Gold has been on a wild ride this year. June-dated gold futures (GCM24) reached a new record of $2,454.20 on May 20 before easing back, driven higher by central bank stockpiling, geopolitical tensions, and uncertainty over Federal Reserve monetary policy. Specifically, central banks in China, Turkey, India, and Kazakhstan have all been increasing reserves to cut their U.S. dollar (DXM24) dependency.

Against this backdrop, this precious metal shines as a go-to safe haven for investors - and the yellow metal’s glittering allure is not fading anytime soon. Goldman Sachs (GS) predicts prices could cross $3,000 per ounce by the year's end.

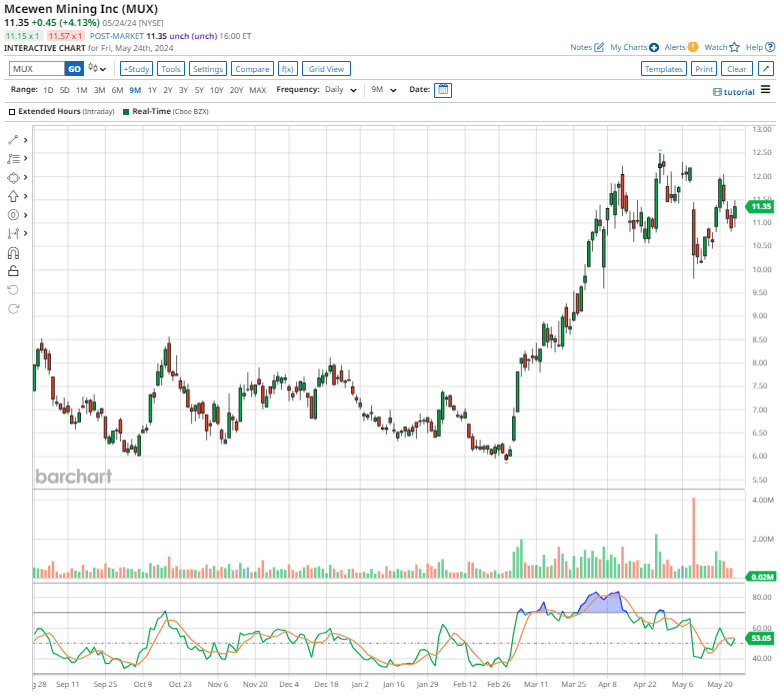

Yet, while gold itself dazzles, gold miners like McEwen Mining Inc. (MUX) toil relentlessly underground. Despite concerns in the mining sector over high rates and inflation, MUX stock has been surfing the golden wave, outperforming the broader market this year, even bouncing back after a 15.2% dip post-Q1 earnings.

So, is it time to hitch a ride on this golden chariot, or is some caution warranted? Let's have a closer look.

About McEwen Mining Stock

Incorporated in 1979, Canadian mining company McEwen Mining (MUX) engages in the exploration, development, production, and sale of gold and silver deposits in the U.S., Canada, Mexico, and Argentina. McEwen Mining also holds a 47.7% interest in McEwen Copper, which is developing the large, advanced-stage Los Azules copper project in Argentina.

Valued at $548.4 million by market cap, shares of McEwen have gained 57.4% on a YTD basis, outperforming the broader S&P 500 Index's ($SPX) 11.2% returns over the same time frame. Moreover, MUX’s 55.9% returns over the past six months easily outshine SPX’s 16.4% gain over the same time frame.

In terms of valuation, McEwen stock trades at 3.55 times sales, lower than some of its peers, like Silvercrest Metals (SILV) and Newmont Mining (NEM).

McEwen Mining’s Mixed Q1 Earnings

Shares of the precious metal mining company declined after it reported Q1 earnings results on May 8. Although McEwen Mining’s revenue of $41.1 million beat Wall Street's estimates by 8.2%, its adjusted loss per share of $0.41 missed projections, even as losses narrowed by 122% annually. Its gross profit increased 35.3% year over year to $6 million, bolstered by a 15% hike in the gold price and 3% more metal sold.

As of March 31, McEwen Mining held consolidated cash and cash equivalents of $22 million, with $14.1 million in working capital. Total long-term debt declined to $40 million from $65 million in the year-ago quarter. The Toronto-based company produced 33,037 gold equivalent ounces (GEOs) in Q1, including 12,934 attributable GEOs from the San José mine, and sold 34,407 GEOs, a 13% increase year over year.

Plus, McEwen Mining's acquisition of Timberline Resources in April promises to enhance operational efficiency, expand production capabilities, and boost exploration prospects in Nevada. McEwen anticipates production between 130,000 GEOs and 145,000 GEOs for fiscal 2024.

Analysts tracking McEwen Mining predict an annual loss per share of $0.70 in fiscal 2024, which is expected to narrow by 60% to $0.28 in fiscal 2025.

What Do Analysts Expect for McEwen Mining Stock?

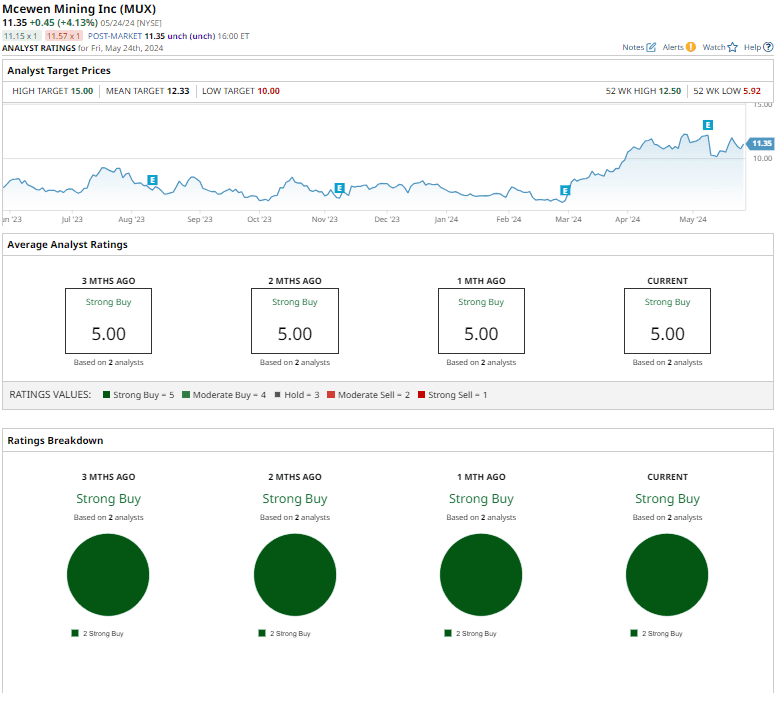

On May 10, Roth MKM analysts reiterated a “Buy” rating and raised the price target from $11 to $12 on McEwen Mining stock.

McEwen Mining has a unanimous “Strong Buy” rating from the two analysts covering the stock.

The mean price target of $12.33 indicates a potential upside of 8.6%. The Street-high target price of $15, assigned by HC Wainwright & Co. analyst Heiko Ihle, suggests the stock could rally as much as 32.2%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.