Alongside artificial intelligence (AI), quantum computing is one of the revolutionary new technologies that's changing the way industries handle and process information. While mega-cap giants like Microsoft (MSFT) and old-guard tech names like IBM (IBM) are involved in quantum computing, it's also a field that lends itself to exciting new startups.

Among those names are D-Wave Quantum (QBTS) and Rigetti Computing (RGTI), which have just been tapped as two of the newest members of the Russell 3000 Index, as well as the Russell Microcap Index. The changes were announced as part of the annual Russell index rebalancing, which typically draws heavier-than-normal volume to markets each June as fund managers and institutional investors track changes in the Russell benchmarks.

Ahead of this increased investor interest, here's a closer look at these two quantum computing stocks.

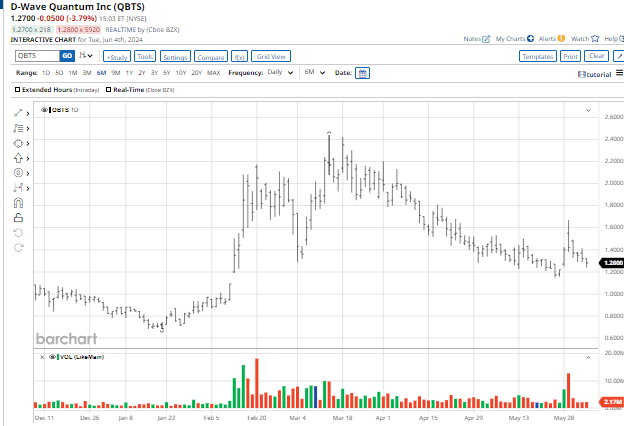

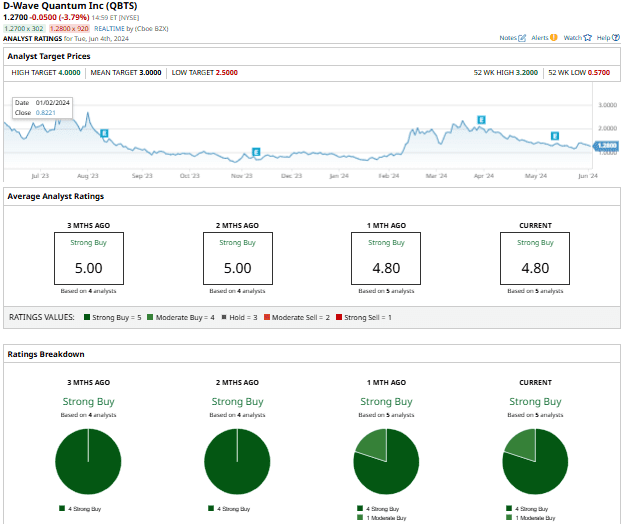

1. D-Wave Quantum Stock

D Wave Quantum Inc. (QBTS) develops and delivers quantum computing systems, software, and services. Valued at $226 million by market cap, the company makes quantum computers and gate-model quantum computers, and also offers quantum hybrid solver solutions, training, and professional services.

Founded in 1999, its portfolio of work has been used by companies including Mastercard (MA), Lockheed Martin (LMT), ArcelorMittal (MT), and Los Alamos National Laboratory. D-Wave offers practical quantum solutions for AI, drug discovery, cybersecurity, fault detection, and financial modeling, among others.

QBTS stock has outperformed the broader markets with a gain of more than 46% this year. However, with the stock down 60% from its 52-week high, it's still possible to buy shares at a discount.

The company reported its Q1 results on May 13, with revenue coming in at $2.5 million, up from $1.6 million reported in the year-ago quarter. It reported a net loss of $0.11 per share, which was wider than the analyst estimate for a loss of $0.09 per share. Its bookings for the quarter increased 54% YoY to $4.5 million from $2.9 million, while the customer base expanded to 128.

D Wave’s Q1 gross profit stood at $1.7 million, reflecting a 294% increase due to revenue growth and better operating efficiency. Operating expenses totaled $19.2 million, decreasing 24% YoY. At the end of the quarter, the company’s consolidated cash balance stood at $27.3 million, a rise of 204% from $9.0 million last year.

QBTS is highly regarded among the 5 analysts tracking the stock, with a consensus “Strong Buy” rating and a mean price target of $3.00. That suggests expected upside potential of 132.5% from current levels.

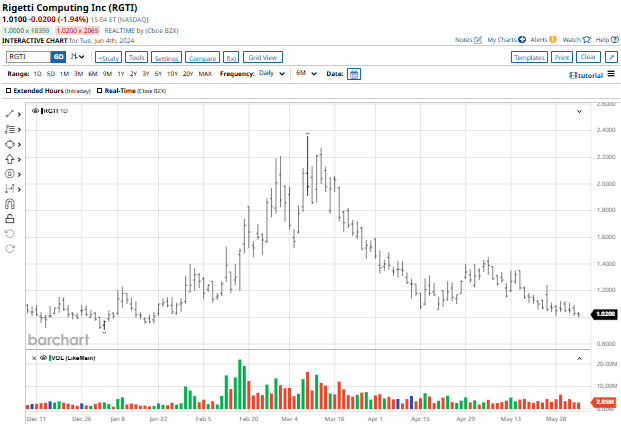

2. Rigetti Computing Stock

Rigetti Computing Inc. (RGTI) is a builder of quantum computers and superconducting quantum processors. Their Quantum Cloud Services (QCS) platform enables their machines to integrate with any public, private, or hybrid cloud systems. It sells its 9-qubit chip and Ankaa-2 system under the Novera brand name, while providing quantum cloud services that include support in programming and private or public cloud connectivity and integration.

Founded in 2013, Rigetti is located in Berkeley, California. Valued at $177 million by market cap, the company recently announced the sale of its third Novera quantum processing unit (QPU).

Rigetti Computing stock has been under fire lately, down more than 56% from its early March highs. The shares are up just 3.6% on a YTD basis.

On May 9, Rigetti reported Q1 earnings results that fell short of Wall Street’s expectations. Q1 revenue rose 38.7% to $3.1 million, while its net loss per share narrowed to $0.14 from $0.19 in the year-ago quarter. At the end of the quarter, Rigetti's cash balance totaled $102.8 million.

On an adjusted basis, RGTI's loss of $0.11 missed estimates for a loss of $0.08, while analysts were targeting higher revenue of $3.24 million.

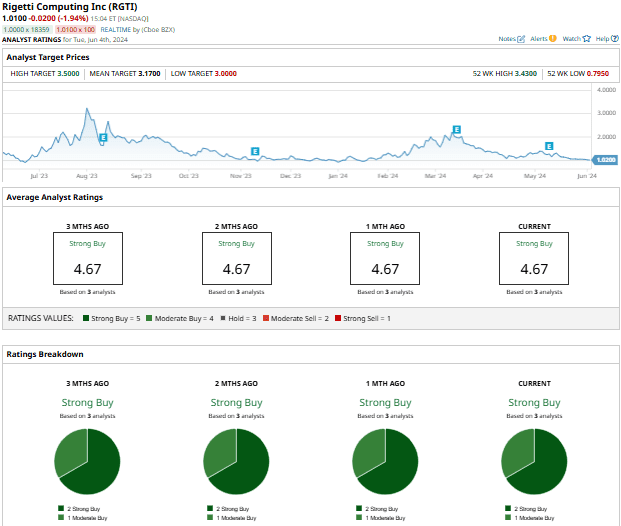

Analysts are still very bullish on the stock, with 2 “Strong Buy” ratings and 1 "Moderate Buy” rating among the three in coverage. The mean price target is $3.17, reflecting a potential upside of 210.7% from current levels.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.