Investors with a lot of money to spend have taken a bullish stance on 3M (NYSE:MMM).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MMM, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 8 options trades for 3M.

This isn't normal.

The overall sentiment of these big-money traders is split between 62% bullish and 25%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $115,500, and 7, calls, for a total amount of $1,121,018.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $105.0 for 3M, spanning the last three months.

Analyzing Volume & Open Interest

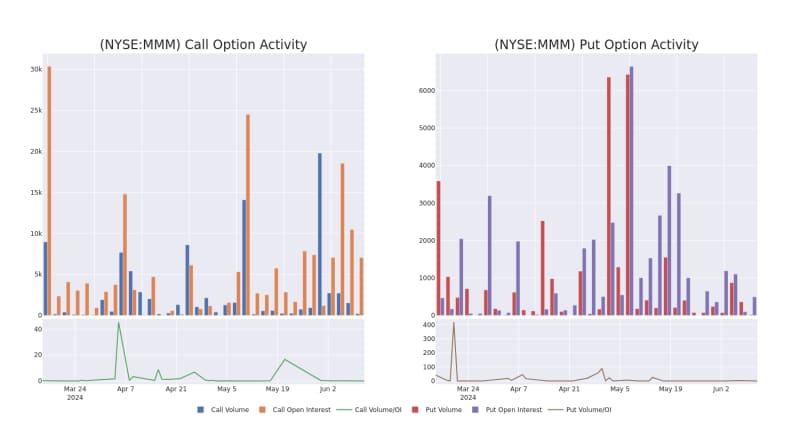

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for 3M's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of 3M's whale trades within a strike price range from $50.0 to $105.0 in the last 30 days.

3M 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

About 3M

3M is a multinational conglomerate that has operated since 1902, when it was known as Minnesota Mining and Manufacturing. The company is well known for its research and development laboratory and it leverages its science and technology across multiple product categories. As of the second quarter of 2024, 3M is organized across three business segments: safety and industrial, transportation and electronics, and consumer. Nearly 50% of the company's revenue comes from outside the Americas, with the safety and industrial segment constituting a plurality of net sales. Many of the company's tens of thousands of products touch and concern a variety of consumers and end markets.

Present Market Standing of 3M

- With a volume of 2,296,794, the price of MMM is down -0.21% at $101.11.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 41 days.

What The Experts Say On 3M

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $126.0.

- Showing optimism, an analyst from Vertical Research upgrades its rating to Buy with a revised price target of $140.

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on 3M with a target price of $118.

- An analyst from B of A Securities upgraded its action to Buy with a price target of $120.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for 3M, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.