While the performance of electric vehicle (EV) stocks, especially Chinese EV stocks, has been disappointing, NIO (NIO) is one specific name that hasn’t lived up to the hype it once generated.

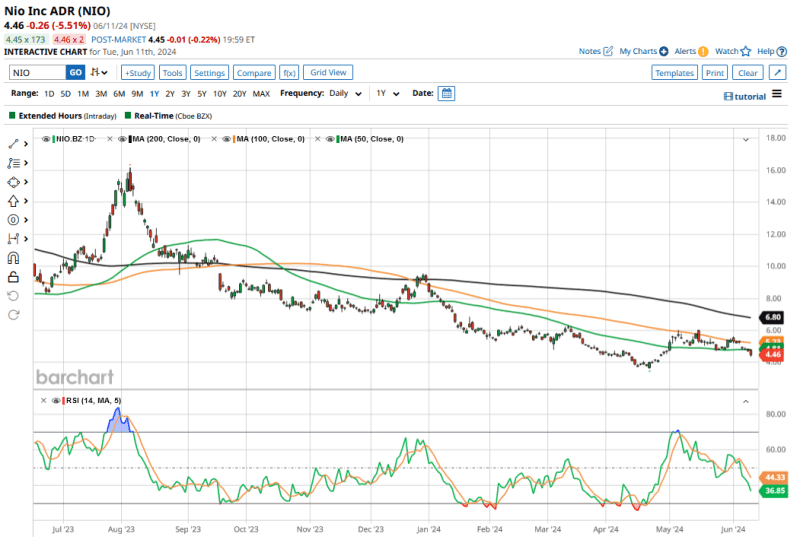

NIO overcame a near-bankruptcy scare and became a $100 billion market cap behemoth in early 2021. But for investors, that was the end of good news. After rallying over 12-fold in 2020, NIO has closed in the red every year since. It is now down almost 51% in 2024, and has had a terrible first half so far.

NIO’s current market cap is below $10 billion and the Chinese EV company trades at a fraction of its 2021 highs. What’s the 2024 forecast for NIO, and can the company beat the EV slowdown blues and rise above $10, as some analysts believe? We'll discuss in this article.

Why Is NIO Stock Going Down?

To begin with, there has been a broad-based sell-off in Chinese EV stocks, and Li Auto (LI) and Xpeng Motors (XPEV) have also lost almost half of their market cap so far in 2024. The price war is intensifying in the world’s largest automotive market, which is taking a toll on the profitability of incumbents.

While NIO impressed markets by delivering a record number of cars in May, its Q1 2024 earnings dampened the enthusiasm. The company’s revenues fell YoY in the quarter, while its loss per share of 33 cents was wider than the 30 cents that analysts were expecting.

NIO Stock 2024 Forecast

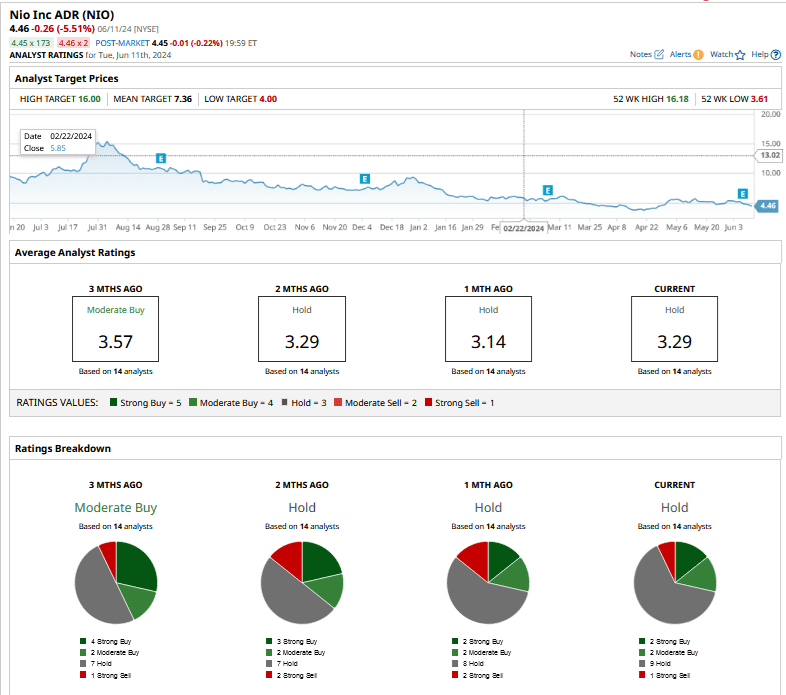

NIO has a consensus rating of “Hold” from the 14 analysts covering the stock. Two analysts each rate the stock as a “Strong Buy” and “Moderate Buy,” while 9 rate it as a “Hold.” The remaining 1 analyst has a “Strong Sell” rating on the stock.

NIO’s mean target price of $7.36 is 65% higher than Tuesday's closing price, while the Street-high target price of $16 implies it could more than triple from these levels.

After NIO’s Q1 earnings release, Morgan Stanley maintained its “overweight” rating and $10 target price on NIO, and the brokerage said it believes the sell-off in the Chinese EV stock has gone too far.

Deutsche Bank analyst Edison Yu – among the biggest bulls on NIO – is also upbeat on the company’s outlook. In a note, Yu said, “With demand now at the strongest levels this year (despite having no new models), we think management may have finally turned a corner after some large disappointments over the past few years.”

What’s Weighing Down Chinese Stocks?

After having recovered from their 2024 lows, Chinese stocks have looked weak of late amid concerns over the health of the world's second-largest economy.

As for Chinese EV stocks specifically, after new tariffs in the U.S., they now face the same prospects in the E.U. Any tariffs in Europe will particularly hit Chinese EV companies hard, as many domestic players had turned to the region to beat the slowdown at home.

NIO Stock: Weighing the Risk-Return Payoffs

NIO is coming up with its new budget brand ONVO, and says its first product, L60, will be a direct competitor to Tesla's (TSLA) Model Y - which, for context, was the best-selling model globally last year. Next up is the launch of even cheaper vehicles under the Firefly brand, where NIO will offer compact vehicles in the price range of RMB 100,000 to RMB 200,000 (between $13,787-$27,573). The company expects its gross margins to return to double digits in Q2 and improve further in the back half of the year.

NIO also secured over $200 million in investment from a strategic investor for its subsidiary NIO Power, which houses its network of battery charging and battery swap stations. The company is open to more partnerships in the business, including from automakers. Abu Dhabi-based CYVN Holdings has also backed NIO, and poured nearly $3 billion into the company.

Can NIO Stock Rise Above $10 in 2024?

While NIO has had brief rallies over the last 2 years, the stock has failed to hold on to the gains. I believe NIO remains a formidable player in the Chinese EV industry, and has a strong balance sheet to withstand the current EV industry slump.

While the stock’s valuations look attractive – it trades at a next 12 months (NTM) enterprise value to sales multiple of only 0.89x – a lot has to go right, both at a macro as well as company-specific level, for the stock to rise above $10.

The company needs to prove its mettle and increase its deliveries meaningfully, and it needs to do so without compromising on margins. If NIO can achieve that feat, the stock could be in for a meaningful rerating, and could race past $10. However, it is bound to be a bumpy ride, especially considering the worsening price war and EV competition in China.

On the date of publication, Mohit Oberoi had a position in: NIO , LI , XPEV , TSLA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.