Qualcomm Inc. (QCOM) stock still looks cheap based on its strong free cash flow (FCF). It could be worth as much as $284, or +38% more. One way to play this is to sell short out-of-the-money puts in nearby expiry periods.

QCOM stock is at $205.83 in midday trading on Monday, June 3. This is 25% higher than its price before the May 1 release of its fiscal Q2 results when it was at $164.11 per share.

I discussed this in a recent May 10 Barchart article, “Qualcomm Is Cheap Here Based on Its High FCF Margins - Shorting OTM Puts Is a Good Play.” I projected that the stock could be worth between $233 and $240 per share. But now I think it could be worth as much as $283 per share, or over 37.6% higher

Strong FCF Margins

Here is how I have revalued QCOM stock. First I looked at revenue projections and then forecasted FCF based on its recent FCF margins. Then I used an FCF metric to value the stock.

For example, the semiconductor design and handset technology company is projected to make $38.36 billion in revenue this fiscal year ending Sept. 30, 2024. And next year this is projected to reach $42.3 billion.

That is important as the company makes consistently high FCF margins (i.e., FCF/revenue). For example, FCF represented 33.7% of sales In the trailing 12 months (TTM) to March 24.

So, using the $42.3 billion revenue projection for next year, FCF can be forecast to reach as much as $14.25 billion (i.e., $42.3b x 0.337). That allows us to project the stock's market cap.

Price Targets

For example, this FCF figure could push QCOM stock to a market value of $316.7 billion. That is the result of dividing $14.25 billion in FCF for next year by 4.5%. This is also the same as multiplying it by 22.2x (i.e., the inverse of 4.5%, or 1/0.045 = 22.22).

This $316.7 billion market cap estimate is 37.6% higher than today's market cap of $205.83 per share. That implies that the stock could be worth 37.6% more, or$283.22 per share.

Some other analysts have higher stock price targets. For example, AnaChart.com, a new sell-side stock analyst tracking service, shows that the average price target of 24 analysts is $222.85 per share.

One way to play this is to sell short out-of-the-money (OTM) put options. That way the investor can make extra income and also potentially buy the stock at a cheaper price if it falls.

Selling QCOM OTM Puts

I discussed this strategy in my last Barchart article on May 10. I discussed selling the $170 strike price put option for the June 7 expiration when the stock was at $181.35. That was 6.42% out-of-the-money, or below the stock price. The premium received was $1.07 or 0.629% (i.e., $1.07/$170). Today those puts are almost worthless and the trade was successful.

That was probably too conservative. For example, I could have recommended selling the $175 strike price puts for $2.14 per contract. That would have provided an immediate yield of 1.22% (i.e., $2.14/$175) for a short put play that was still 3.67% below the spot price.

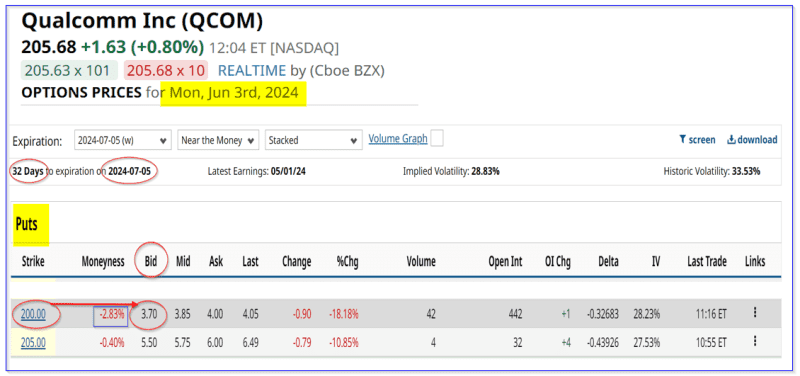

So, today, this trade can be repeated, although it is not as profitable. For example, look at the July 5 expiration period, 32 days away. It shows that the $200 strike price puts, which are still 2.83% below today's price, trade for $3.70 in premium on the bid side.

That represents a monthly yield of 1.85% (i.e., $3.70/$200). That is a very good expected return for most investors.

Downside Risk

Moreover, buying in at $200 is not that bad an entry price, especially given the upside in QCOM stock. This would only happen if the stock fell to $200 in the next month and the short put contract play was exercised. Then the $20,000 that the investor had to secure in cash to do the trade (making $345 immediately) would be used to buy 100 shares.

Granted, if the stock fell to $200 or lower, the short put play could result in an unrealized loss (i.e., if QCOM fell below $200 and the investor's short puts were assigned). But keep in mind that the breakeven price is $200-$3.70, or $196.30. That is 4.56% below today's price, so there is some good downside protection.

The bottom line is that QCOM stock looks cheap here. One easy way to play this is to sell short out-of-the-money put options to gain extra income and also potentially buy in at a cheaper price than today.

More Stock Market News from Barchart

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.