Forget all the talk about a global economic slowdown. We are experiencing a Godotrecession-one that we’re forever waiting on to show up.

In fact, the flow of goods traded around the globe is showing signs of accelerating after a brief slump in 2023. This is pushing up shipping rates, and giving supply-chain managers flashbacks to the spike in shipping rates that occurred during the COVID-19 pandemic.

The month-long advance in seaborne freight rates stems from a number of problems. These include: Houthi attacks on shipping in the Red Sea, port congestion in Asia, drought in Panama, possible labor strikes in North America that threaten to hobble ports and rail services, and rising trade tensions between the U.S. and China.

Let’s take a brief look at these factors pushing up global shipping rates.

Rough Seas for Shipping

Shipping companies were already facing rough seas, thanks to the Houthis’ attacks on ships in the Red Sea. This forced carriers to send their vessels the longer way around southern Africa rather than through the Suez Canal. A.P. Moller-Maersk A/S (AMKBY), the world’s second-largest container line, estimates the industry’s capacity loss at 15% to 20% this quarter on routes to northern Europe from Asia.

Second, there is the broad-based congestion in several major Asian ports. Hapag Lloyd AG (HPGLY), the world’s fifth-largest container carrier, said recently that in the Chinese ports of Qingdao, Shanghai, and Ningbo, ships are waiting several days for a berthing slot because of both the number of vessels and bad weather.

The company added that wait times are also elevated in Singapore and Malaysia. Singapore is the world’s second-largest container port. It is currently experiencing delays of up to seven days, with nearly half a million containers waiting to be shipped.

Third, the drought in Panama lowered water levels in the Panama Canal, which gets its water from Gatun Lake. This has limited the number of ships going through the canal daily.

Next, there are the threats of a Canadian rail strike, as well as upcoming contract talks here in the U.S. for dockworkers in both the East Coast and Gulf Coast ports.

Finally, in the midst of this latest surge in container rates, the U.S. government announced more tariffs on Chinese imports — adding to the urgency for companies to stock up now.

That’s what happened in 2018 and 2019, when the Trump administration imposed tariffs on China. And with the prospect of a possible second Trump Administration, companies worried about new tariffs are pulling forward their imports to get them into the country before those are imposed.

Add all of these threats up, and the reality is that companies don’t want to get caught short-handed heading into the second half of the year.

Demand has also been boosted by customers who previously slashed inventories in expectation of weak consumer demand this year. With consumer demand now not as depressed as some businesses expected (that Godot recession again), they are now quick to pay higher prices to get access to the limited global shipping capacity.

Shipping Rates Rise Again

According to the logistics firm Freightos, the spot rate for the cost for a 40-foot container to the U.S. West Coast from Asia jumped 13.4% to $4,915 in the week ended May 26, marking the fifth straight weekly advance. That’s triple what it was in late December.

Data from Xeneta, a container shipping information service, show how the challenges on the Panama Canal route have pushed up prices. Spot rates were $5,584 per 40-foot container between Asia and the U.S. East Coast on May 16, more than twice the $2,434 cost in the year ago period.

In addition, the average cost of shipping a 40-foot container between the Far East and northern Europe at short notice - the figure that is most sensitive to market prices - hit $4,343 last week, roughly three times higher than the same period last year, according to Xeneta.

Keep in mind that this is happening now, during spring, which is normally a quiet time in the shipping industry. Typically, the peak period occurs between late summer and autumn, when retailers start importing goods for Black Friday sales and the Christmas shopping season.

The current strength in shipping - and the U.S. economy - can also be seen in the data from our ports. Container imports through the top 10 ports in the U.S. rose for a seventh straight month in April from a year earlier. This pushed the three-month trailing average gain to 19.1%. That was the strongest showing since July 2021, near the peak of the pandemic demand surge.

How to Invest

I suspect these problems in shipping will only grow as we head into the peak season for shippers. That means rates are headed even higher, boosting the fortunes of the shipping companies and their investors.

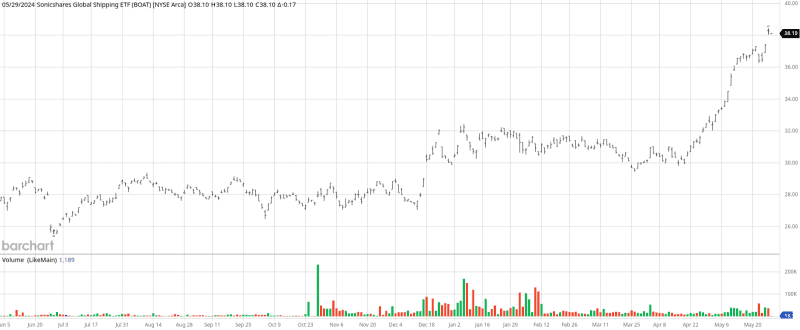

One easy and broad way to play the industry is through an ETF. The SonicShares Global Shipping ETF (BOAT) provides pure-play exposure to the global maritime shipping industry.

The fund is based on the Solactive Global Shipping Index. Its largest portfolio positions include the aforementioned Moller Maersk, as well as a number of Asian shippers.

BOAT is doing well, up 27% year-to-date and nearly 38% over the past 52 weeks. It’s a buy at the current price around $38 and up to the mid-40s.

On the date of publication, Tony Daltorio did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.