Artificial intelligence (AI) has transitioned from a nascent concept to a transformative force across industries. This has fueled a surge in AI-related stocks, demonstrating investor confidence in the technology's potential.

As AI adoption accelerates, the critical infrastructure supporting these platforms is poised for significant growth. Data centers, the vital engine room of the AI ecosystem, stand to benefit the most. IN fact, projections indicate that data center demand could double by 2030, which presents a compelling opportunity for market participants to identify potential leaders within this niche.

To that end, Stephen Ellish, analyst at Morningstar, recently identified a handful of energy stocks engaged in carbon capture, gas transportation, and gas storage - all essential to power AI data centers - that he says look undervalued at current levels. Here's a closer look at his picks.

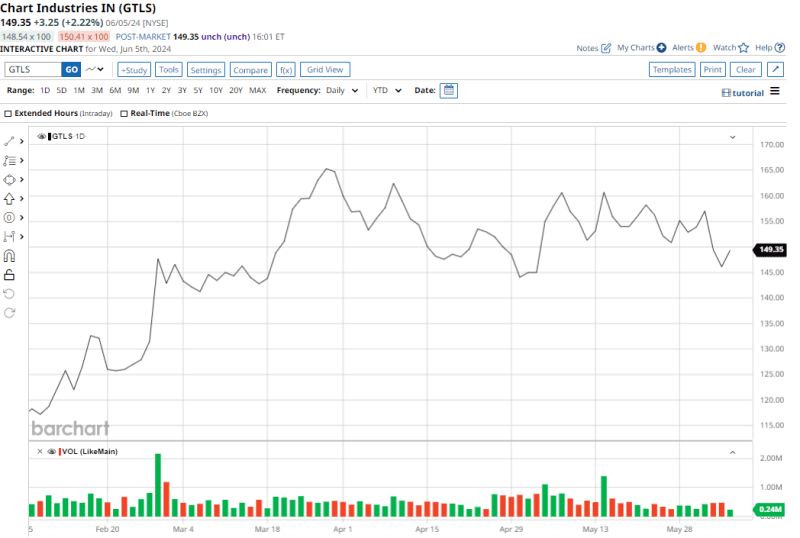

#1. Chart Industries

Based out of Minneapolis, Chart Industries (GTLS) designs and manufactures a wide range of cryogenic equipment essential for the entire liquid gas supply chain, and caters to multiple applications within the clean energy and industrial gas markets. Its market cap currently stands at $6.39 billion.

GTLS stock is up 7.2% on a YTD basis, and down about 20% from its 52-week highs.

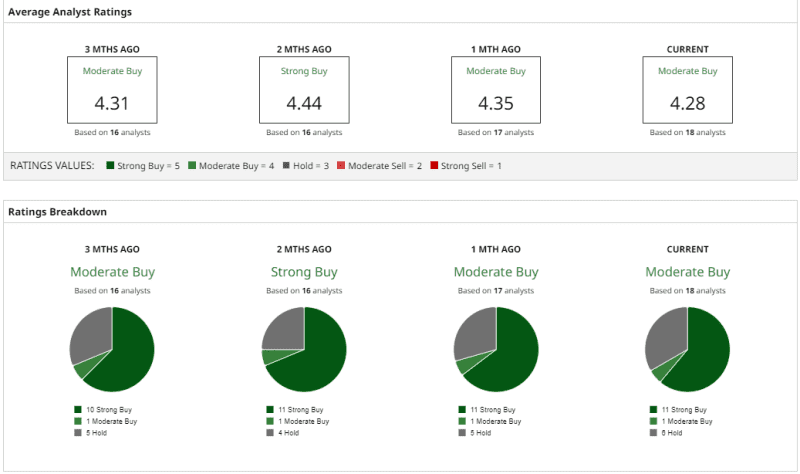

Overall, analysts consider the stock a “Moderate Buy,” with a mean target price of $195.28. That suggests expected upside potential of about 33.4% from current levels.

Out of 18 analysts covering GTLS stock, 11 have a “Strong Buy” rating, 1 has a “Moderate Buy” rating, and 6 have a “Hold” rating.

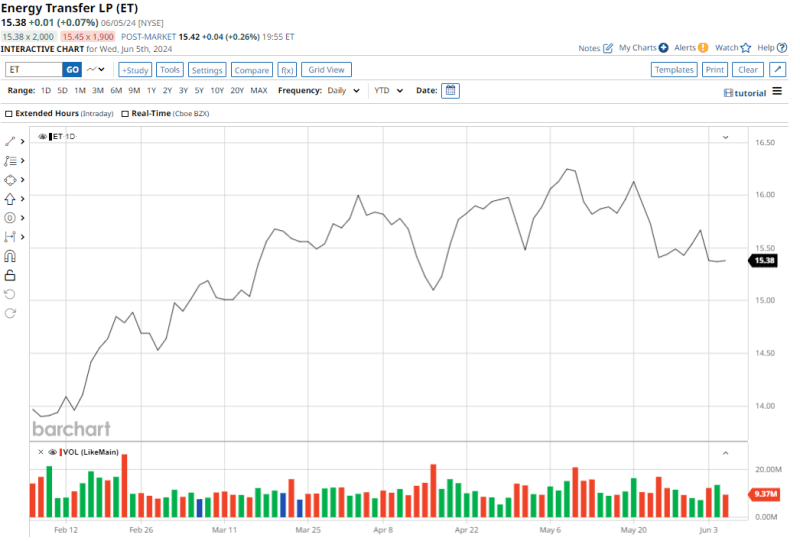

#2. Energy Transfer

Energy Transfer (ET) is a Texas-based energy company, founded in 1995 by Ray Davis and Kelcy Warren, that transports, stores, and processes natural gas (NGN24), natural gas liquids (NGLs), and crude oil (CLN24). The company is one of the leading midstream energy companies in the U.S., commanding a market cap of $51.8 billion and offering a healthy dividend yield north of 8%.

ET stock is up 11.4% on a YTD basis, and has gained more than 19% over the past year.

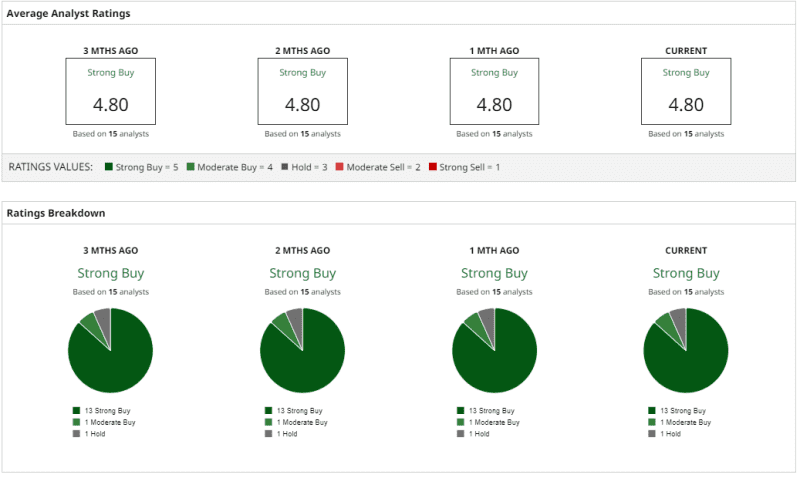

Analysts have a consensus rating of “Strong Buy” for Energy Transfer stock, with a mean target price of $18.69. This indicates an upside potential of about 21.5% from current levels.

Out of 15 analysts covering the stock, 13 have a “Strong Buy” rating, 1 has a “Moderate Buy” rating, and 1 has a “Hold” rating.

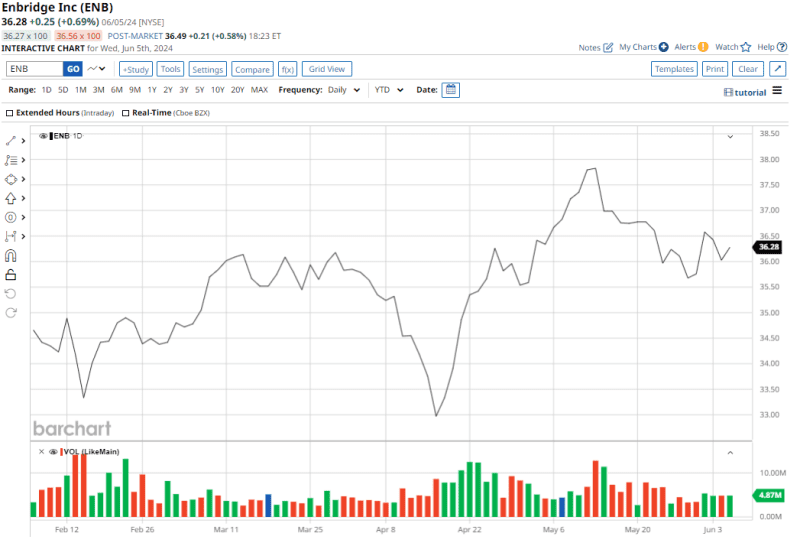

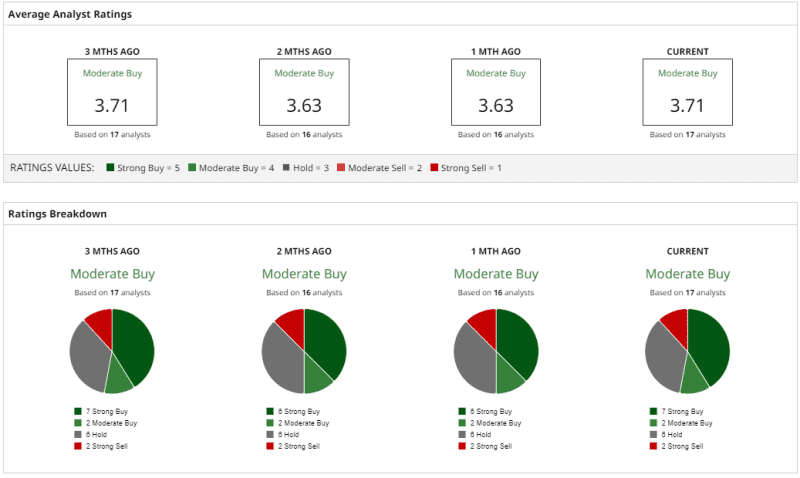

#3. Enbridge

Founded in 1949, Enbridge (ENB) is a diversified energy transportation and distribution company. Their operations are divided into five segments: namely, liquid pipelines; gas transmission and midstream; gas distribution and storage; renewable power generation; and power services. Enbridge currently commands a market cap of $77.1 billion.

ENB stock is nearly flat on a YTD basis. Notably, it offers a dividend yield of 7.32%, which is well above the energy sector median of 3.6%.

Overall, analysts have an average rating of “Moderate Buy” for ET, with a mean target price of $39.12 - implying upside potential of roughly 8.3% from current levels.

Out of 17 analysts covering the stock, 7 have a “Strong Buy” rating, 2 have a “Moderate Buy” rating, 6 have a “Hold" rating, and 2 have a “Strong Sell” rating.

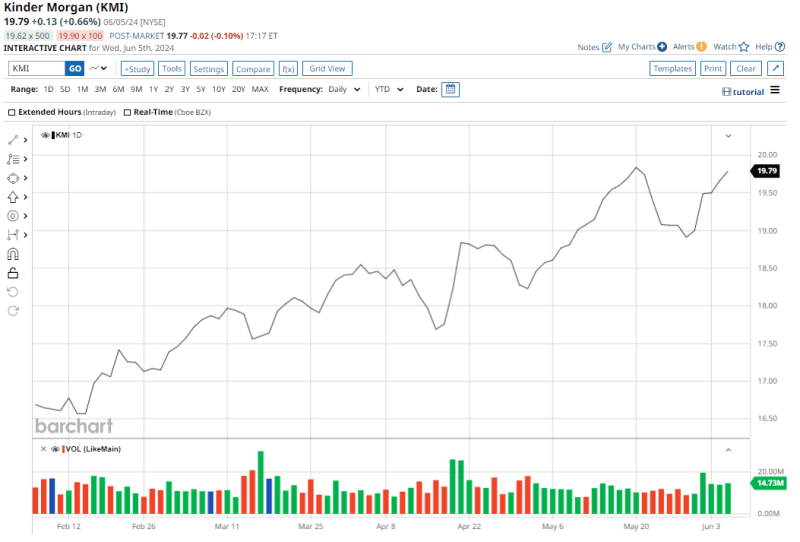

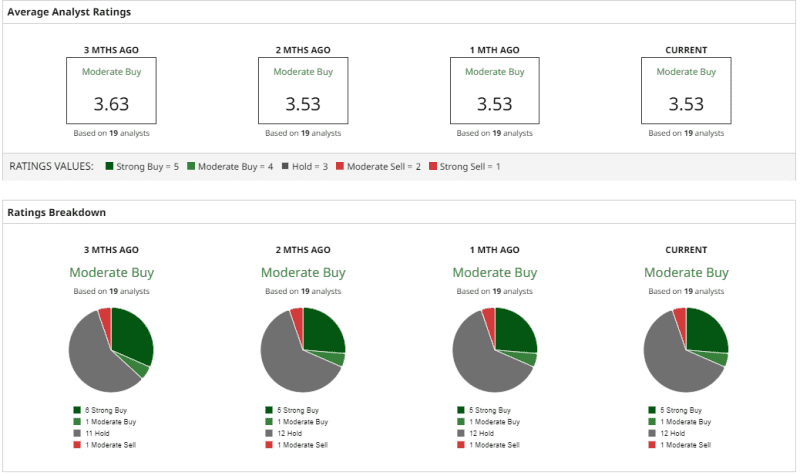

#4. Kinder Morgan

Founded in 1977 by Richard D. Kinder and William V. Morgan, Kinder Morgan (KMI) is a major energy infrastructure company in North America. They focus on the transportation, storage, and distribution of natural gas and NGLs through a vast network of pipelines and terminals. The company operates across various segments including natural gas pipelines, NGL pipelines, terminals, product pipelines, and CO2 pipelines. Its market cap currently stands at $43.9 billion.

KMI stock is up 11.8% on a YTD basis, and it offers a dividend yield of 5.81%.

Analysts have deemed KMI stock a “Moderate Buy,” with a mean target price of $20.44. This denotes an upside potential of about 5.5% from current levels.

Among the 19 analysts covering the stock, 5 have a “Strong Buy” rating, 1 has a “Moderate Buy” rating, 12 have a “Hold” rating, and 1 has a “Moderate Sell” rating.

#5. TC Energy

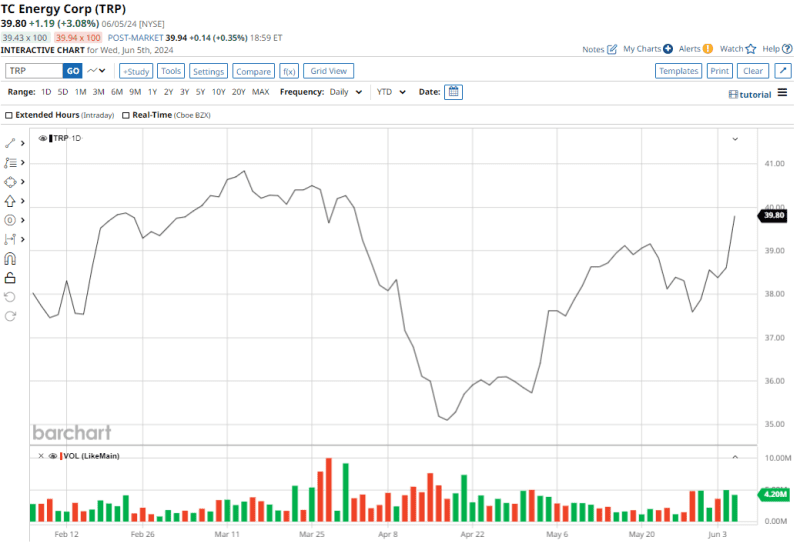

Incorporated by an act of Parliament on March 21, 1951, under the name Trans-Canada Pipe Lines Limited, TC Energy (TRP) is a major North American midstream energy company. Their core business focuses on transporting liquids and natural gas through pipelines across Canada, the United States, and Mexico. Its market cap currently stands at $39.8 billion.

TRP stock is up just 2.6% on a YTD basis, though the stock offers an impressive dividend yield above 7%.

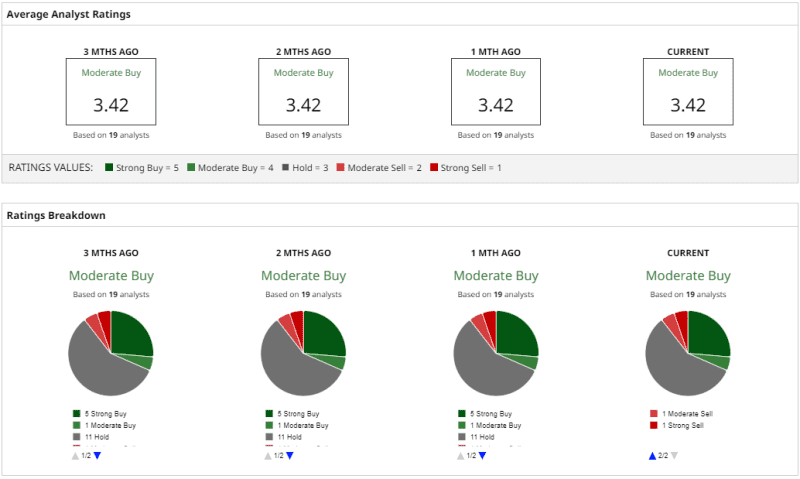

Overall, analysts have a consensus rating of “Moderate Buy” for TRP stock. The mean target price of $40.56 suggests an expected upside potential of about 1.5% from current levels, though the Street-high target of $45.75 is more than 14% overhead.

Out of 19 analysts covering the stock, 5 have a “Strong Buy” rating, 1 has a “Moderate Buy” rating, 11 have a “Hold” rating, 1 has a “Moderate Sell” rating, and 1 has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.