CrowdStrike Holdings (CRWD), the cybersecurity solutions company, produced good results, with a higher free cash flow (FCF) margin. It looks cheap now based on its FCF. This was after the stock recovered from an initial dip after the first quarter FY 2025 (April 30, 2024) results were released on June 4.

CRWD stock closed at $349.12 on Friday, June 7, after hitting a low earlier in the week of about $305 after the results. However, the stock could still be worth at least 18% more at $412 per share based on its strong FCF margins. This article will show how.

Management Guides for Strong Revenue and FCF

CrowdStrike generated 33% higher revenue YoY during the quarter and increased its guidance for revenue for the fiscal year ending Jan. 31, 2025. They said that they now expect to see up to $4.01 billion in revenue (up from $3.989 billion guided last quarter).

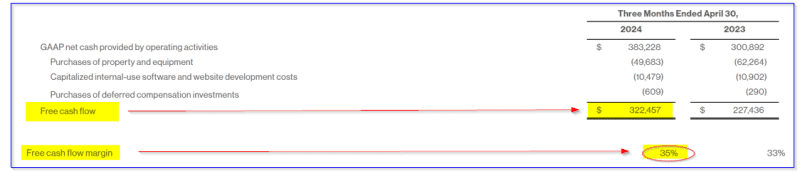

Moreover, the company generated $322.5 million in free cash flow (FCF) during the quarter, its highest yet. That was 41.8% higher than last year and 13.9% over the $283 million in FCF it generated last quarter.

But here is what is even more important. The FCF margin rose to 35%, up from 33% last quarter as well as last year. That means that the proportion that FCF represents of revenue is increasing, indicating its profitability and operating leverage are moving up.

Free Cash Flow Projections

That implies good things going forward. For example, analysts now project that sales next year could rise to $5.06 billion, up from $4 billion this year. That implies that the next 12 months (NTM) sales will be on a run rate of $4.5 billion.

So, applying a 35% margin estimate to this number means that FCF might reach $1.575 billion (i.e. 0.35 x $4.5b). Just to be conservative, though, let's assume a 33.5% FCF margin. That implies that FCF could rise to $1.5075 billion (i.e., 0.335 x $4.5b).

This is over 60% higher than the $938.2 million in FCF that CrowdStrike made last fiscal year. In other words, the company's profitability is expected to skyrocket, even using conservative assumptions.

That could easily push the value of CRWD stock much higher. Here's how.

Valuing CRWD Stock Based on its FCF

For example, using a 1.5% FCF yield metric could push the market capitalization of CrowdStrike stock to over $100 billion, up from $85 billion today. That can be seen by dividing the NTM FCF estimate of $1.5075 billion by 0.015 (i.e., $1.5075b/0.015 = $100.5 billion).

The basis for this FCF yield metric assumes that CrowdStrike could out 100% of the $1.5 billion in free cash flow in dividends. In that case, the dividend yield would likely be about 1.5%.

In any case, the potential upside in the stock is $100.5b/$85b, or +18.2%. That implies that CRWD stock could be worth 18.2% more than its price on Friday of $349.12. That results in a price target of $412.66 per share (i.e., 1.182 x $349.12).

Other analysts agree. For example, the average price target of 40 analysts surveyed by Barchart is $395.07, with a high price of $435. In addition, Yahoo! Finance, which uses Refinitiv data, reports there is an average price target of $398.56 from their survey of 45 analysts. AnaChart.com, a new sell-side analyst tracking service, shows that 41 analysts have an average of $390.15 price target.

One way to play this is to sell short out-of-the-money (OTM) put options. Here's why.

Shorting OTM Puts in CRWD Stock

CrowdStrike's put option premiums are relatively high and worth shorting for income. Moreover, selling OTM puts provides a way for an investor who is not already in the stock to potentially buy in cheaper, along with the income.

For example, look at the June 28 expiration period, three weeks from now. It shows that the $330 strike price put options, which is 5.48% below Friday's price of $349.12, have a premium of $5.00 per put contract.

That means that an investor who secures $33,000 in cash and/or margin can make an immediate $500 in income by entering an order on Monday to “Sell to Open” this contract. That works out to a put yield of 1.515% (i.e., $5.00/$330) since every contract represents 100 shares.

This is a very high yield for such a short period. For example, if the investor can repeat this play 4 times over the next quarter, they have an expected return (ER) of $2,000. That represents an ER yield of 6.06% over just 91 days (i.e., $2,000/$33,000). This assumes that the same put yield can be made each time, which, of course, is not guaranteed.

But it shows how high the expected return is now for short-put plays. The bottom line is that CRWD stock looks cheap here over the next year. One way existing investors can play this is to short OTM puts for extra income.

And for those not yet in the stock it represents a disciplined way to buy in at a lower price if the stock falls to the strike price and the put option is exercised. However, the extra income from shorting OTM puts will lower the investor's breakeven point.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.