Tesla (TSLA) is currently going through one of the most turbulent times in its history. The company is battling slowing top-line growth and cratering margins in a macro environment where electric vehicle (EV) companies are squarely out of favor with markets.

Then we have the company’s annual meeting next week, where shareholders will decide on CEO Elon Musk’s 2018 compensation package. A vote on the gigantic pay package, once worth $56 billion, was called for after a Delaware judge voided the previous package earlier this year.

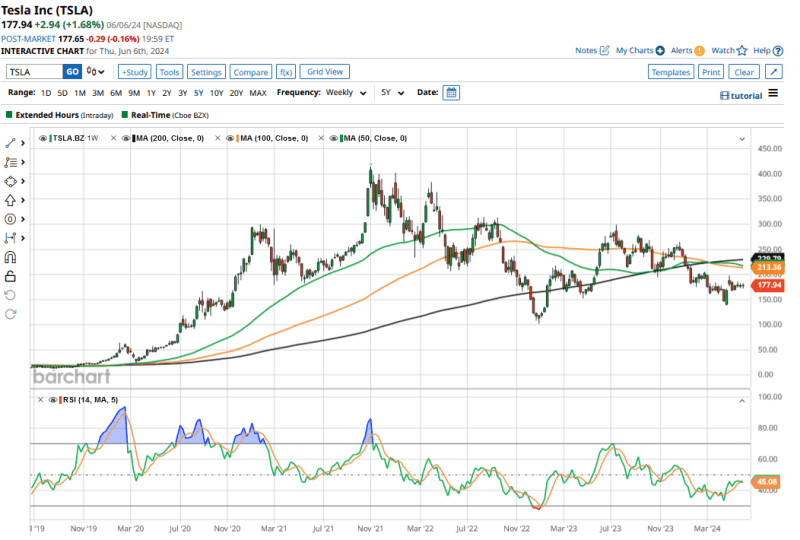

Amid all of the controversies and headwinds, Tesla is stacked at the bottom among “Magnificent 7” names this year. With a YTD loss of over 28%, it is the only constituent of the widely followed group that's in the red. Also, the Elon Musk-run company trades at less than half of its 2021 highs.

Tesla Became the First Automaker With a $1 Trillion Market Cap

That same year, Tesla broke several records when it became the first automotive company to have a market cap of over $1 trillion. No automaker has come even remotely close to that level - and even if we add the current market caps of leading automakers, we won’t reach $1 trillion.

To be sure, putting Tesla in the same league as automakers would attract the ire of Tesla/Musk fans – and rightly so. The company is much more than an automaker, even as most of its current revenues come from selling electric cars. It is working on autonomous cars, robotics, and supercomputers. These products are critical to Tesla’s valuation, and the company will need to make progress on them before it reclaims its title as a $1 trillion behemoth.

Elon Musk’s 2018 Compensation Package

There is a problem, though, as Musk has said he won’t be comfortable building new-age artificial intelligence (AI) products at Tesla unless he has 25% voting rights in the company.

If that “threat” wasn’t enough, Tesla is calling upon shareholders to approve Musk’s compensation package to “retain Elon's attention and motivate him to continue to devote his time, energy, ambition and vision.” That's as good as saying Musk won't stay at Tesla without that mammoth package.

Adam Jonas of Morgan Stanley – arguably among the biggest Tesla stock bulls – warned that Tesla could significantly curtail its AI efforts if Musk does not get 25% voting rights.

"While Tesla may still be in position to benefit indirectly from AI advancements, we believe that most of the adjacent AI efforts could be concentrated within non-Tesla entities where Elon Musk has control,” added Jonas, who has a Street-high $310 target price on Tesla.

Can Tesla Become a $1 Trillion Company by 2025?

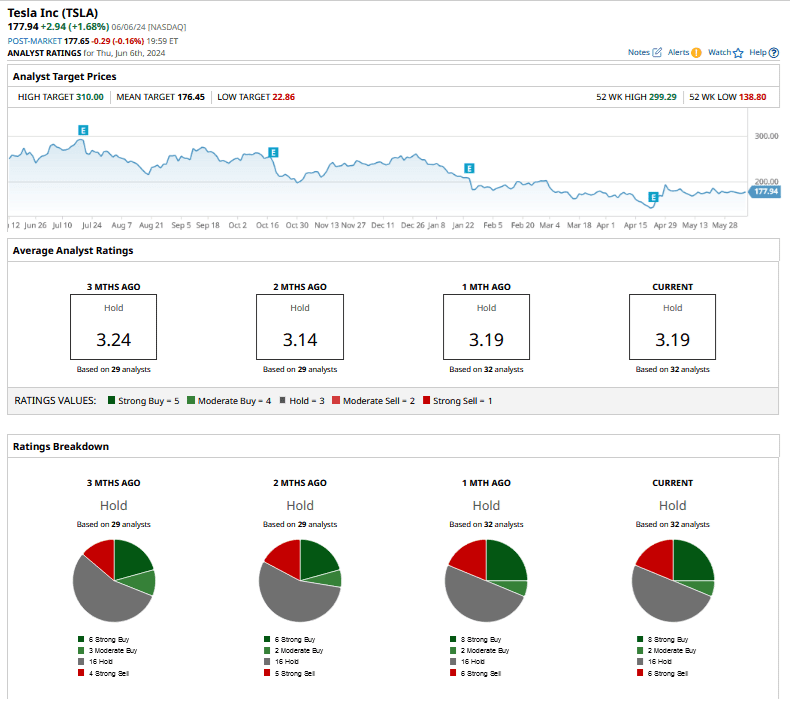

Jonas’ target price implies an upside of 74% over the next year. If his target price is realized, Tesla’s market cap would get quite close to the $1 trillion level. However, the average analyst does not share Jonas’ optimism towards Tesla, and the stock’s mean target price of $176.45 is slightly below current prices.

Of the 32 analysts covering Tesla, only 8 rate it as a “Strong Buy,” and 2 a “Moderate Buy.” Half of the analysts rate Tesla as a “Hold,” while the remaining 6 say it's a “Strong Sell.” If anything, analysts have turned bearish on Tesla this year amid concerns over EV demand.

Tesla Bulls Expect It to be a $4 Trillion Company

Ron Baron, who supports Musk’s compensation plan, expects it to be a $4 trillion company over the next 10 years. Cathie Wood of Ark Invest has set a base case 2027 target price of $2,000 on Tesla, while her bull case target price is $2,500. Even Wood’s bear case target price is $1,400, and hitting that level would mean Tesla’s market cap easily breaching $4 trillion.

Musk himself expects Tesla to be a nearly $5 trillion company, based on his argument that the company’s market cap could one day surpass the combined market caps of Apple (AAPL) and Saudi Aramco.

Will Tesla Stock Go Back Up?

For now, though, the road to Tesla becoming a $4 trillion behemoth looks quite hazy. The first milestone the company needs to achieve is to get back into the $1 trillion market cap club, which won't be easy, considering the current headwinds. To begin with, the uncertainty over Musk’s compensation package needs to be cleared, and markets need clarity about his long-term association with Tesla. With all his controversies, Musk still looks like the best person to lead the company.

Also, markets need concrete signs of progress in Tesla’s software business, including on the long-promised full autonomy. The company is set to unveil its robotaxi on Aug. 8, which will be the first real test of the progress that it is making in the software and AI business.

Apart from the software, Tesla will also need to ramp up deliveries and expand its target market by coming up with a budget EV model in the $25,000 ballpark. Overall, the ball is in Tesla’s court, and the company needs to convince markets that it is still a growth story despite recent debacles. The path towards a $1 trillion market cap will, however, require a lot of effort, as well as some support from the macro environment.

On the date of publication, Mohit Oberoi had a position in: TSLA , AAPL . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.