Way too much is happening worldwide in terms of geopolitics not to have an effect on global stock markets. While the world's largest democracy, India, just concluded its general elections - where the incumbent party returned to power with a reduced majority - France's surprise declaration of a snap election has raised uncertainties further in Europe, which has already been reeling from the Russia-Ukraine war, as well as the impending British elections.

Add to this the ongoing Israel-Hamas conflict, where a ceasefire agreement has yet to be accepted, and it becomes a heady cocktail of geopolitical overhang for market participants to navigate. Given this degree of uncertainty, investors who aren't positioned or hedged correctly risk tumbling down a slippery slope of heavy losses as stocks swing wildly in response to headlines.

Recently, analysts at brokerage firm Bank of America (BAC) identified oil as the best hedge against pre-election volatility, based on historical price trends. And with crude oil down about 17% from 52-week highs, the firm says there's nearly zero risk premium priced into crude at current levels.

For investors looking to hedge against potential pre-election volatility, here are two top oil majors that have been in operation for decades, have robust earnings, and are members of the famed “Dividend Aristocrats” club, too.

#1. Chevron Corp

Founded in 1879 as Pacific Coast Oil Company, Chevron (CVX) is one of the largest integrated energy companies in the world. They are involved in the entire oil and gas production process, from exploration and extraction to refining, marketing, and transportation. They also have a growing renewable energy segment. The company currently commands a mammoth market cap of $288.5 billion.

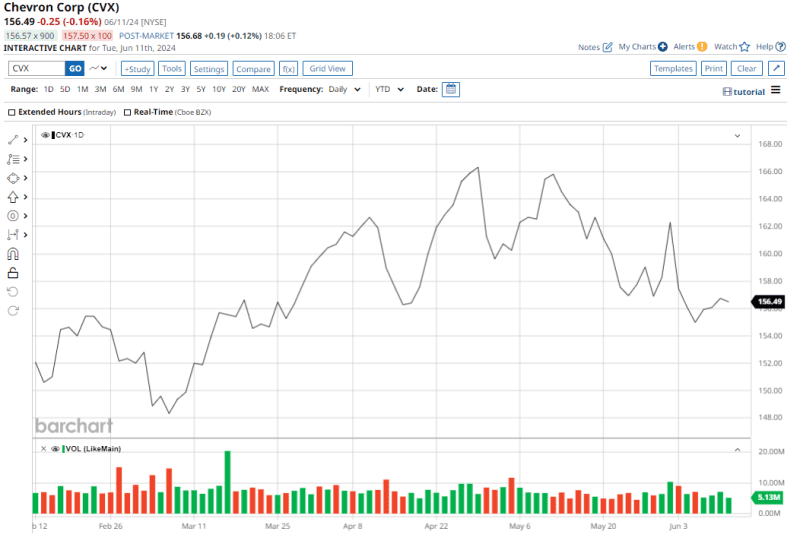

CVX stock is up 3.4% on a YTD basis, and it offers a dividend yield of 4.01% - higher than the industry median of 3.86%. Moreover, the company has been raising dividends consecutively for the past 36 years, and with a payout ratio of 49.2%, there's room for further growth.

In the first quarter, Chevron's numbers were a mixed bag, as earnings topped expectations, but revenue missed estimates. Revenues for the quarter came in at $48.7 billion, down 4.1% from the previous year. Adjusted EPS fell by 17.5% over the same period to $2.93, but came in above the consensus estimate of $2.92. In fact, over the past five quarters, Chevron's EPS have missed expectations on only one occasion.

Overall, over the past five years, Chevron's revenue and EPS have recorded a CAGR of 5.25% and 8.02%, respectively.

Worldwide net oil-equivalent production increased by 12.3% from the prior year to 3,346 million barrels of oil equivalent per day (MBOED).

Notably, the company generated net cash from operating activities of $6.8 billion and exited the quarter with a cash balance of $6.3 billion. Total debt levels were at $21.8 billion.

However, quarterly results are seldom a true indicator of an oil company like Chevron's performance in the long term, which looks solid. A case in point is the recent approval by Hess Corporation (HES) shareholders of the merger with Chevron. With Hess in its portfolio, Chevron's annual production will get a significant boost, especially in Guyana, where HES currently has a 30% interest in the high-growth Stabroek Block.

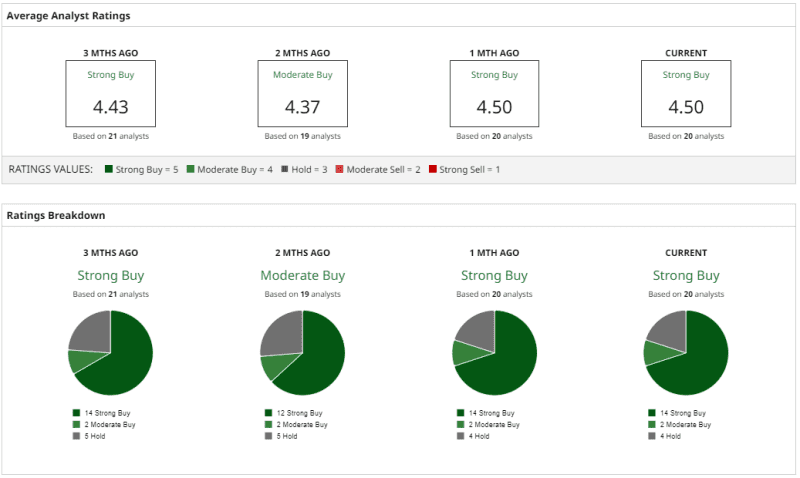

Analysts have an average rating of “Strong Buy” for CVX stock, with a mean target price of $183, which indicates an upside potential of about 18.7% from current levels. Out of 20 analysts covering the stock, 14 have a “Strong Buy” rating, 2 have a “Moderate Buy” rating, and 4 have a “Hold” rating.

#2. Exxon Mobil Corp

Founded in 1999 through the merger of Exxon and Mobil, Exxon Mobil (XOM) is one of the world's largest integrated oil and gas companies. They operate across the entire oil and gas value chain, including exploration and production, refining, transportation, and marketing of petroleum products. The company has a vast global reach with operations in over 50 countries. Its market cap currently stands at an impressive $442.3 billion.

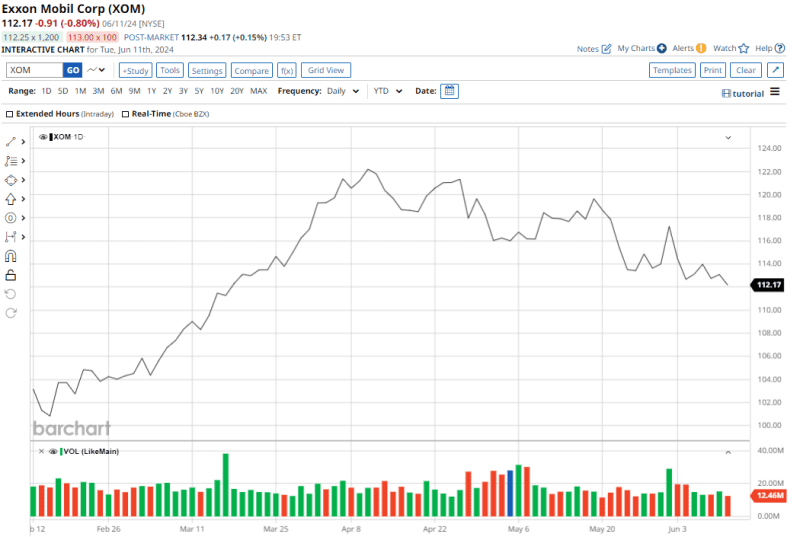

XOM stock is up roughly 11% on a YTD basis. It offers a dividend yield of 3.39%, and has been raising dividends consistently for the past 25 years. Its payout ratio of 42.5% indicates the dividend is well-covered by earnings, leaving room for future growth.

Like its counterpart above, Exxon's results for Q1 were mixed, with an earnings miss and a top-line beat. Revenues for the quarter were $83.1 billion which denoted a yearly decline of 4%, while EPS slipped by 27.2% over the same period to $2.06, missing the consensus estimate of $2.19.

However, zoom out, and Exxon's numbers over the past five years look decent. The company recorded revenue and EPS growth at a CAGR of 3.99% and 12.34%, respectively.

Worldwide oil production was 3,784 koebd compared to 3,831 koebd in the prior year. Despite a drop in production, Exxon's net cash from operating activities came in at $14.7 billion, while its cash balance at the end of the quarter was at $33.3 billion. Further, long-term debt was reduced to $32.2 billion from $37.5 billion at the beginning of the year.

Exxon is also betting big on lithium production. With the IEA saying that EVs require about 9 kilograms of lithium each, Exxon plans to mine enough lithium for 1 million EVs per year. Exxon's lithium business could generate $135 million annually in revenues for the company. Other areas of renewable, new energy and chemicals-related involve developing closed-loop recycling and production technologies for chemicals. This approach minimizes waste by efficiently transforming used chemicals back into their original form or into valuable new products.

Additionally, Exxon is exploring advancements in bio-based materials to offer sustainable alternatives. Proxxima technology, for example, holds promise for creating lightweight, corrosion-resistant, and long-lasting replacements for traditional thermoset resins. Finally, Exxon is researching the valorization of refinery waste streams. This involves converting low-value materials from refineries into useful carbon products, maximizing resource utilization and minimizing waste generation.

Further, the company remains on track in its cost-saving initiatives, recently backing its target for $15 billion in cost-savings initiatives by 2027, with the $10 billion milestone already crossed in Q1 2024.

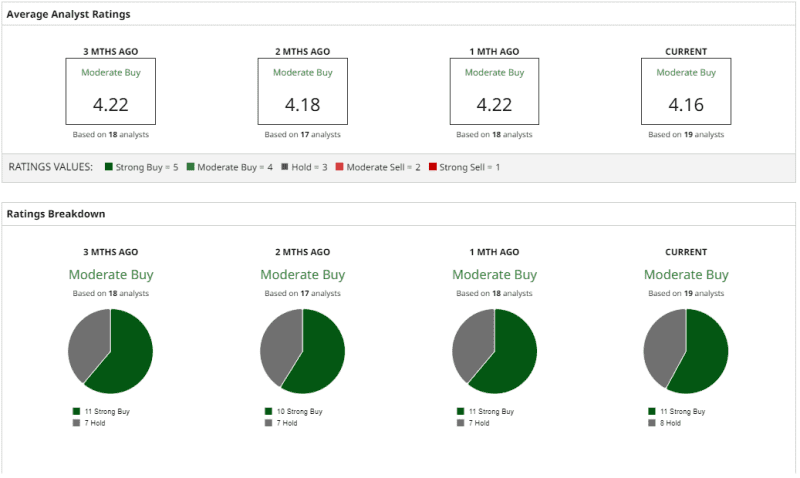

Overall, analysts have a consensus rating of “Moderate Buy” for Exxon stock, with a mean target price of $135. This indicates an upside potential of about 20.5% from current levels. Out of 19 analysts covering the stock, 11 have a “Strong Buy” rating and 8 have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.