Investors with a lot of money to spend have taken a bullish stance on Walt Disney (NYSE:DIS).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with DIS, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 34 uncommon options trades for Walt Disney.

This isn't normal.

The overall sentiment of these big-money traders is split between 52% bullish and 38%, bearish.

Out of all of the special options we uncovered, 25 are puts, for a total amount of $1,799,323, and 9 are calls, for a total amount of $413,056.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $95.0 to $145.0 for Walt Disney over the recent three months.

Analyzing Volume & Open Interest

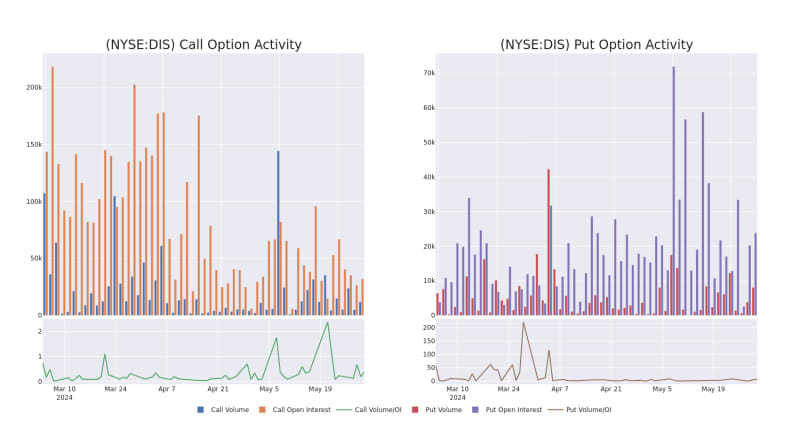

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Walt Disney's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Walt Disney's substantial trades, within a strike price spectrum from $95.0 to $145.0 over the preceding 30 days.

Walt Disney 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

About Walt Disney

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from franchises and characters the firm has created over the course of a century. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney's own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney's theme parks and vacation destinations, and also benefits from merchandise licensing.

Following our analysis of the options activities associated with Walt Disney, we pivot to a closer look at the company's own performance.

Where Is Walt Disney Standing Right Now?

- With a volume of 7,033,075, the price of DIS is up 1.74% at $103.47.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 68 days.

What The Experts Say On Walt Disney

5 market experts have recently issued ratings for this stock, with a consensus target price of $122.4.

- An analyst from UBS persists with their Buy rating on Walt Disney, maintaining a target price of $130.

- An analyst from Deutsche Bank persists with their Buy rating on Walt Disney, maintaining a target price of $130.

- Consistent in their evaluation, an analyst from Macquarie keeps a Neutral rating on Walt Disney with a target price of $107.

- In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $145.

- An analyst from Redburn Atlantic has elevated its stance to Neutral, setting a new price target at $100.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Walt Disney options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.