Investors with a lot of money to spend have taken a bullish stance on Warner Bros. Discovery (NASDAQ:WBD).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with WBD, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 8 uncommon options trades for Warner Bros. Discovery.

This isn't normal.

The overall sentiment of these big-money traders is split between 75% bullish and 12%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $412,967, and 4 are calls, for a total amount of $155,249.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.5 to $10.0 for Warner Bros. Discovery during the past quarter.

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for Warner Bros. Discovery options trades today is 19824.33 with a total volume of 14,241.00.

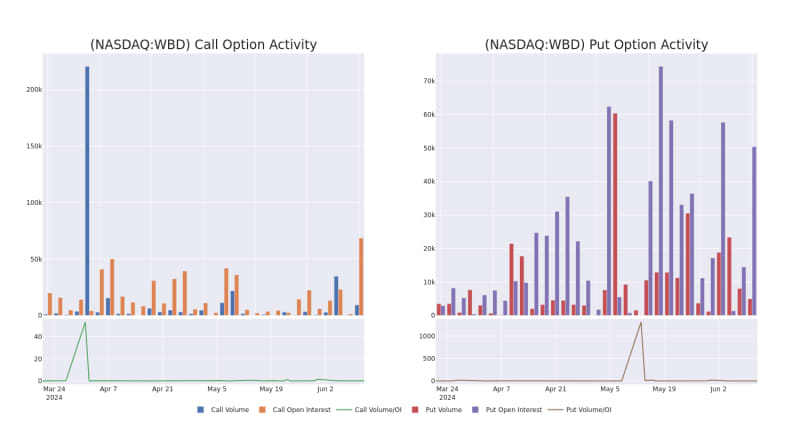

In the following chart, we are able to follow the development of volume and open interest of call and put options for Warner Bros. Discovery's big money trades within a strike price range of $7.5 to $10.0 over the last 30 days.

Warner Bros. Discovery Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

About Warner Bros. Discovery

Warner Bros. Discovery was formed in 2022 through the combination of WarnerMedia and Discovery Communications. It operates in three global business segments: studios, networks, and direct-to-consumer. Warner Bros. Pictures is the crown jewel of the studios business, producing, distributing, and licensing movies and television shows. The networks business consists of basic cable networks, such as CNN, TNT, TBS, Discovery, HGTV, and the Food Network. Direct-to-consumer includes HBO and the firm's streaming platforms, which have now been consolidated to Max and Discovery+. Much of the DTC content is created within the firm's other two business segments. Each segment operates with a global reach, with Max available in over 60 countries.

Present Market Standing of Warner Bros. Discovery

- With a volume of 22,953,924, the price of WBD is down -3.0% at $7.8.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 50 days.

What The Experts Say On Warner Bros. Discovery

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $15.0.

- An analyst from Barrington Research persists with their Outperform rating on Warner Bros. Discovery, maintaining a target price of $15.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Warner Bros. Discovery, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.