By Tamas Csonka in Budapest

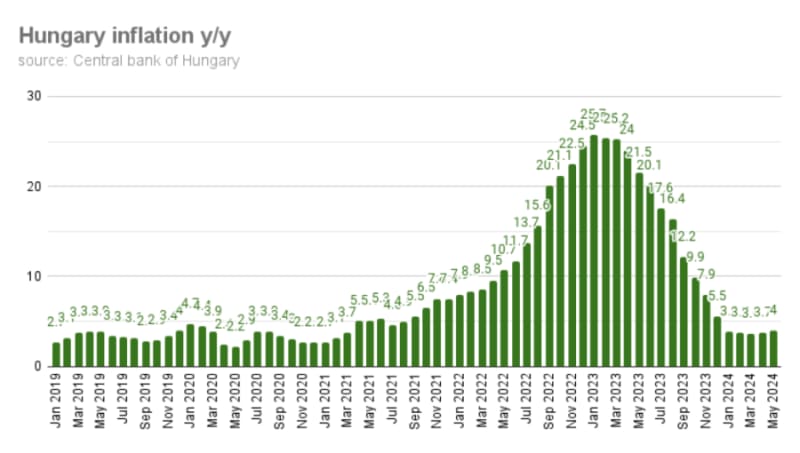

The annualised consumer price index in Hungary reached 4.0% (chart) in May, edging up from 3.7% in the previous month, in line with estimates, the Central Statistics Office (KSH) said on June 10. Compared to the previous month, prices fell by 0.1%.

Headline CPI reached the 3.0% +/-1pp tolerance band of the National Bank (MNB) in January after peaking at 25.7% a year earlier, supported by government measures and central bank monetary policy.

Core inflation excluding indirect tax effects, a bellwether indicator of underlying inflation, fell to 4.0% in May from 4.1% in the previous month.

In a monthly analysis, the MNB said motor fuel prices had contributed 0.2pp and prices of regulated products 0.2pp to the uptick in headline inflation, while services prices had brought it down by 0.1pp.

Central bank policymakers earlier predicted a temporary rise in inflation in the middle of 2024 because of retrospective pricing of market services and base effects.

Looking at components, food prices, which account for 30% of the basket, increased by 1% in May, partly due to base effects and widespread price reduction, after the government put pressure on fuel retailers to bring prices closer to the regional average.

Household energy prices, with a 5% weight, fell by 2.4%, including a 4.7% drop in gas prices and a 2.9% decline in electricity prices. Service prices, with a 26% weight, increased by 9.5% in line with trends seen earlier.

The degree to which repricing took place in May was below the historical average for tradables and food prices, but above the average for market services, the MNB said. Central bankers have signalled earlier that repricing of market services has been a major factor in high service prices. Curbing that practice would be important to anchor inflation expectations at a lower level to mitigate inflation-related risks, they noted.

Indicators measuring households' inflation expectations picked up in May, the MNB said. Corporate expectations for retail sales prices and services prices declined.

Erste Bank said annualised CPI could fluctuate between 4-5% in 2024,with no clear trend throughout the year. The bank forecasts disinflation to restart next year and to return to the central bank's target range in 2025.

In the absence of major surprises, domestic bond and currency markets might keep searching for a clear direction until the Federal Reserve's first interest rate cut, which is currently anticipated by the end of the year, Amundi said in a note.

The central bank may be hesitant to continue monetary easing despite weaker-than-expected economic data due to ongoing concerns about inflation. Policymakers argued that the volatile financial market environment and the inflationary risks continue to warrant a careful and patient approach.

At the last rate-setting meeting, MNB deputy governor Barnabas Virag said the scope of further rate cuts in the second half was limited. The markets are expecting the base rate to drop to 6.75-7% from 7.25% at the end of the month and then the MNB to halt its easing cycle.