Marvell Technology (MRVL) stock still looks undervalued despite disappointing results released on May 30 for the quarter that ended May 4. MRVL stock could still be worth over 31% more at $89 per share.

MRVL stock closed at $68.10 on Thursday, June 6, down 13% from a recent peak of $78.33 on May 28, before the fiscal Q1 2025 results were released. Investors were surprised that the chip design company showed a 12% lower revenue Y/Y.

In addition, adjusted net earnings per share of 24 cents came in as expected. Investors wanted to see an unexpected upside on the earnings side.

Nevertheless, Marvell Technology, the chip design company - not the entertainment company, guided for higher revenue this quarter on a Q/Q basis. For example, management expects net revenue to be $1.25 billion (+/- 5%). That is higher than the $1.161 billion it generated in that past fiscal quarter.

One good result is that analysts have raised their estimates for revenue this year and next. That could help push its valuation higher.

FCF and FCF Margins Should Remain Strong

In addition, Marvell Technology's free cash flow (FCF) is expected to stay strong. Moreover, its FCF margins will directly affect the stock's valuation going forward.

This quarter it made $233 million in FCF on revenues of $1.161 billion, or an FCF margin of 20%. However, that was significantly lower than the prior quarter's FCF margin of 33.3%.

I discussed this in my May 26 Barchart article, “Marvell Technology Results Due Out This Week Could Push MRVL Stock Higher.” That lower consecutive FCF margin could also be another major reason why there has been weakness in MRVL stock.

But I also discussed taking a trailing 12-month (TTM) look at its FCF margins. That helps iron out seasonal fluctuations and higher quarters (like in the fiscal Q4 ending Feb. 3).

For example, in the priorquarter ending Feb 3 (its fiscal Q4), the company's TTM FCF margin was 18.8% (i.e., $1.034 billion on $5.5 billion of revenue). But, this past quarter ending May 4, the TTM FCF margin was slightly higher at 21.67% (i.e., $1.159 billion on $5.347 billion in revenue).

So, going forward we can use that higher FCF margin to estimate the company's forward projected free cash flow. That will help us derive a stock price target.

Target Price Using FCF Margins and FCF Yield Metrics

As mentioned, analysts have recently raised their revenue forecasts. Now they are projecting $5.41 billion this fiscal year ending Jan. 31, 2025, up from $5.32 billion (as discussed in my prior article). Moreover, for the following year, they project 32.5% higher sales at $7.17 billion (up from $7.05 billion.

So, on average over the next 12 months (NTM) the run rate revenue forecast is $6.245 billion on average. Applying a 21.67% FCF margin results in a projected $1.353 billion in free cash flow (FCF) over the NTM period.

That is useful to set a price target. For example, as discussed in my last article, the stock will likely have about a 1.75% dividend yield if it were to pay out 100% of FCF. This is because it spends just 20% on dividends now and it has a 0.35% yield.

Therefore, if we divide the NTM FCF forecast of $1.353 billion by 1.75%, its market valuation could be over $77 billion. That is 31% higher than its present $58.95 billion market capitalization.

In other words, MRVL stock could be worth 31% more than $68.10 per share over the next 12 months. That means its price target is $89.21 per share.

Analysts Have Higher Price Targets As Well

This price target is similar to surveys of analysts' price targets. For example, Barchart's survey of 29 analysts has an average price target of $88.94 \- very close to my FCF-based price target.

Moreover, Yahoo! Finance reports that the average of 30 analysts is $88.78 per share. AnaChart, a new sell-side analyst tracking service, shows that 26 analysts have an average price target of $80.19.

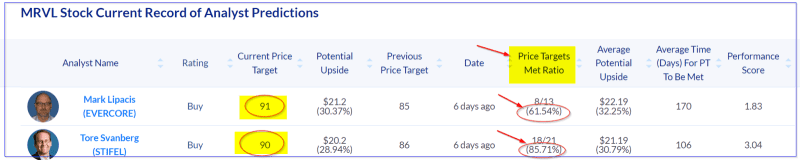

All of these average target prices are significantly over today's price, even though the stock has dropped recently. For example, AnaChart shows that two top-rated analysts have current price targets of $91 and $90 per share (see below).

This table shows that Mark Lipacis, of Evercore, has a $91 price target that he set 6 days ago when the company came out with earnings. Note that he has been successful 61.5% of the time in meeting his price targets.

The same is true with Tore Svanberg of Stifel. He has a $90 price target and a success ratio of 85.7%. In other words, there is a very good likelihood going forward that his price target will be met.

The bottom line is that analysts agree with me that MRVL stock looks cheap here. One way to play this is to sell short out-of-the-money (OTM) put options. That way the investor can make extra income while also waiting to buy at a lower price, if possible, if MRVL stock drops to the OTM strike price.

Selling OTM Puts

For example, look at the June 28 expiry period, which is 3 weeks from now. It shows that the $65.00 strike price put options trade for $1.17 on the bid side (before Friday's open June 7).

That means that a short seller at this strike price, which is 4.55% below the June 6 price close, can make an immediate yield of 1.80% (i.e., $1.17/$65.00).

Here is how that works. The investor secures $6,500 in cash and/or margin with their brokerage firm. Then, they get permission to sell the June 21 $65.00 put options in a"Sell to Open" order.

Their brokerage account will immediately receive $117. That is why this is a 1.80% yield (i.e., $117/$6,500 = 1.80%). Moreover, it provides good downside protection, since the breakeven price for the investor is $65.00-1.17, or $63.83. That is 6.3% below the closing price of $68.10 on Thursday, June 6.

Keep in mind that this also represents a good expected return (ER) if the investor can repeat the trade. For example, over the next quarter (i.e., 12 weeks) if the investor can make $117 in four (i.e., 12 wks/3 wks per short-put expiration period), the ER is $468 (i.e. $117 x 4). That represents an ER yield of 7.20% (i.e., $468/$6,500) in just 12 weeks.

That provides huge downside protection in case the stock falls to the strike price and the investor has to buy MRVL stock with the secured cash. In addition, existing shareholders in MRVL stock can do this short-put play and make any extra capital gains if the stock rises. Plus they can keep in short put income.

The bottom line is that MRVL stock looks cheap here and one way to play it is to short OTM puts in nearby expiry periods.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.