The technology sector is poised for substantial growth in a world brimming with cutting-edge innovations. Within this space, mega-cap stocks are the heavyweights with market caps over $200 billion. These companies, known for their strong financials and global reach, are prominently featured in benchmark equity indexes like the S&P 500 Index ($SPX) and the Nasdaq-100 Index ($IUXX).

Among these giants, Netflix, Inc. (NFLX) and Apple Inc. (AAPL) haven’t racked up the biggest YTD gains in 2024, but they’re still attracting bullish attention from analysts. Evercore ISI Group recently tagged Netflix with a “small buy” due to its solid financial standing. Meanwhile, Bank of America (BAC) analyst Wamsi Mohan maintained his “Outperform” rating on Apple as anticipation builds for the June 10 Worldwide Developer Conference (WWDC).

As we enter June, here's a closer look at why analysts think these two mega-cap tech stocks are worth a second look at current levels.

Tech Stock #1: Netflix

Founded in 1997 and headquartered in Los Gatos, California, Netflix, Inc. (NFLX) has revolutionized entertainment with its streaming platform, offering a vast library of TV shows, movies, and award-winning original content. Initially a DVD rental service, Netflix transitioned to streaming in the 2010s, becoming an international giant with a market cap of over $276.5 billion.

Leveraging artificial intelligence (AI) algorithms for personalized recommendations, Netflix deepens customer connections and drives engagement. In 2024, it expanded into gaming, launching 40 titles, including internal developments like Oxenfree II and Netflix Stories, like Love is Blind, with ambitious plans to grow its gaming portfolio.

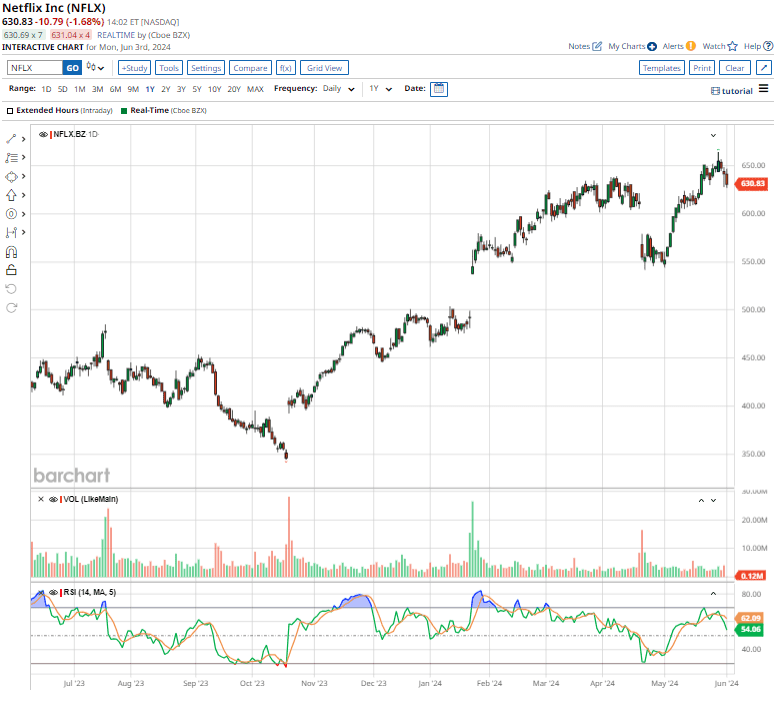

Shares of this mega-cap stock have rallied 57.4% over the past 52 weeks, outpacing the Nasdaq-100's returns of 26.8% over the same time frame. NFLX stock’s impressive 29.4% gain on a YTD basis also outshines the broader market’s returns in 2024.

In terms of valuation, the stock trades at 35.36 times forward earnings, which is lower than its own five-year average of 50.92x.

On April 18, the video streamer revealed its Q1 earnings results, which exceeded Wall Street’s expectations. Revenue jumped 14.8% annually to $9.4 billion, edging past estimates on strength in membership growth and pricing strategies, while operating income hit a record $2.6 billion. With EPS soaring 79% to $5.28, Netflix beat projections by an impressive 17.3%.

Amid recent efforts to restrict password sharing, Netflix’s subscriber base has soared, growing 16% annually to 269.6 million, demonstrating the strength of its platform and brand loyalty. In its Q1 shareholder letter, management highlighted, "despite anticipated engagement headwinds from paid sharing and more choices for consumers, our engagement remains healthy—hours viewed per account amongst owner households in Q1'24 were steady with the year-ago quarter."

However, shares of Netflix fell 9% on April 19 after it guided for slower sales growth and said it will no longer report quarterly subscriber numbers.

For fiscal 2024, the company expects revenue growth of 13% to 15%, down from the 15-16% expected previously, and an operating margin of 25%, up from its prior forecast of 24%. Analysts tracking Netflix project the company’s profit to climb 52.2% year over year to $18.31 per share in fiscal 2024 and grow another 20.8% to $22.12 per share in fiscal 2025.

On May 28, Evercore ISI reiterated its “Outperform” rating on Netflix and increased its price target to $700 from $650, citing several factors for this positive outlook. Evercore analysts led by Mark Mahaney noted, "No, our $700 PT doesn’t imply dramatic upside to the current NFLX share price. That's why NFLX is a small buy for us here.”

They emphasized that Netflix is in its strongest financial, fundamental, and competitive position ever. Their confidence stems from the latest survey showing that U.S. Netflix users reported a 61% satisfaction rate, a 5% sequential increase, and the rise of subscription advertising video on demand (SAVOD), which is expanding Netflix's market. Evercore also highlighted the potential of Netflix's growing line-up of live events, with significant user interest in sports content driving retention and attracting new subscribers.

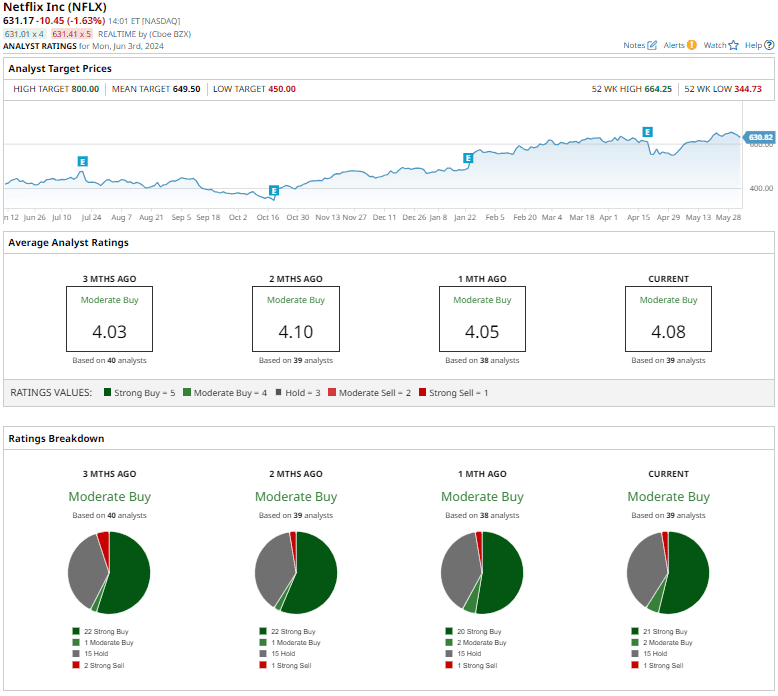

Netflix stock has a consensus “Moderate Buy” rating overall. Out of the 39 analysts covering the stock, 21 suggest a “Strong Buy,” two advise a “Moderate Buy,” 15 recommend a “Hold,” and the remaining one gives a “Strong Sell” rating.

The average analyst price target of $649.50 indicates a potential upside of less than 3% from the current price levels. However, the Street-high price target of $800 suggests the stock could rally as much as 26.8%.

Tech Stock #2: Apple Inc.

California-based powerhouse Apple Inc. (AAPL), incorporated in 1977, is a global tech giant renowned for its innovative products like the iPhone, iPad, and Mac. Boasting a massive market cap of over $2.9 trillion, Apple leads in consumer electronics, software, and digital services, consistently setting trends in technology and design while maintaining a loyal customer base and a cutting-edge ecosystem.

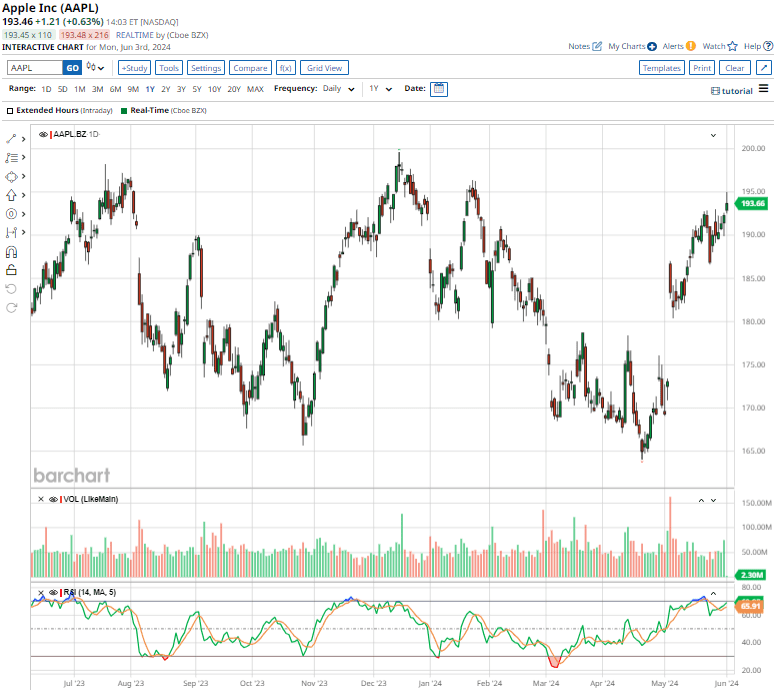

Shares of Apple have gained just 6.8% over the past 52 weeks, though they’re up about 17% from their late April lows. AAPL was pressured earlier this year by a combination of analyst downgrades, flagging sales in China, and U.S. antitrust charges, but the shares recovered the worst of their losses after well-received earnings. Now, the stock is trading just 3.2% away from its all-time high of 199.62, set in mid-December.

On May 16, Apple’s board of directors paid its shareholders a cash dividend of $0.25 per share, marking a 4% increase and the 12th consecutive dividend increase. Its annualized dividend of $1.00 per share translates to a 0.51% yield. Additionally, the board has also authorized an additional program to repurchase up to $110 billion of the company’s common stock.

In terms of valuation, the stock is trading at 29.10 times forward earnings and 7.65 times sales – higher than some of its industry peers, but lower than Microsoft (MSFT).

On May 2, the company reported its fiscal Q2 earnings results, which exceeded Wall Street’s projections. Revenue declined 4.3% year over year to $90.7 billion, largely due to a 10.5% decrease in iPhone sales, as the device accounts for roughly half of total revenue. During the quarter, product sales dipped by 9.5% annually, while service revenue grew by 14.1%. Net income arrived at $1.53 per share, surpassing consensus estimates for $1.50.

Looking ahead to Q3, management anticipates low single-digit year-over-year revenue growth, marking a reversal from recent declines. The services business is projected to lead with double-digit growth. Analysts tracking Apple expect the company’s profit to reach $6.57 per share in fiscal 2024, up 7.2% year over year, and grow another 9.76% to $7.21 in fiscal 2025.

CEO Tim Cook expressed optimism about Apple's future in generative AI during the Q2 earnings call, highlighting substantial investments in this area. He noted, “We are making significant investments and we're looking forward to sharing some very exciting things with our customers soon,” which many market-watchers interpreted as a hint that AI announcements will be forthcoming at the company’s annual Worldwide Developers Conference (WWDC), set for June 10.

In fact, on May 29, BofA analyst Wamsi Mohan backed an "Outperform" rating and $230 price target for the stock in anticipation of a game-changing reveal at the upcoming WWDC event. Mohan suggests that AI-enabled phones could ignite a "once-in-a-decade" upgrade cycle, driving generative AI into the mainstream with Apple's 2.2 billion active devices. These AI-infused devices promise vast improvements in photography, health monitoring, security, and battery life, setting the stage for rapid adoption and substantial growth.

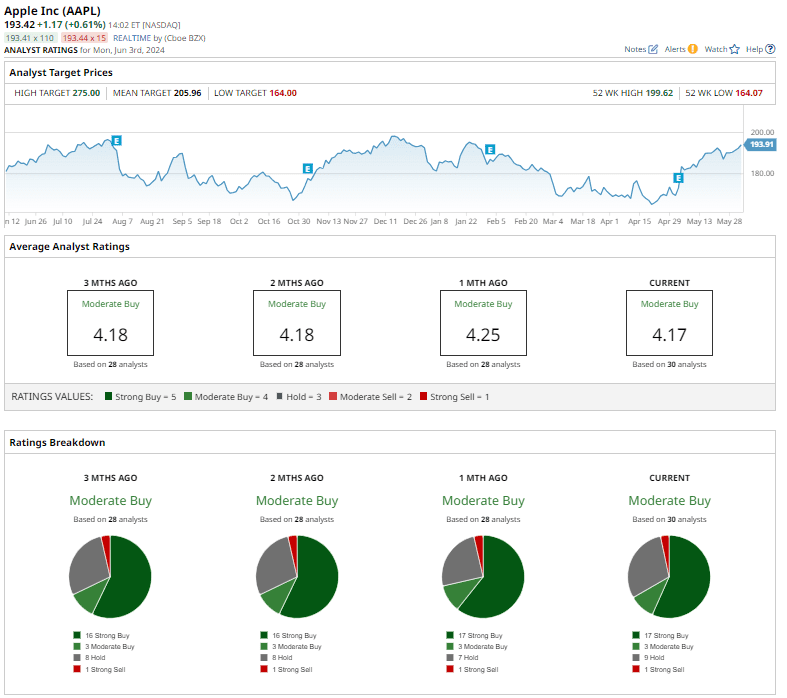

Apple stock has a consensus “Moderate Buy” rating overall. Out of the 30 analysts offering recommendations for the stock, 17 suggest a “Strong Buy,” three advise a “Moderate Buy,” nine give a “Hold,” and the remaining one recommends a “Strong Sell” rating.

The average analyst price target of $205.96 indicates a potential upside of 6.4% from the current price levels. However, the Street-high price target of $246 suggests that the stock could rally as much as 42%.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.