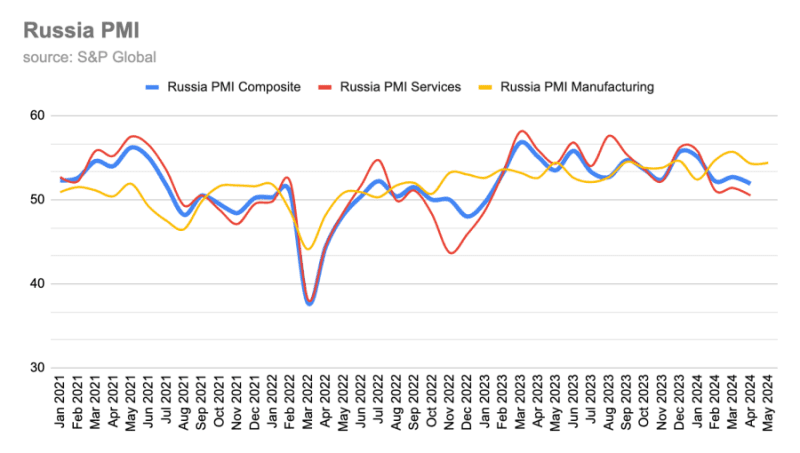

“Operating conditions at Russian manufacturers continued to improve during May, according to latest PMI data from S&P Global. Output growth strengthened amid sustained and robust customer demand, which drove the upturn in new orders. New export sales fell further, however, albeit at only a fractional pace. The sharp rise in new business led firms to expand capacity, as the pace of job creation accelerated to the second-fastest on record, and the steepest since September 1997. Employment growth stemmed in part from a third successive monthly uptick in backlogs of work. Nonetheless, business confidence slipped to a nine-month low,” S&P Global said in a press release.

Russia's economy has been growing a lot faster than expected as the newPutinomics changes the model from hoarding money and paying down debt, to spending freely and investing into a dual use economy as Russian President Vladimir Putin outlined recently in his guns and butter speech in May.

While most of the main indicators are doing very well, according to the Central Bank of Russia (CBR)’s lastmacroeconomic survey, high inflation, lack of labour and falling productivity remain the main headaches.

Output at Russian goods producers increased at a quicker pace during May reports S&P Global, with production rising steeply. The rate of expansion accelerated from April and was the second-fastest since January 2017. Greater output was linked by firms to robust demand conditions and another monthly upturn in new sales.

While military spending is driving the economy, as part of Putin’s long-term strategy he told his new Defence Minister Andrei Belousov that the government should not ignore civilian production as part of theNational Projects 2.1. At the same time, although inflation is high, nominal wages are rising even fast, which has led to rising real incomes that is fuelling a consumption boom and that is knocking on to strong manufacturing results across the board.

“New orders continued to rise at a historically elevated pace midway through the second quarter. Although softening to the slowest since January, the rate of growth was sharp. The uptick in new business was attributed to increased spending on advertising, new client wins and sustained demand conditions,” says S&P Global.

Sanctions have impacted Russia’s exports and new export orders declined for the sixth time in the last seven months in May, S&P Global reports. “That said, the pace of decrease eased to only a fractional rate.”

Strong demand continues to drive job creation. Firms stepped up their hiring, as the pace of job creation accelerated to the sharpest in over 26-and-a-half years. Greater staff numbers were reportedly due to further growth in new orders and a rise in backlogs of work. Moreover, the level of work-in-hand increased for the third month running in May. The pace of accumulation quickened and was modest overall.

Despite the full order books, managers are becoming more pessimistic about the rest of the year. The degree of business confidence slipped to a nine-month low in May, S&P Global reports. “Nonetheless, the level of optimism still signalled historically upbeat expectations regarding future output,” S&P Global said. “Positive sentiment was often linked to hopes of further new customer wins and stronger demand conditions.”

However, the constraints andoverheating economy means that inflation quickened for a second successive month in May and was the sharpest since December 2023. Increased transportation and supplier costs reportedly drove the faster uptick, according to S&P’s panellists.

“Russian goods producers recorded a further rise in selling prices midway through the second quarter, thereby extending the current sequence of inflation that began in November 2022. Panellists reported hiking output charges in line with a sharper increase in cost burdens. The rate of charge inflation was the quickest in four months,” S&P Global said.

Manufacturing firms raised their input buying at a steep pace in May, amid greater production requirements and a further increase in new orders. Despite greater purchasing activity, companies struggled to replenish pre-production inventories due to supplier delays. Stocks of purchases fell at a solid pace, while stocks of finished items declined modestly and for the first time in three months.

Deteriorating vendor performance was largely caused by logistics delays. That said, the extent to which lead-times lengthened was the least marked in just over a year.