By Ben Aris in Berlin

CBR Governor Elvia Nabiullina listed four factors to ensure the stability of the Russian economy during a presentation at St Petersburg International Economic Forum (SPIEF) on June 5.

These are macroeconomic stability, the creation of a class of retail investors, the development of tools to maintain financial stability and the launch of a programme to improve the banking system.

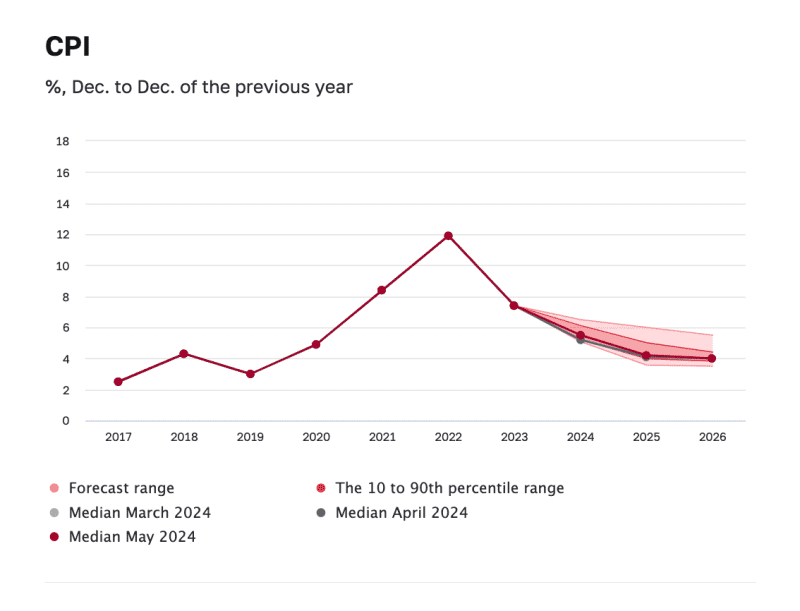

“The first is, of course, macroeconomic stability. We have gained experience, for example, of living in conditions of not very high inflation. By 2017, we reached 4% inflation, which many people had little faith in, and maintained it at this level for about five years… We also had long-term financing, mortgages then began to grow at a market rate of 8-9% and without expensive budget programmes,” she said.

According to her, after the departure of foreign investors, the importance of retail investors has increased. Nabiullina noted that in 2018 there were “100,000 people in the country who entered the capital market,” and now there are 3.8mn people.

“We have experienced many crises, this forced us to create an extensive system of instruments that ensure financial stability. When a shock occurs, we can immediately reverse them and reduce the impact of shocks on the financial system,” she added.

Russia has risen to become the fourth largest economy in the world on PPP (purchase power parity), according to the World Bank, a year earlier than demanded by Russian President Vladimir Putin.

Nabiullina’s comments as the CBR released the May edition of its macroeconomic survey that shows the economy continues to stabilise, although not without feeling some pain from the international sanctions imposed on Russia.

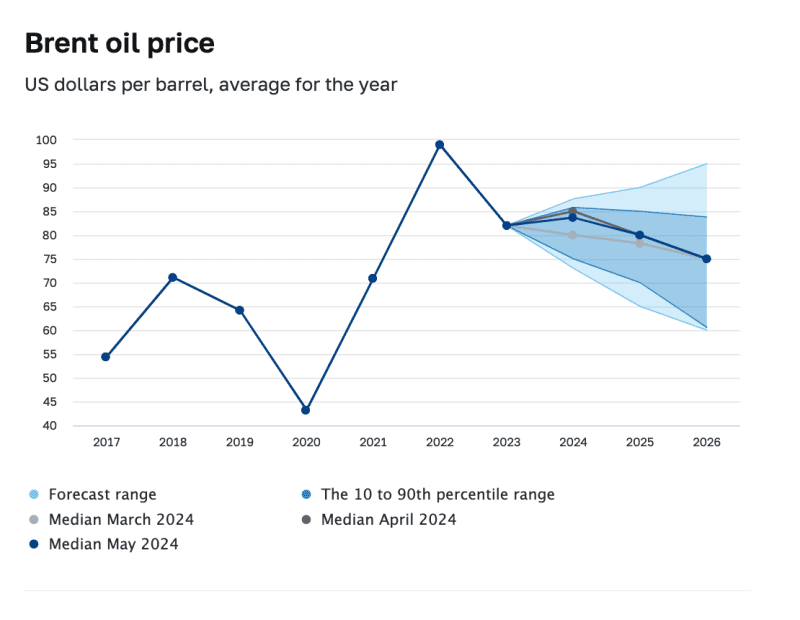

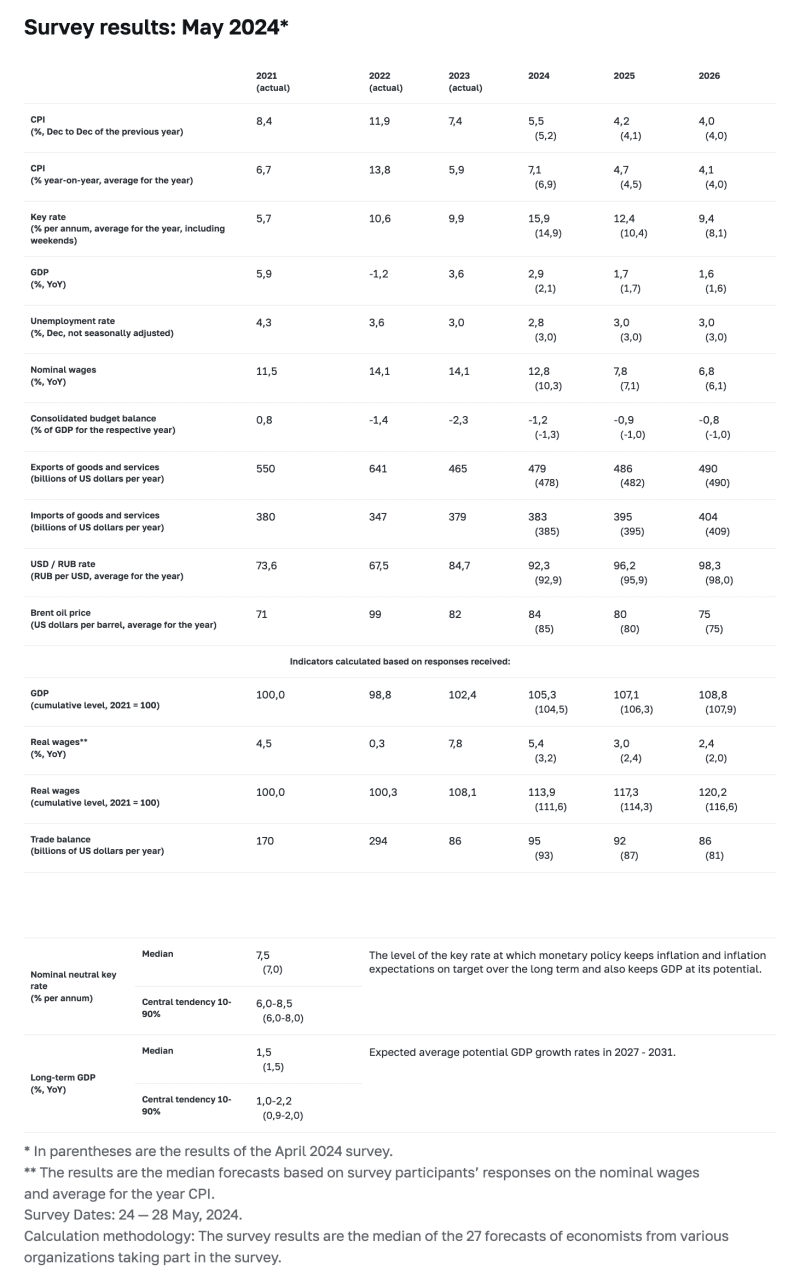

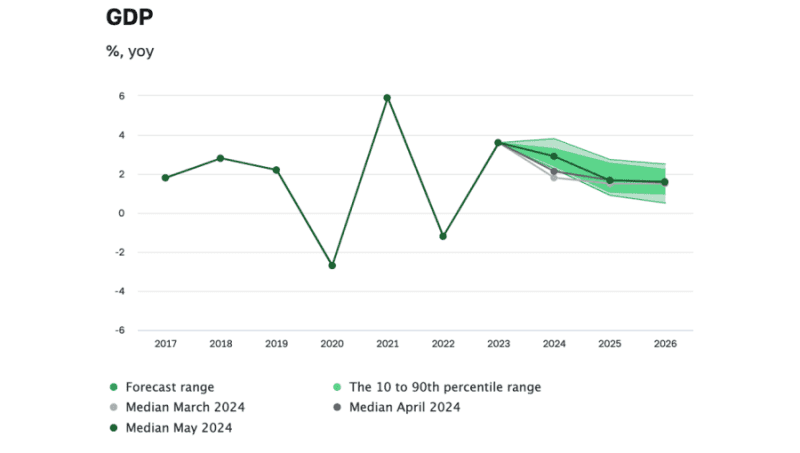

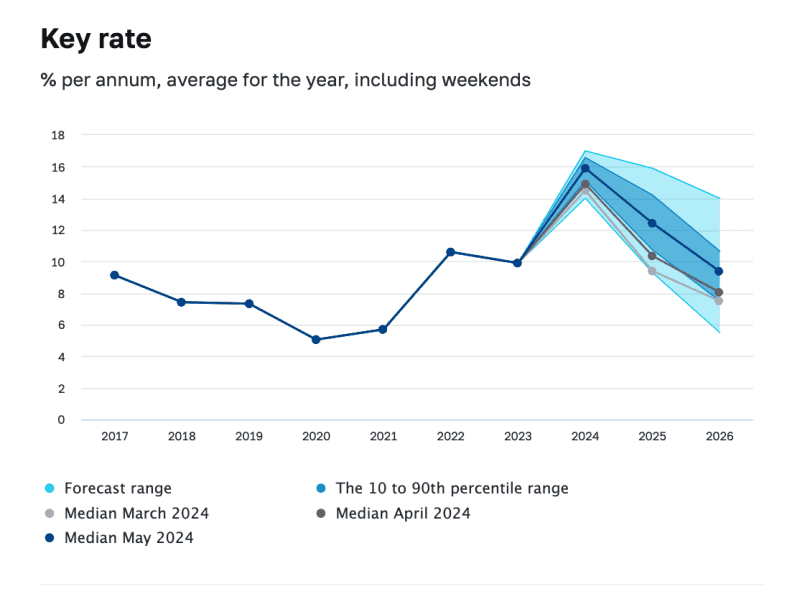

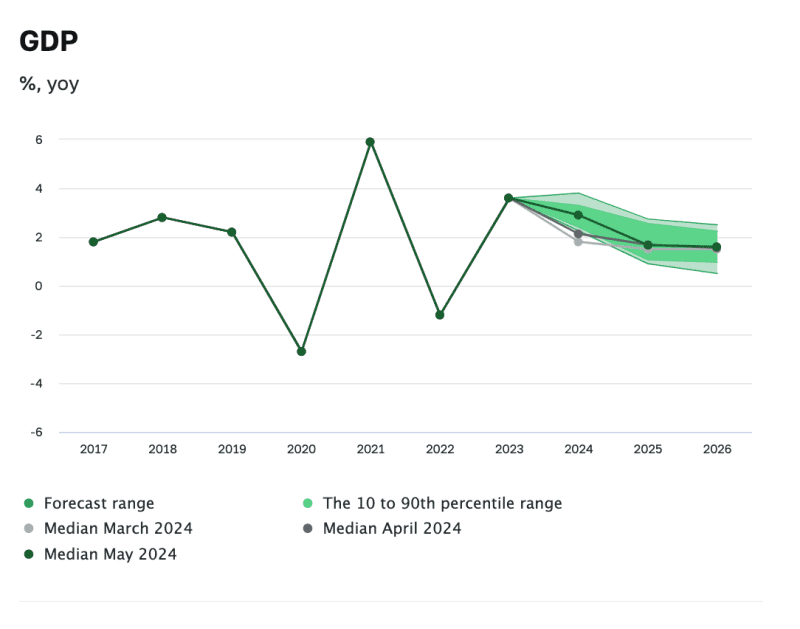

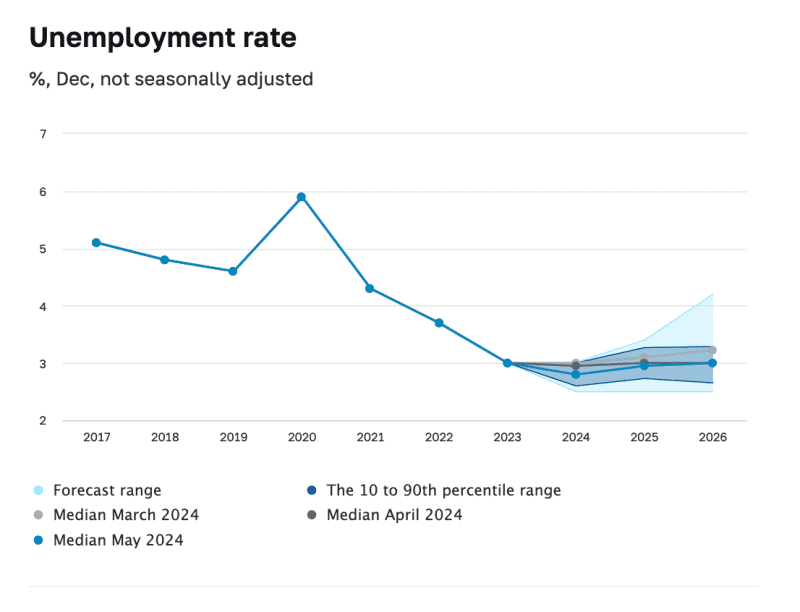

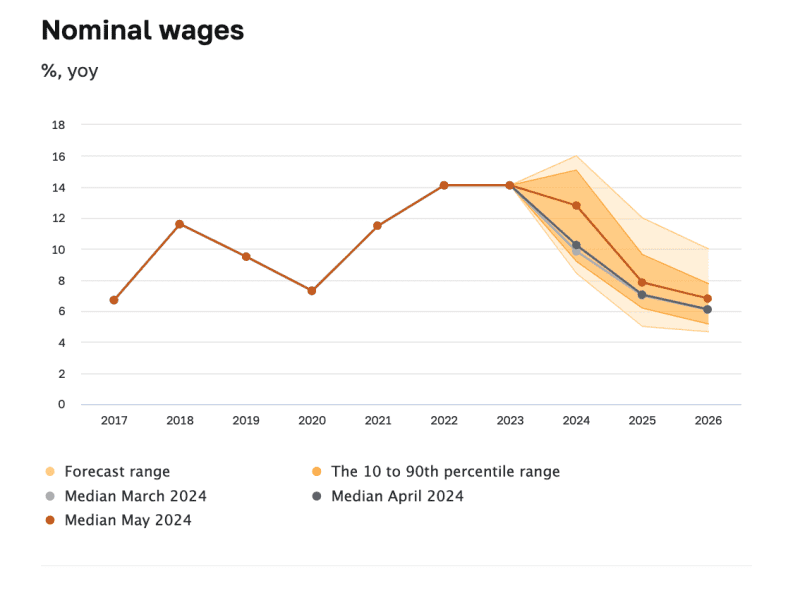

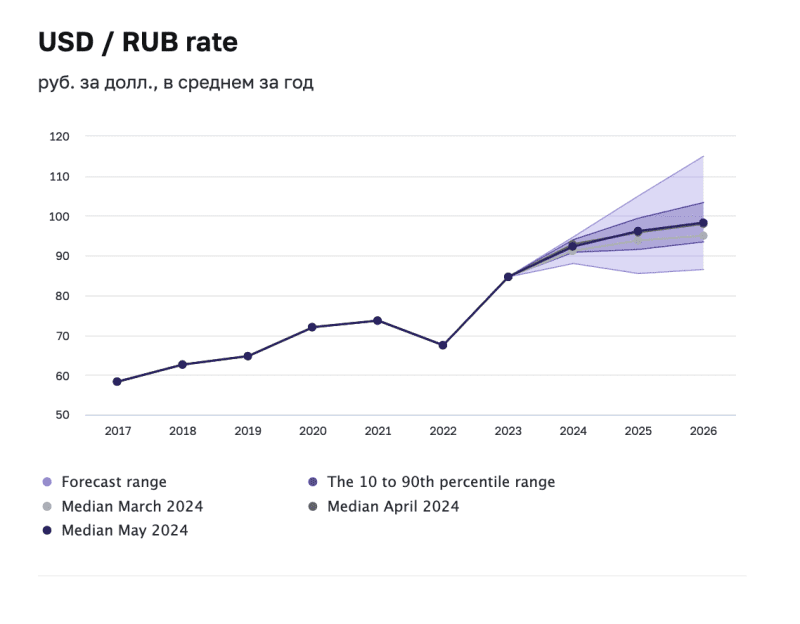

Each month the CBR surveys two dozen professional independent economists to aggregate their forecasts. The ranges of analysts’ forecasts for the next years have narrowed for most indicators. At the same time, the ranges for the key interest rate, unemployment rate, USD/RUB exchange rate, exports, imports and Brent oil price are significantly widening by the end of the forecast period.

Below are the CBR”s main conclusions in each category:

Inflation: Inflation forecast for 2024 has been raised to 5.5% (+0.3 pp compared to the April survey). Analysts expect that inflation will return to the target of close to 4% in 2025 and remain at this level further on.

Key rate: Analysts have raised the average key rate forecast over the entire forecast horizon: to 15.9% per annum (+1.0 pp) for 2024, to 12.4% per annum (+2.0 pp) for 2025, to 9.4% per annum (+1.3 pp) for 2026. This also reflects a higher estimate of the neutral key rate – 7.5% per annum (+0.5 pp).

GDP: Forecast for 2024 has been raised by 0.8 pp to 2.9%. The forecast for 2025, 2026, as well as the estimate of the long-term GDP growth rate are unchanged at 1.7%, 1.6% and 1.5%, respectively. According to analysts, the GDP change in 2026 to the 2021 level will be +8.8% (+7.9% according to the April survey).

Unemployment rate: Analysts expect that unemployment will decline to 2.8% (-0.2 pp) in 2024 and will then return to the 2023 level of 3.0%.

Nominal wages: Analysts have raised their forecast for nominal wages growth to 12.8% (+2.5 pp) in 2024, followed by a deceleration to 7.8% (+0.7 pp) in 2025 and to 6.8% (+0.7 pp) by the end of the forecast horizon. Calculations based on analysts’ forecasts of nominal wages and average CPI suggest that real wages will increase by 5.4% (+2.2 pp) in 2024, by 3.0% (+0.6 pp) in 2025, by 2.4% (+0.4 pp) in 2026. Accordingly, by the end of the forecast horizon, real wages will be 20.2% higher than in 2021 (16.6% higher, according to the April survey).

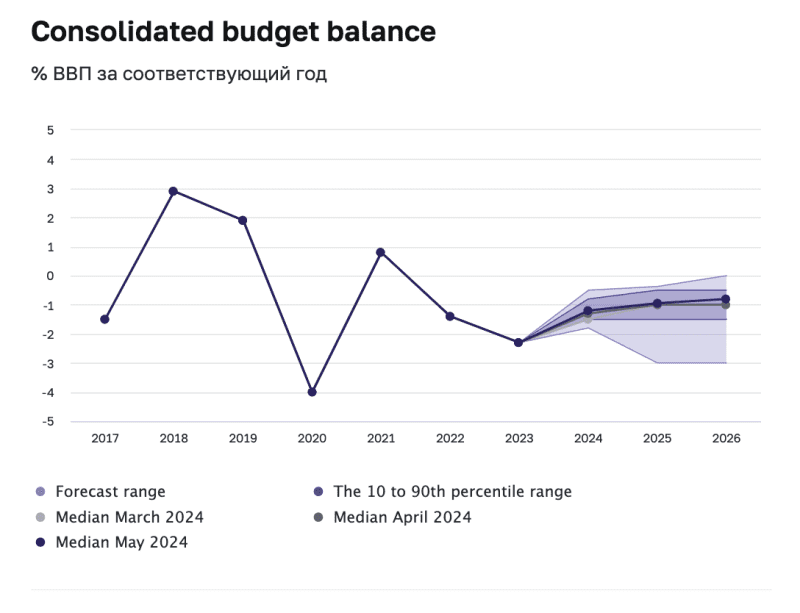

Consolidated budget balance: Analysts expect a slightly smaller consolidated budget deficit of 1.2% of GDP in 2024, followed by a decline to 0.9% in 2025 and to 0.8% by the end of the forecast horizon.

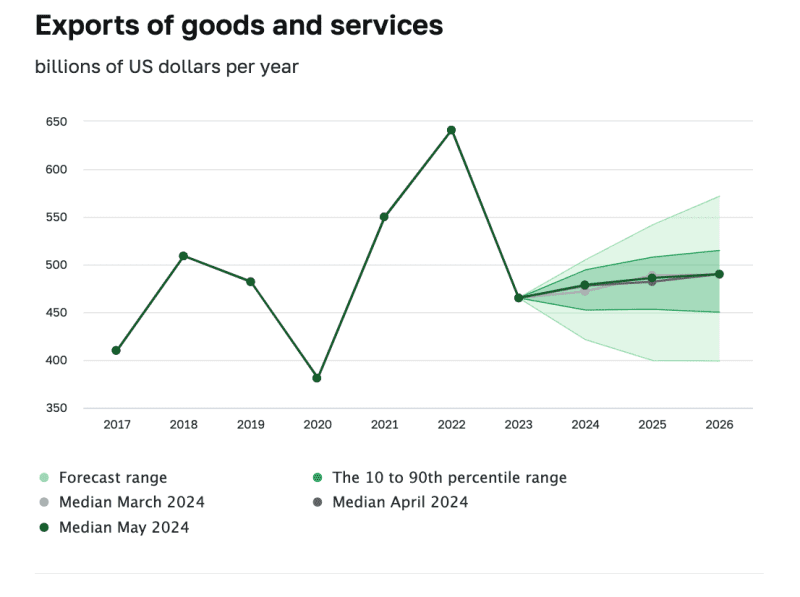

Exports of goods and services: No significant changes: $479bn (+$1bn) in 2024, $486bn (+$4bn) in 2025 and $490bn in 2026, which is 11% lower than exports in 2021.

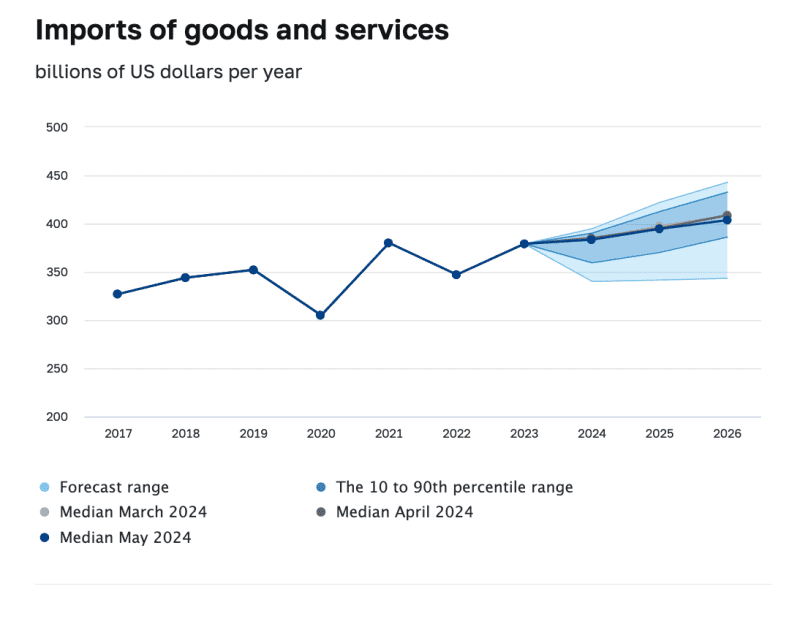

Imports of goods and services: Forecasts have barely changed: $383bn (-$2bn) for 2024, $395bn for 2025 and $404bn (-$5bn) for 2026, which is 6% higher than imports in 2021.

USD/RUB exchange rate: Analysts’ forecast for 2024 is RUB92.3 per dollar, RUB96.2 per dollar for 2025 and RUB98.3 per dollar for 2026 (revised by -0.6-0.3% compared to the April survey).

Brent oil price: According to analysts’ expectations, the average Brent oil price in 2024 will be $84 per barrel. The price will then decrease to $80 per barrel in 2025 and to $75 per barrel in 2026.