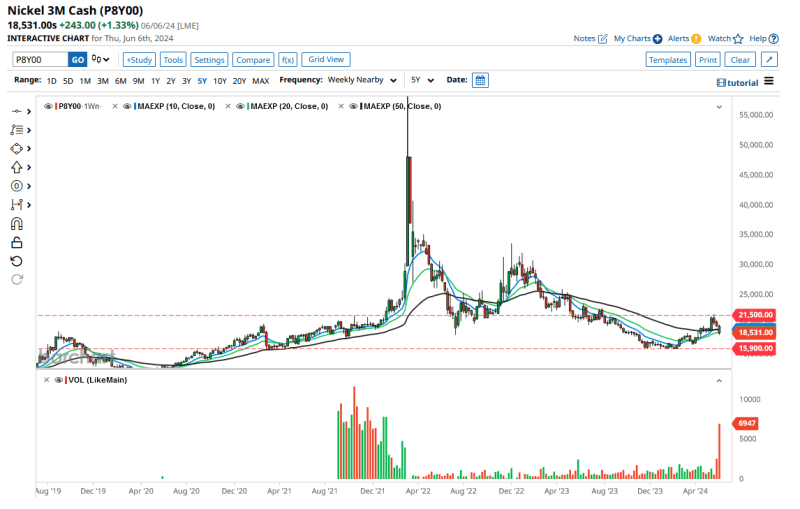

We start this week with a look at Nickel 3M Cash (P8Y00), down -7.64%.

The French New Caledonia overseas territory is holding about 20-30% of the world's reserves, and recent political turmoil has produced a sharp rise in recent months. As France is lifting the state of emergency and dialogue is coming back, transit of goods is recovering. It still remains to be seen what impact will have in the mining sector.

The fall is important, because it broke the 10-, 20- and 50-unit exponential moving averages, and the last 5 sessions marked lower lows with lower highs. Large speculative positions have abandoned the trade the last week, with a record weekly volume of 6,947 contracts not seen since February 2022.

Nickel has a firm support at 15,900 and a strong resistance at 21,500.

The funds' net position at 11,463 have been actually increasing, which contradicts the current trend.

The contract had a solid run from the 15,900 lows back in February 2024, and it has a bright future, as fundamentally the commodity will be scarce in the next years.

Funds are paying attention to this pullback for an optimal entry point, as it may be short-lived.

Best European Commodity Performers This Week

Cocoa #7 (CAU24) +6.02%

There are restrictions in Ivory Coast sales that will lower global supplies and support the latest rally. Demand for cocoa beans remains inelastic to the sharp price increases.

The weekly chart remains very bullish with a "Three White Soldiers" candle pattern and the last candle well above the 10, 20 and 50

EMA. Prices could retest the 9,200 resistance very soon if the current deficit and export restrictions in West Africa are not eased. Implied volatility at 66% also is very high but a bit below the 79% record from last May.

The 6,000 mark has proved to be strong support, and again, all technicals for now are pointing up.

Aluminium Alloy 3M Cash (P4Y00) +4.27%

This metal is in a consolidation area after the rally initiated on the week of Feb. 26. The daily action has broken the 10 and 20 EMA, but the weekly candles are well above the averages. No cause for alarm for long traders so far.

Weak PMI data from China are not helping metals, but aluminium did not have a big impact so far.

LME Funds net position at 104,988 contracts shows speculators favor the long side. This volume is a record since June 2022. LME inventories at 1,103,500 t are just slightly recovering from the historical lows of 278,000 in September 2022. Russian sanctions and the current world shortage will likely limit any starting downtrend.

Worst European Commodity Performers this week

Milling Wheat (MLU24) -5.98%

Russia's Sovecon has cut the wheat 2024 crop forecast to 80.7 mln tons (revised down from 94 millions in March). Persistent dry conditions in the main wheat production regions and above-average rain in Siberia keep reducing the production forecast for 2024.

On the other hand, the U.S. is showing good yield forecasts for the winter season with harvested crop so far above the 5-year average.

This European contract has a liquid options market as an alternative to the direct future contract. Implied volatility at 33% at the end of May is high compared to last year, which averaged 20%. That creates a good opportunity for selling options at above-average premiums.

For now, the mood remains bearish.

Zinc Special Hg Cash (Q3Y00) -5.34%

Zinc suffered liquidation like the group of metals in the last 2 weeks. The candle pattern "Three Dark Crows" is very bearish. The 10 EMA has been broken and now the 20 is also being put to the test as resistance.

LME stocks reporting 260,825 tons on June 7 marks a high since June 2021 and that might keep prices in check for now. LME Zinc Future and Options investment funds net position at 39,388 contracts (as of May 26) are sharply increasing and not supporting the current bearish mood.

China's manufacturing PMI are not supporting this year's rally in metals, which even indicates contraction in Chinese industrial activity for this year. Zinc is fundamental in the property building sector and the high unsolved inventories in China will be a challenge for the metal during 2024.

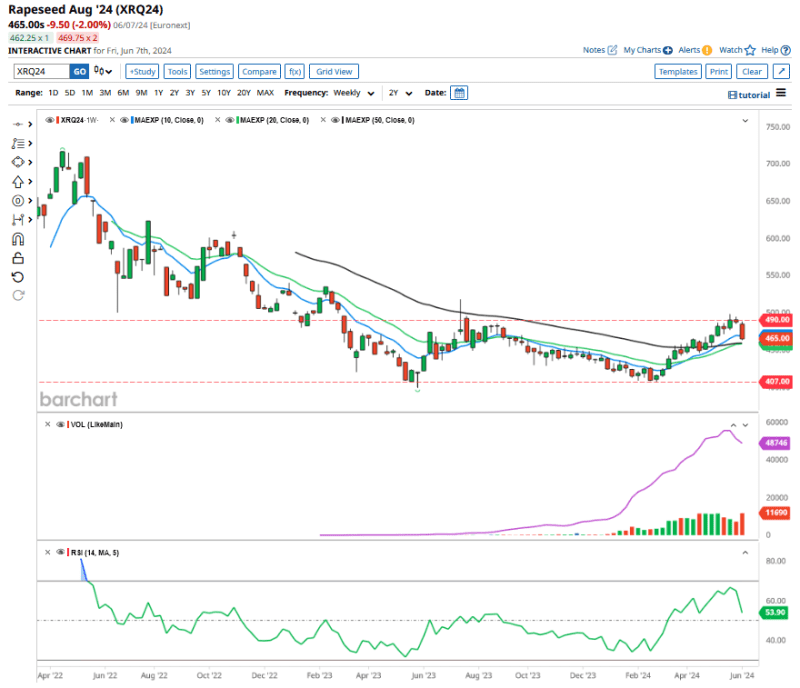

Rapeseed (XRQ24) -4.62%

European Rapeseed is having its second red week, and is taking a rest from the continuous uptrend that started in March 2024. We have not seen the weekly RSI reach levels above 65 since

May 2022, and a pullback was "expected."

If next week closes below the 10 EMA (as it is trying to do this week), it will confirm a trend reversal and not just pullback.

Also worth noticing, 490 is a very tough resistance, tested from July 2023 and never broken. This time was no different.

Processing of rapeseed in Ukraine will remain strong during the 2024/25 season. Rapeseed crushing season will start earlier than usual, so rapeseed processing will increase rapidly. Many Ukrainian crushers have switched to rapeseed processing replacing sunflower, which will keep adding to the supply.

There is a key support at 407 for this contract, and next week will be determine if this initial "Evening Star" candle pattern will actually bring the bear.

On the date of publication, Cesar Marconetti did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.