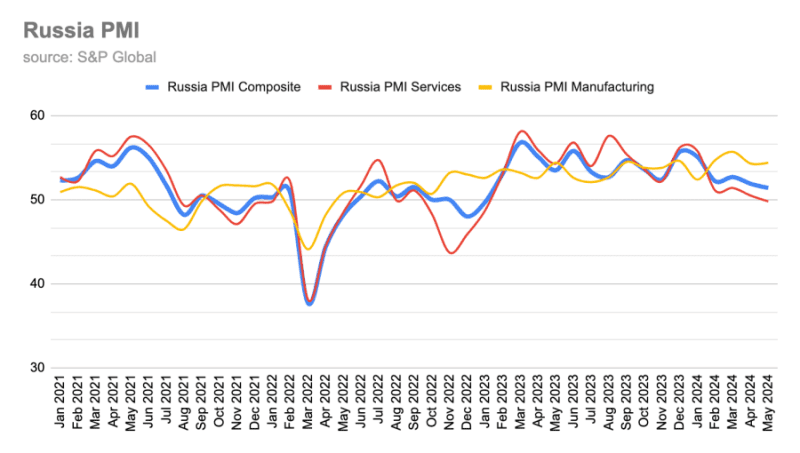

The seasonally adjusted S&P Global Russia Services PMI Business Activity Index slipped into the red in May posting a score of 49.8, down from 50.5 in April, just above the no-change benchmark of 50. (chart)

“The decline in activity brought to an end a 15-month sequence of expansion. Lower output levels were often attributed by panellists to more subdued demand conditions and little change in new orders on the month,” S&P Global reported.

The service’s result follows on from very robust growth in the manufacturing PMI, which posted 54.4 in May, well above the 50 no-change mark. Job creation in manufacturing hit a 26-year high as the Kremlin pours money into the military industrial sector.

Taken together, the Composite PMI posted at 51.4 in May, down from 51.9 in April, to signal the slowest upturn in overall business activity in the current 16-month sequence of expansion, S&P Global reports.

“The rise in activity was only marginal overall, as service sector output dipped into contraction territory,” S&P Global reports.

Russia’s economy has been growing strongly in the last year as it enjoys a military Keynesianism boost from heavy state spending on the military. At the same time an acute labour shortage has pushed up nominal wages faster than inflation, but persistent inflation, currently at 7.8%, remains the main economic headache and the Central Bank of Russia (CBR) is expected to hike rates again from the current 16% at the next monetary policy meeting this week which will slow growth.

“Russian services firms signalled a renewed fall in business activity during May,” according to the latest PMI survey from S&P Global. “The drop in output was the first since January 2023 and stemmed from broadly unchanged levels of new order inflows. Despite a near-stagnation in new business, companies continued to take on additional staff, albeit at the slowest pace for three months. Greater employment was underpinned by an improvement in business confidence in the outlook for output, alongside efforts to deplete backlogs of work… That said, the pace of the downturn was only fractional.”

Although still below the series average, the rate of input price inflation quickened midway through the second quarter. In turn, firms raised their selling prices at a sharper pace.

While real wages continue to grow, the persistent high inflation is slowly eating into consumers' purchasing power and more muted demand conditions, which reportedly weighed on the expansion in new business in May, as new orders were broadly unchanged from April, says S&P Global. Some businesses also noted a drop in client numbers, according to the panellists. The respective seasonally adjusted index was at its lowest since January 2023.

Inflation is also driving up services input prices which increased at a quicker pace in May.

“The rate of cost inflation ticked up for the second month running to the fastest since January. Panellists noted that greater transportation and supplier costs, alongside increased wages, pushed up input prices. Nonetheless, the pace of inflation was below the series' long-run trend and much slower than the average between 2021 and 2023,” says S&P Global.

On the selling prices front, Russian service providers continued to raise output charges midway through the second quarter. In line with a steeper uptick in cost burdens, firms increased prices at the quickest rate for three months.

“Anecdotal evidence widely attributed higher charges to the pass-through of greater costs to customers,” says S&P Global.

The tight labour market remains a problem, but despite relatively subdued demand conditions, services firms continued to hire additional staff in May. The pace of job creation eased to the weakest in three months but remained stronger than the series average.

Additional capacity, alongside little change in new orders, allowed companies to work through their backlogs in May. Incomplete business fell for the second month running, but at only a marginal pace.

Finally, expectations regarding business activity over the coming year improved in May. Service providers hoped stronger demand conditions and the acquisition of new customers would help boost output. The degree of optimism was historically elevated and the highest for three months, said S&P Global.

In general the private sector firms continued to take on additional staff in May especially in manufacturing, which remains the driver of the Russian economy, with factory employment growth quickening to almost a series record pace.