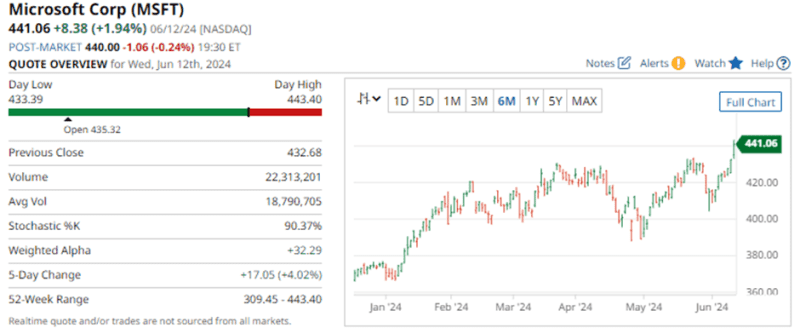

Microsoft (MSFT) broke out to a new high yesterday and is showing strong accumulation.

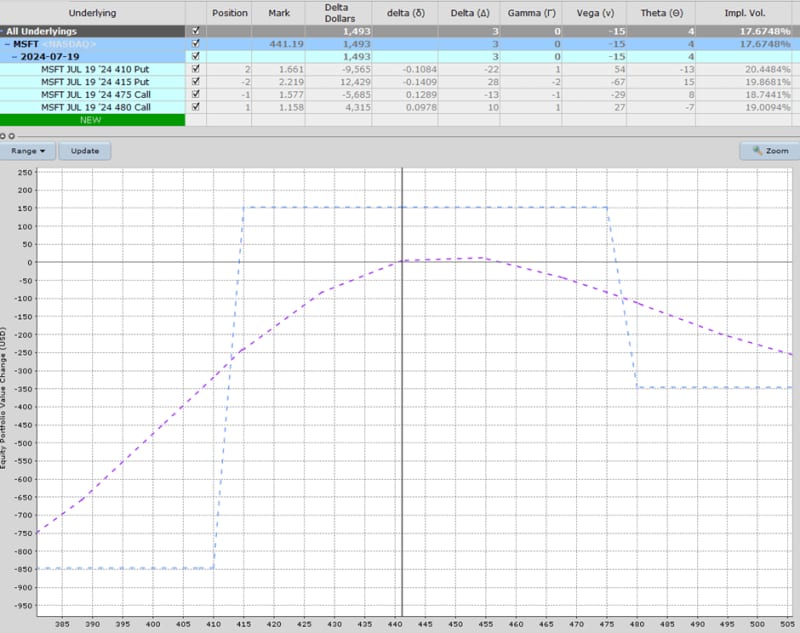

Today, we are looking at an unbalanced iron condor, with a slightly bullish bias.

This can be achieved by trading more put spreads than call spreads.

As a reminder, an iron condor is a combination of a bull put spread and a bear call spread.

First, we take the bull put spreads. Using the July 19 expiry, we could sell two put spreads with the 415-410 strike prices. That spread could be sold for around $0.40. Selling two contracts would generate $80.

Then the bear call spread, which could be placed by selling the 475 call and buying the 480 call. This spread could also be sold for around $0.45.

Trading two put spreads for every one call spread gives the trade a slight bullish bias, but also more risk on the downside.

In total, the iron condor will generate around $1.25 or $125 of premium.

The profit zone ranges between 413.75 and 476.25. This can be calculated by taking the short strikes and adding or subtracting the premium received.

The maximum risk is $875 on the put side and $375 on the call side.

If we take the premium ($125) divided by the maximum risk ($875), this iron condor trade has the potential to return 14.29%.

A stop loss in this case might be calculated based on 25% of capital at risk, so a loss of around $220.

Company Details

The Barchart Technical Opinion rating is a 100% Buy with a Strongest short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

The market is in highly overbought territory. Beware of a trend reversal.

Of the 38 analysts covering MSFT stock, 34 have a Strong Buy rating, 3 have a Moderate Buy rating and 1 has a Hold rating.

Implied volatility is 18.22.45% compared to a twelve-month high of 34.78% and a low of 19.98%. That gives MSFT stock an IV Percentile of 8% and an IV Rank of 24.04%.

Microsoft Corporation is one of the largest broad-based technology providers in the world.

The company dominates the PC software market with more than 80% of the market share for operating systems.

The company's Microsoft 365 application suite is one of the most popular productivity software globally.

It is also now one of the two public cloud providers that can deliver a wide variety of infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS) solutions at scale.

Microsoft's products include operating systems, cross-device productivity applications, server applications, business solution applications, desktop and server management tools, software development tools and video games.

The company designs and sells PCs, tablets, gaming and entertainment consoles, phones, other intelligent devices, and related accessories.

Through Azure, it offers cloud-based solutions that provide customers with software, services, platforms and content.

Summary

Unbalanced Condors are a great way to play a neutral to slightly bullish outlook on a stock.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.