A left-wing policy wonk selected as a Labour candidate has deleted a social media post calling for a cap on Individual Savings Accounts, sparking concerns about potential taxes on saving under Labour.

Torsten Bell, a new Labour candidate, has recently deleted social media posts about capping total ISA savings at £100,000, GB News can reveal.

Mr Bell was the head of the Resolution Foundation think tank but has been parachuted in to fight Swansea West by Labour's NEC.

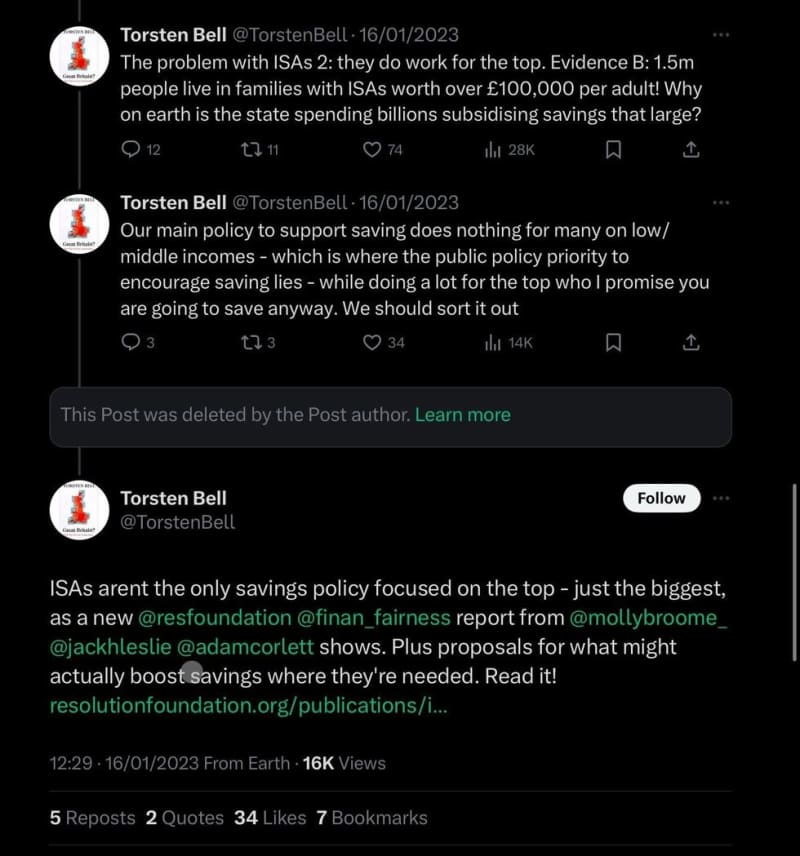

Sharing a report by the foundation last January on savings, Mr Bell said that they “work for the top.”

Posting on X, formerly Twitter, he said that the government’s policy to support saving “does nothing” for many on low or middle incomes while “doing a lot for the top.”

He added: “We should sort it out.”

In the next post, Mr Bell said “at a minimum we should be capping total ISA savings at £100k.”

The post has since been deleted, but GB News accessed it through a web archive.

ISAs currently have no upper savings limit, with individuals allowed to save £20,000 per year tax-free.

In a briefing note on ISAs seen exclusively by GB News, the TaxPayers’ Alliance said that in 2020-21, over 40 per cent of adults had an ISA.

In other key findings, the think tank said that investing £20,000 in a stocks and shares ISA with a further deposit of £20,000 each year will see a total value of £312,699 after 10 years at expected return rates and a value of £1,094,743 after 20 years.

The TPA said that the total value of an ISA after 20 years minus the investment over that time would be £694,743.

But it warned that under a £100,000 tax-free cap proposed by Mr Bell, £3,000 capital gains tax-free allowance and £20,000 maximum annual deposit limit, a total of £138,349 would be paid in capital gains tax if you withdrew from an ISA after 20 years.

Darwin Friend, Head of research at the TaxPayers' Alliance, said: “Taxpayers’ will be concerned that proposals to tax ISAs are edging closer to power.

“With the tax burden already set to reach an 80 year high, Brits will feel ripped off that one of the few tax-free tools they have could be removed.

“The new government needs to maintain the current status of ISAs and take action to reverse the record tax burden.”

The Labour Party was contacted for comment.