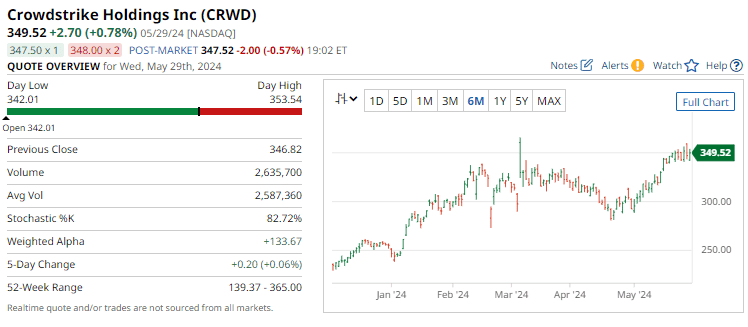

Crowdstrike’s (CRWD) continues to be one of the strongest stocks in the market.

The Barchart Technical Opinion rating is a 100% Buy with a Strengthening short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

The market is approaching overbought territory. Be watchful of a trend reversal.

CRWD rates as a Strong Buy according to 35 analysts with 3 Moderate Buy ratings and 2 Hold ratings.

CrowdStrike Holdings, Inc. is a leading cybersecurity company that specializes in providing advanced threat intelligence and endpoint protection.

Founded in 2011, the company offers cloud-native solutions that utilize artificial intelligence to detect and prevent cyber threats in real-time.

Their flagship product, the CrowdStrike Falcon platform, is renowned for its ability to safeguard enterprises from a wide array of cyberattacks, including malware, ransomware, and sophisticated hacking attempts.

With a strong emphasis on innovation and cutting-edge technology, CrowdStrike serves a diverse range of industries, helping organizations protect their data and maintain cybersecurity resilience.

Today, we’re going to look at a bull put spread trade.

A bull put spread is a bullish trade that also can benefit from a drop in implied volatility.

The maximum profit for a bull put spread is limited to the premium received while the maximum potential loss is also capped. To calculate the maximum loss, take the difference in the strike prices of the long and short options, and subtract the premium received.

CRWD BULL PUT SPREAD

Implied volatility is currently sitting at 55.33% which gives CRWD and IV Percentile of 88% and an IV Rank of 63.51%.

Crowdstrike’s expected move between now and June 21 is around 12.8% in either direction. On the downside, that would put CRWD stock at around $306.

In other words, the options market is expecting CRWD stock to stay above $306 between now and June 21.

To create a bull put spread, we sell an out-of-the-money put and then by a put further out-of-the-money.

Selling the June 21 put with a strike price of $300 and buying the $290 put would create a bull put spread.

This spread was trading yesterday for around $1.30. That means a trader selling this spread would receive $130 in option premium and would have a maximum risk of $370.

That represents a 35.14% return on risk between now and June 21 if CRWD stock remains above $300.

If CRWD stock closes below $290 on the expiration date the trade loses the full $370.

The breakeven point for the bull put spread is $298.70 which is calculated as $300 less the $1.30 option premium per contract.

Crowdstrike is set to report earnings on June 4th, so this trade would have earnings risk if held through that date.

Conclusion And Risk Management

One way to set a stop loss for a bull put spread is based on the premium received. In this case, we received $130, so we could set a stop loss equal to the premium received, or a loss of around $130.

Another way to manage the trade is to set a point on the chart where the trade will be adjusted or closed. That could be around $305.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.