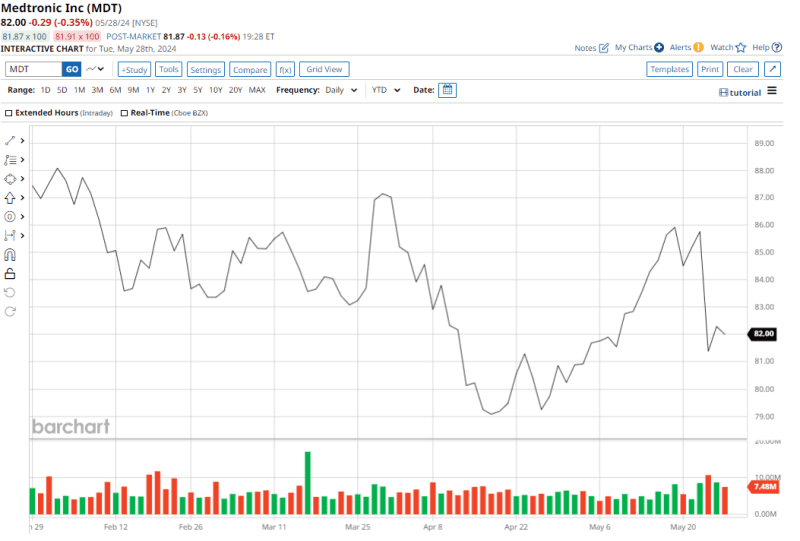

Shares of Medtronic (MDT), the Dublin-based medical device company, haven't exactly impressed with their 2024 price action. The company's latest results for the fiscal fourth quarter didn't help matters, either; despite beating top and bottom-line estimates, soft earnings guidance for the quarter and year ahead spooked investors, and led to a 5% single-day selloff in the stock post-earnings.

Overall, MDT stock is down 1% on a YTD basis, and the shares are more or less flat over the past year - underperforming the S&P 500 Index ($SPX) considerably.

Longer term, MDT has delivered negative returns over the last three-year and five-year periods, too.

However, this Dividend Aristocrat is more than four decades into an impressive dividend growth streak, and just announced its latest hike - bringing its forward yield to a generous 3.43%.

So, should dividend investors consider buying Medtronic stock after earnings? Let's have a closer look.

MDT Beats on Q4 Earnings, Revenue

Despite the negative reaction to its latest quarterly results, Medtronic's key metrics actually came in above expectations. In the fiscal fourth quarter, the company reported net sales of $8.59 billion, up marginally from the prior year. EPS slipped by 7% on a YoY basis to $1.46, but still surpassed the consensus estimate of $1.45. Notably, the company's EPS has topped expectations in each of the past five quarters.

Overall, over the past 10 years, Medtronic has grown its revenue and EPS at a CAGR of 6.72% and 1.91%, respectively.

In terms of liquidity, Medtronic closed the March quarter with a cash balance of $1.28 billion, compared to its current debt obligations of $1.09 billion. Additionally, in FY 2024, the company generated free cash flow of $5.2 billion, up 14%, and net cash from operating activities of $6.79 billion.

In FY25, the company expects its organic revenue growth to be in the range of 4%-5% and EPS growth to arrive between 4%-6%. Management's forecast for fiscal Q1 EPS of $1.19 to $1.21 fell short of the $1.24 consensus among analysts, while MDT's guidance for FY25 EPS of $5.40 to $5.50 aligned with Wall Street's consensus at the midpoint.

Given its underperformance on price, MDT is pretty reasonably valued. The stock is trading at a forward P/E of 15.06, and forward price/sales of 3.22 - multiples that compare favorably to the current sector medians of 19.67 and 4.26, respectively, as well as Medtronic's own five-year average valuation metrics.

Medtronic Could Be a Future Dividend King

Medtronic is also a dividend powerhouse, which makes it an attractive choice for income investors.

Along with its fiscal Q4 results, the company raised its quarterly dividend to $0.70 per share from $0.69 per share. This marked the 47th consecutive year of dividend increases for the company, comfortably establishing its position as a Dividend Aristocrat.

Moreover, its dividend yield of 3.43% is much higher than the healthcare sector median of 1.5%. Medtronic maintains a dividend payout ratio around 53%, providing it with more headroom to grow its dividends in the years ahead, and potentially achieve that coveted “Dividend King” status.

How AI is Driving Growth for Medtronic

Medtronic is one of the largest medical technology companies in the world by revenue, according to Statista, and the top company by market share.

The company is divided into 4 different segments - cardiovascular, medical-surgical, neuroscience, and diabetes - all of which look poised for growth over the next decade. More broadly, the global medical devices market size is projected to reach $996.93 billion by 2032.

Medtronic is also leveraging artificial intelligence (AI) for growth. As Chairman and CEO Geoff Martha explained on the Q4 earnings call, the company is seeing “strong adoption of unit-adapted spine intelligence, our integrated AI surgical planning solution. Here, we're taking data and building deep learning models that see patterns and create personalized outcomes for patients… We call it the AiBLE ecosystem, and it's a big competitive differentiator for us.”

Beyond AI, Medtronic embraces other cutting-edge tech. The company is expanding the installed base for its Hugo robotic system, which offers versatility for soft tissue surgery, and its minimally invasive TAVR valve system is another key growth driver.

Further solidifying its commitment to innovation, Medtronic continues the rollout of the MiniMed 780G, an algorithm-driven insulin delivery system that drove 11% growth in the diabetes segment during the most recent quarter.

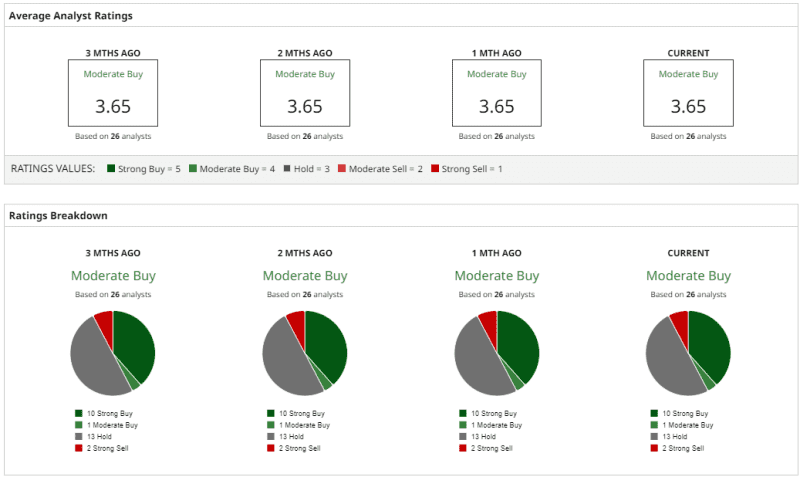

Analysts See Upside Ahead for MDT Stock

Analysts are optimistic on MDT stock, which has an overall rating of “Moderate Buy.” Out of 26 analysts covering the stock, 10 have a “Strong Buy” rating, 1 has a “Moderate Buy” rating, 13 have a “Hold” rating and 2 have a “Strong Sell” rating.

The mean target price from this group is $93.65, which indicates an upside potential of about 15% from current levels.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.