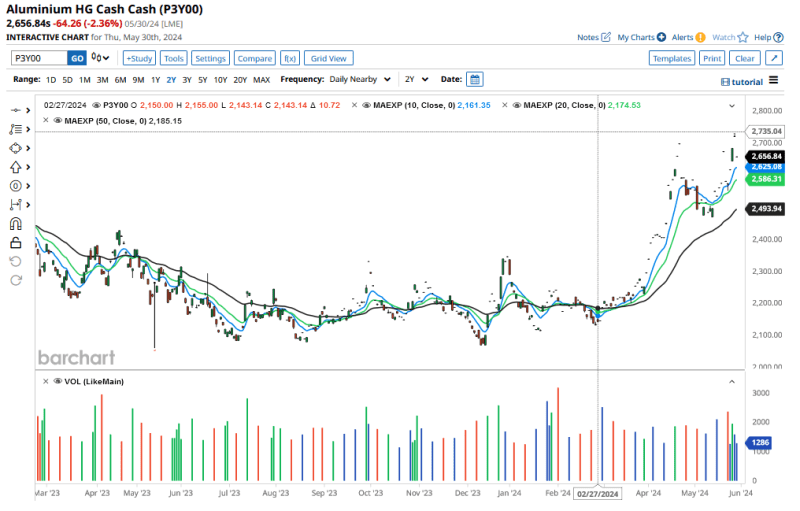

Aluminium HG Cash (P3Y00) is up +15.93% on the week, as aluminium LME inventories at the end of May are at 1,120,050 t. Although this is well above record-low levels reached in August 2022 of 294,550 t., it still remains low in historical levels. The most recent high was 5,484,375 t in January 2014.

Prices tend to move inverse to inventories, and this is what we have seen most of the last year. However, this is not the case for May, where both were rising.

On May 17, the LME Aluminium Futures and Options Funds net positions were at 100,046 contracts, confirming the current strong trend, but not yet at the 120,000 that were close to a "maximum" in the past 6 years. So there is still potential demand for the this bull trend to run further.

Funds are increasing positions in aluminium, switching from copper on speculation of less production in China, and issues with Rio Tinto (RIO) exports in Australia.

The 10, 20, and 50-unit exponential moving averages (EMAs) confirm the current uptrend that could set 3,000 as the next target.

Best European Commodity Performers This Week

Cocoa #7 (CAU24) +17.16%

As per previous reports, it is all about fundamental news coming from the Ivory Coast, with a decline of 30% of exports year over year. The liquidity in this market is very low, with option contracts at very wide spreads, which makes them hard to trade or hedge.

Non-commercial investors (speculators) are in control of the recent run, as a warning that the risk of a sharp reversal remains high.

The last Cocoa Organization reports a shortfall of 374,000 tonnes this season, supporting current high prices.

Having said that, the forward curve is showing a steady decline of futures prices until the end of 2025 revealing that the market expects this supply shock to be resolved in the next months.

Trading Cocoa at these levels remains very tricky both with options and futures. Retail traders could look instead into the WisdomTree Cocoa ETC (COCO.LN) for exposure with less leverage.

Robusta Coffee 10-T (RMN24) +9.01%

With the recent high of 4,388, this contract broke the last high of 4,338 reached last April. The chart shows rising open interest at 49,355 with consistent volume above 10,000 contracts traded on average daily in the last 20 sessions. So, the move looks justified.

Robusta coffee is one of the few European contracts with some active options available. At the current high implied volatility of 51.7% those ready to sell options at high premiums could find this time particularly attractive.

Tight supplies reported from Vietnam this week are driving most of the move. The forward curve is (like cocoa) in contango, indicating that the market is discounting already that current high prices are not going to continue

in the next months.

As a warning to long traders, current levels generated a sharp reversal back in April. With current liquidity, it is possible to use proper stop losses.

Worst European Commodity Performers This Week

Nickel 3M Cash (P8Y00) -3.82%

The forward curve rises sharply into the next years, indicating a fundamental deficit expectation for the middle to long term. The commodity is up over 20% year to date, with severe supply issues due to political turmoil in New Caledonia, which has up to 30% of world reserves.

Furthermore, sanctions on all Russian metals are having a negative impact on inventories, providing further support for rising prices.

Technically, this contract is testing a fundamental dynamic support now that is trading at the 20 EMA. The trend is still up, but watch out carefully around this level, as the 20 EMA statistically has been a reliable threshold for signaling trend change.

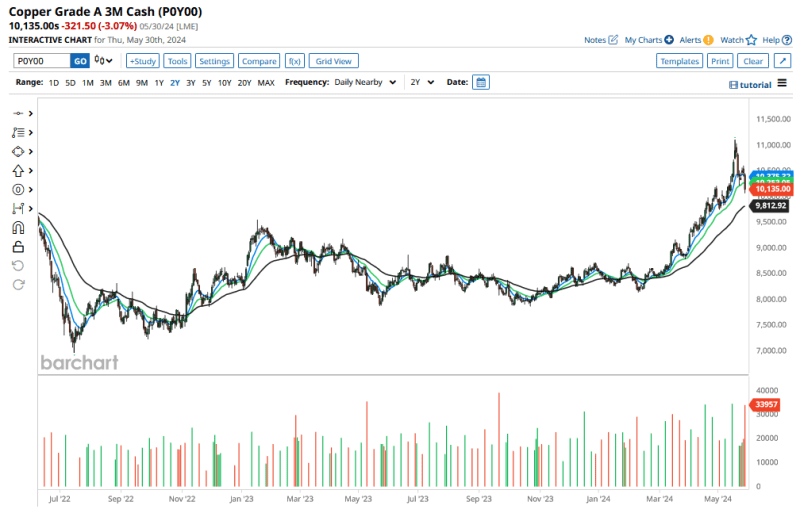

Copper Grade A 3M Cash (P0Y00) -3.71%

Similar to nickel, the uptrend is weakening in the last weeks, with the contract testing the 20 EMA. Should it cross it down with a full candle, it will likely activate further liquidation and further profit-taking.

The forward curve expects rising prices until June 2025. However, current high prices are having an effect on the demand side, with China manufacturing activity falling in May.

Expectations of higher interest rates (which are bearish for metals), high speculative positions, and less demand from China could set the stage for a short-term reversal if the 20 EMA is broken.

On the date of publication, Cesar Marconetti did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.