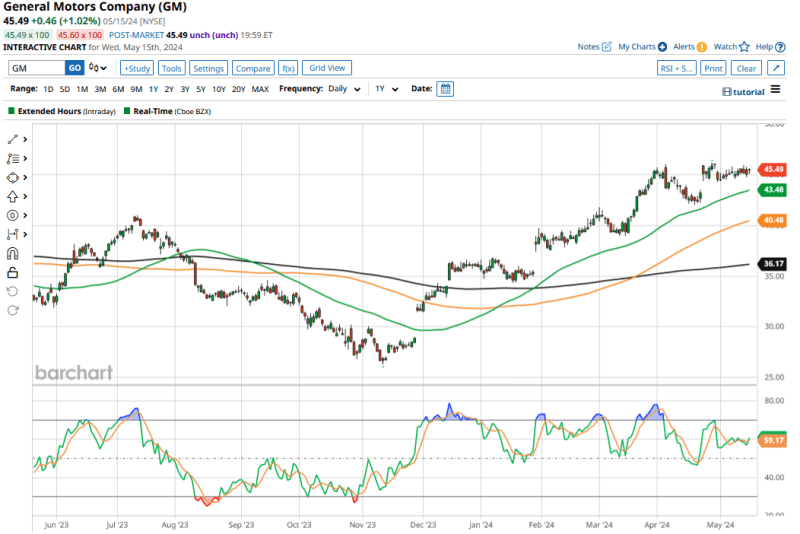

With a YTD gain of almost 27%, General Motors (GM) is among the top 50 gainers in the S&P 500 Index ($SPX), and is outperforming rival automaker Ford (F), which is barely flat for the year. What’s the forecast for GM stock and is the Detroit “Big Three” icon headed towards $100? We’ll discuss in this article.

To start, let’s look at GM’s financial performance this year, which has been a key driver of its YTD outperformance.

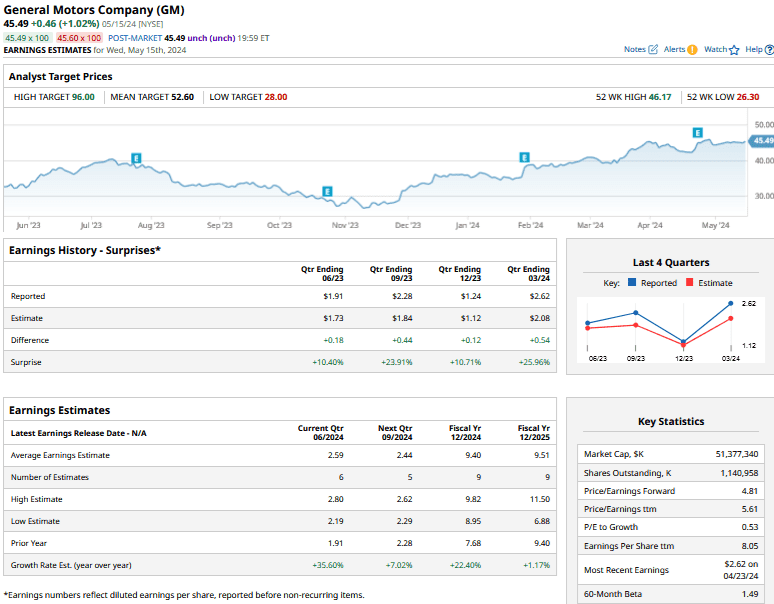

GM Reported Better-Than-Expected Earnings in Q1

In Q1, GM reported revenues of $43.01 billion – up 7.6% YoY, and comfortably ahead of the $41.92 billion that analysts expected. The company’s adjusted earnings per share (EPS) came in at $2.62, which again easily surpassed the $2.08 that analysts were expecting.

Importantly, the pricing environment was strong during the quarter, and average selling prices did not fall to the extent that GM anticipated.

After a strong Q1, GM raised its full-year guidance, and expects to post an adjusted EPS between $9-$10 in 2024 – up from the previous guidance of $8.50-$9.50. It also revised the adjusted automotive free cash flow guidance by $500 million, and now expects the metric to range between $8.5 billion-$10.5 billion this year.

GM stock trades at a next 12-month (NTM) price-to-earnings (PE) multiple of a mere 4.76x. While Detroit automakers never commanded “Tesla-like premiums,” the current valuations look depressed even by the low bar that markets have set for legacy automakers like Ford and General Motors.

GM Stock Trades At Depressed Valuations

For instance, GM’s current NTM PE is a significant discount to its three-year average of 6.45x, and is only a tad higher than the low of 4.2x over the period. One might have expected value investors to pounce on the stock at these valuations. However, the reverse seems to be happening, as Warren Buffett – arguably among the best value investors of all time – exited GM stock last year.

Incidentally, during the Q1 earnings call, GM touched upon its valuation when CFO Paul Jacobson acknowledged that the company’s PE multiple is lower than historical averages, as well as its peers and other industrial companies. He added, “we’re not satisfied and know that we have a lot of work to do on our valuation and remain committed to improving it.”

Four Risks General Motors Investors Should Watch Out For

There are reasons why GM stock trades at a mid-single digit PE multiple. Here are some of the key risks and challenges that the company is facing:

- Peak profits and vehicle prices: GM and Ford have been posting healthy profits, capitalizing on the strong pricing and demand for SUVs, trucks, and pickups in North America. There are, however, fears that the pricing could fall going forward, and hurt the margins for legacy automakers. Predictions of a slowdown in the U.S. economy are not helping matters, and a section of the market is shying away from cyclical names like GM.

- Higher inventory: On a related note, GM ended Q1 with an inventory of 63 days, which was higher than what it forecast.

- EV losses: While legacy automakers' internal combustion engine (ICE) businesses continu to do remarkably well, they are saddled with losses in their electric vehicle (EV) businesses, with GM being no exception. Given the price war initiated by the U.S. EV market leader Tesla (TSLA), EV pricing might continue to act as a headwind in the short to medium term.

- Losses in the international business: While GM’s North America business continues to do well, the company posted losses in China and other international markets in Q1. In particular, there are concerns over its China business, which used to be a profit machine for GM a few years back. The macro dynamics have since changed on the mainland amid competition from domestic automakers, and foreign companies like GM are losing market share.

- Cruise self-driving unit: GM’s Cruise self-driving business has failed to live up to expectations, and last year the company had to pause its operations, which have since resumed. The cash-guzzling business might need more funding, which could be a drain on GM’s otherwise strong cash flows.

Why Fears Over General Motors Could Be Overblown

To be sure, while these all are legit fears, I believe they could be overblown. First, the U.S. economy is holding up relatively well, and while Fed rate cuts look to be off the table in the immediate term, the central bank should be in a position to cut rates later this year.

In its EV business, GM still expects volumes between 200,000-300,000 in 2024, while forecasting a variable profit in the back half of the year. It further expects its EV business to post mid-single-digit margins in 2025. While delivering EV profitability won’t be easy, given the slowing demand and pricing pressure, GM is quite confident it can achieve this feat.

As for China, GM expects the business to be profitable for the rest of the year. CEO Mary Barra said that the company is “committed to China” in the long term, even as analysts probed whether GM could consider selling that business, as it did with several other international markets.

GM Stock Forecast

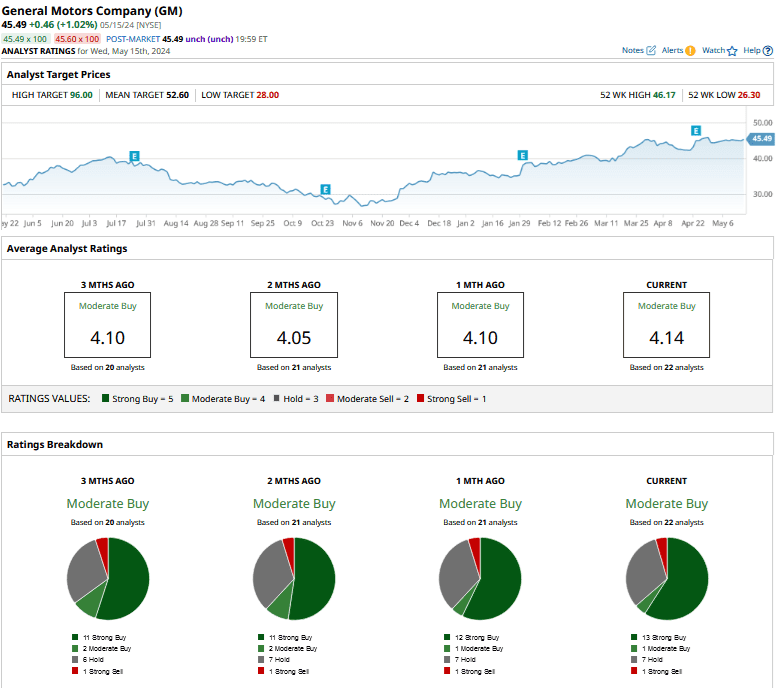

Of the 22 analysts covering GM stock, 13 have a “Strong Buy” rating and 1 carries a “Moderate Buy.” Seven more analysts rate it as a “Hold,” and 1 says it's a “Strong Sell.” GM’s mean target price is $52.60, while the Street-high target price is $96 – which, if hit, would mean the stock more than doubling from these levels.

GM’s valuations are too cheap to ignore, and the stock looks long overdue for a rerating. In my view, if GM can hit the kind of EV margins that it is touting by the next year, the stock could be in contention to hit $100, especially if the ICE business continues to perform the way it has done for the last couple of years.

On the date of publication, Mohit Oberoi had a position in: F , GM , TSLA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.