By Tamas Csonka in Budapest

Rising consumer demand for services and positive net exports helped Hungary’s economy to rebound in the first quarter, after a year in recession, while industry was a negative contributor to growth.

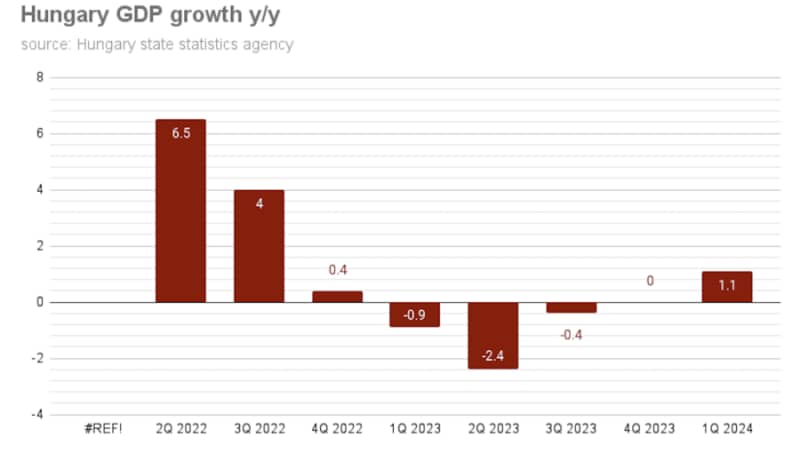

Hungary’s statistics office on June 4 KSH confirmed the preliminary reading that the economy grew 0.8% compared to Q4 and 1.1% (chart) in annual terms, or 1.7%, when adjusted to working days, above the analysts’ consensus.

The breakdown by sectors shows that on the production side, services lifted GDP by 1.7pp and on the expenditure side it was household consumption adding 1.8pp to growth. The monthly industrial data foreshadowed a weak performance of the industry, which contributed negatively to growth by 0.9pp.

On the production side, the balance of taxes and subsidies and construction output added 0.2pp and 0.1pp to growth, while the value added of agriculture was flat. Within services, real estate was the main contributor with a 0.5pp value added.

Data confirmed that manufacturing output fell by 4.8% in the first quarter as demand for transport and electrical equipment, including EV batteries, contracted, due to subdued demand by Western carmakers.

On the expenditure side, the trade balance contributed 3.1pp to GDP growth and final consumption 1.8pp. Gross capital formation had a 3.7pp negative impact on GDP.

The positive contribution of net exports was the result of imports (-9.2%) falling at a steeper pace than exports (-5.3%) despite the weak external environment.

Analysts expect economic growth to accelerate in the following months boosted by consumption as real wages are set to grow 6-7% after a decline of the same pace a year earlier. The fall in interest rates and the inflow of EU funds and FDI investment investments could also support growth in 2024. New capacity expansions in the vehicle sector are likely to spur output to over 4% in 2025, they added.

Weak external demand, especially at Hungary’s largest export market in Germany, poses the biggest downside risks for 2024, Makronom Institute said, leaving its 2.8% GDP target unchanged after the data. This remains at the higher end, as analysts' forecasts ranged between 2.2% and 2.8%. The government slashed its forecast from 4% to 2.5% in the spring.