By Akin Nazli in Belgrade

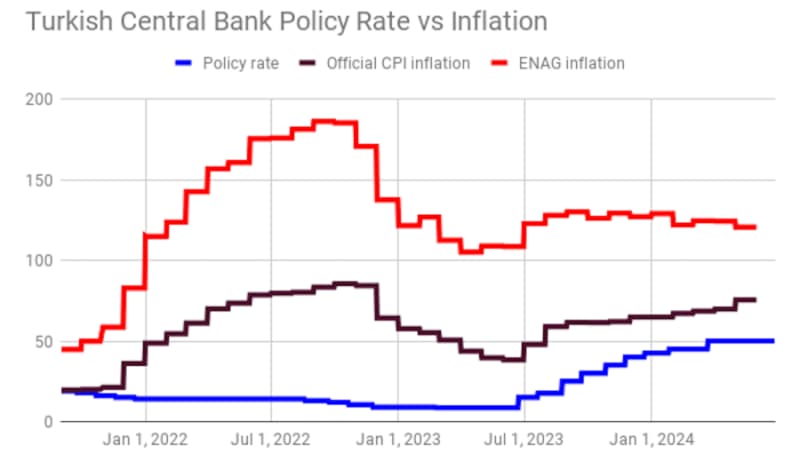

Turkey’s consumer price index (CPI) inflation officially stood at 75.45% y/y in May versus 69.8% y/y in April and 38% y/y in June last year, the Turkish Statistical Institute (TUIK, or TurkStat) said on June 3 (chart).

At 75.45%, TUIK’s inflation series has reached its peak. It will quickly fall back to the 40%s in the next few months thanks to the base effect.

Pushing the headline figure to below 40% would perhaps prove too much of a stretch for the country’s infamous statistical institute.

On May 9, the central bank hiked its end-2024 official inflation 'target' to 38% in its latest quarterly inflation report from the 36% stated in the February report.

The upper boundary of the end-2024 forecast range was pushed up to 42%.

The authority previously pinpointed how the official annual series would peak at 75-76% in May.

It also foretells how average official monthly inflation will decline to 1.5% in 4Q23.

On August 8, the central bank will release its next inflation report and updated forecasts.

For May, TUIK also posted official inflation of 3% m/m for the third consecutive month since March.

TUIK is set to deliver further outcomes in the 2-3%s for the official monthly headline indicator.

At 75% y/y, Turkey left Venezuela and Sudan behind in the world inflation league, moving up to third place.

The Istanbul-based ENAG inflation research group of economists, meanwhile, calculated a Turkish inflation figure of 121% y/y for May. The ENAG figure recorded for April was 124% y/y, while for June last year it was 109% y/y.

TUIK also gave an official figure of 58% y/y for producer price index (PPI) inflation in May.

Policy rate

In June 2023, following the post-election appointment of Turkey’s new economic team led by finance minister and ex-Wall Street banker Mehmet Simsek, the Erdogan regime U-turned on monetary policy and launched a tightening process that is ongoing.

Prior to the tightening, another wave of currency depreciation coupled with widespread tax hikes by the new orthodox management dynamited pricing behaviour in the country once again.

Across the tightening process, the policy rate was hiked to 50% by March this year from 8.5% in June last year.

Disinflation will be established in the second half of the year, the monetary policy committee (MPC) of Turkey’s central bank has been reiterating since March.

The next MPC meeting is scheduled for June 27. The rate-setters at this point look set to stick with the 50% benchmark.

CDS above 300-level

Looking at the global markets, as things stand they do not suggest any notable turbulence. Turkey’s CDS moved above the 300-level, while the yield on the Turkish government’s 10-year eurobonds remains below the 8%-level.

In June, the European Central Bank (ECB) is expected to deliver a rate cut while the Federal Reserve (Fed) has been delaying the delivery of its expected rate cut.

Above the 300-level in the CDS could be seen as a window for considering a purchase of Turkey’s eurobonds for those who are up to trading the country’s FX papers or selling the country’s CDS for those who are up to trading Turkey’s risk premium.

The CDS is a clean instrument for betting on Turkey without getting involved in local risks in relation to the lack of rule of law.

Currency swaps on the London offshore market also provide a window for avoiding local legislation. However, Turkish authorities order local banks to dry up lira liquidity in the market from time to time (when they lose their grip on the local currency). Some people are, as a result, burnt.

USD/TRY in the 32s

Since March, the Erdogan administration has been applying its straight-line USD/TRY rate policy. It has been drawing a line around the 32-level this time around.

As a result of the portfolio inflows, the northward pressure on the USD/TRY pair was reversed and the window for slowly building up lira papers is now open.

Portfolio inflows are not resulting in lira appreciation since the central bank is buying everything.

Eyes on interest gains

As the Erdogan administration avoided a lira devaluation in the post-election period, the window for benefiting from the subsequent appreciation, meanwhile, remains closed.

Investors’ eyes, as a result, focus on interest gains.

With the May inflation announcement, inflation has peaked, and the horizon for the beginning of rate cuts (currently expected in 4Q24) will be discussed in the coming period.

Government lira paper price jumps with rate cuts will be on the radar.

Real economy

Although the lira is not appreciating in nominal terms, it is gaining significant value in real terms as actual inflation stands at above 100% and official inflation at 70%.

Turkey’s economy management parrots the line that they will secure appreciation in the lira’s real value.

For a Turk, a vacation on a Greek island is again much cheaper than a vacation in a Turkish town on the Aegean coast.

The economy management is currently pushing to avoid a mid-year hike in the minimum wage.

End of summer

Since there is no lira free-float regime at the moment, there is no explosion seen on the cards.

However, when the carry traders close their position, the Erdogan regime may let the lira depreciate.

In its latest medium-term programme (OVP), officials pencilled in an average USD/TRY (central bank buying) rate of 37 for 2024.

The pair may not stay in the 32s for ever.

On November 5, the US will hold its presidential election. Donald Trump, now a convicted felon, came along with a roar in the Republican Party presidential primaries. The motivation levels of the anti-Trump voters will decide the outcome. Will there be more of the 'antis' now Trump's officially a criminal? Or less?

In any case, “end of summer, September, October, US elections” may provide some ideas about when the carry traders may think of taking profit in the current round of inflows.

Simsek’s talk of fiscal tightening is, meanwhile, doing its job as the finance industry is noting in its analysis that he is applying a fiscal tightening policy.

Simsek’s Mercedes has become an issue for Turks after he advised government personnel to ride Turkey’s ‘native and national’ Togg e-vehicles.

Portfolio flows

There’s still no foreign interest in Borsa Istanbul.

In the week ending May 24, carry trade inflows declined to $525mn, while inflows into the government’s lira papers remained strong at $1.57bn.

Table: Between March 29 and May 24, Turkey attracted about $19bn in carry trade.

Table: Between March 29 and May 24, foreign investors bought $7bn worth of government lira papers.

Currently, 1-week swaps cannot go over 5% of a bank’s equity, while the limit is applied as 10% for 1-month and 30% for 1-year maturities.

As of May 24, the Turkish banking industry’s combined equity stood at $92bn while banks’ swaps with foreigners were estimated at around $13bn.

In the shorter-term maturities, it could be that the pressure on the limit is being felt presently.

Simsek is considering raising the limits in one-way (buy lira at spot and swap it with a Turkish bank) and at maturities longer than six months.

Reserves

In addition to portfolio inflows, local banks have delivered some FX loans (in-balance sheet FX assets are up) and FX deposits have to a degree declined (in-balance sheet FX liabilities are down).

(For exact figures check the banking watchdog BBDK’s weekly bulletin here.)

As a result, the banks cut their FX swaps with the central bank and sold the sum to the authority.

In the table above, the central bank’s net swap stock with local banks declined by $36bn from March 29 to May 24. This sum is thought to have been bought by the authority.

On May 23, it introduced some more macroprudential measures in the form of a cap placed on the FX loan growth.

It could be expected that the increase in the FX loans will not bring more declines in the swaps, while the declines in the swaps will depend on the declines in FX deposits in the coming period.

In the same period (March 29-May 24), the central bank’s net FX position recovered by $62bn. It looks like the $36bn of decline in the local banks’ swap stock and around $26bn of portfolio inflows were entirely bought by the central bank.

As of May 24, the central bank’s FX position was estimated as standing at about minus $12bn.

And (almost) finally... tentative truce in the gang wars

Erdogan and his junior coalition partner Devlet Bahceli have reached a tentative truce when it comes to the latest round of clashes among the gangs that make up the Erdogan regime.

After Erdogan’s interior minister Ali Yerlikaya paid a visit to Bahceli, Bahceli sacrificed/fired his aid Olcay Kilavuz.

Kilavuz is among the main ways, in evidence gathering, of connecting the murder of Sinan Ates to the headquarters of the Nationalist Movement Party (MHP).

In 2023, Ates, a former head of the Grey Wolves (Ulku Ocaklari), was shot dead by motorbikers in Ankara. The Grey Wolves group is the youth wing of the MHP.

For some reason (there are many rumours as to the reason), the headquarters of the MHP got annoyed with Ates. A drug-running gang arriving in official vehicles from Istanbul turned up and shot him.

The idiot hitman, who was supposed to only wound Ates, mistakenly murdered him.

These people, who mistakenly kill their own man, are involved in governing Turkey. It is no joke that the destiny of almost a hundred million people is in the hands of these fools.

You can just imagine what a Kurd experiences in Turkey if a Grey Wolves top man is killed by players in the governing coalition.

The trials for the assassination are currently ongoing, with the Ates case among the few proceeding court cases conducted by Erdogan’s gangs to attack Bahceli’s gangs.

The judges have not imposed a ban on Kilavuz leaving the country. That would seem to indicate a last exit for him.

If Kilavuz does not take his chance, his life expectancy in Turkey will not look too good. His death would remove some important evidence.

And finally... the 'softening'

When it comes to Erdogan’s latest campaign, namely a 'softening the political atmosphere in the country', he will soon pay a return visit to Ozgur Ozel, his new boy for the lately emerged 'softening' affairs.

It should be noted that the 'softening' is limited to Ozel, the new leader of the main opposition Republican People’s Party (CHP).

Through a 'softening' with the CHP, Erdogan aims to scrap the “50% plus one vote” rule on declaring a victory in the first round of the presidential election.

On June 3, Erdogan seized the Hakkari municipality from the pro-Kurdish DEM Party, arresting the mayor and installing a 'trustee'.

After the March 31 local elections, Hakkari became the first DEM-held municipality. In the coming period, Erdogan will seize almost all DEM's municipalities one by one as he did after the previous local elections held in 2019.