In a May 10 Barchart article on gold and silver price action, I highlighted how July COMEX silver futures had failed at its first attempt to eclipse the $30 per ounce level. I wrote:

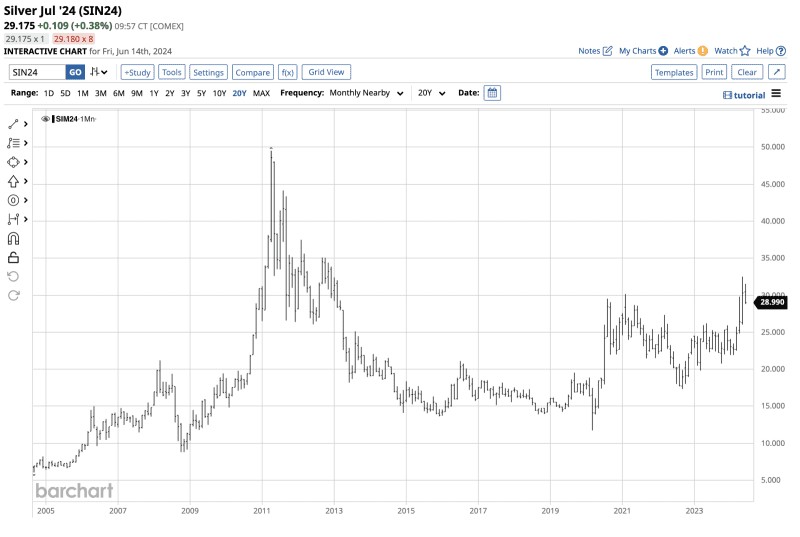

Silver failed at the $30 level on its first attempt to eclipse the 2021 high, the highest price in over a decade. Silver futures reached nearly $50 in 2011. Silver has been recovering since the May 2 low.

While past performance is never a guarantee of future performance, it's worth noting that significant corrections in gold and silver have consistently presented buying opportunities over the past quarter century. This trend, always your best friend, suggests that the long-term paths of least resistance in gold and silver are poised to rise in May 2024, instilling confidence in the reliability of this investment strategy.

July silver futures were at the $28.47 per ounce level on May 10 after trading to a $30.19 high on April 12, 2024. The price moved higher since then before correcting to under the $30 level.

A multi-year high in silver

Silver prices rose to the highest level since December 2012 in May 2024.

The twenty-year chart highlights the rally that took the continuous COMEX silver futures contract to a $32.50 high on May 20, with the active July contract reaching $32.75 per ounce. The move above the February 2021 high was a significant technical event.

Gold and silver are the oldest means of exchange

Gold and silver have been money for thousands of years.

The Bible contains over four hundred references to gold and mentions silver nearly three hundred times. Gold and silver have long been stores of value and symbols of wealth. For many years, countries worldwide backed currencies in the two metals, with many coins made of silver.

I remember my grandfather, born in the very early 1900s, often referring to the change in his pocket as silver because the dimes and quarters contained the metal.

Silver is a critical metal with increasing demand for electronics, green-energy initiatives (solar panels), and other applications. Global silver consumption in 2023 was around 36,000 metric tons. While consumption declined 6% from 2022, it significantly outpaced production.

In January 2024, The Silver Institute projected the fourth consecutive year of a “structural market deficit” in silver. The Institute projected a deficit of 176 million ounces (5,475 metric tons) after a deficit of 194 million ounces (6,035 metric tons) in 2023.

The deficits and a technical upside break in the silver market will likely lead to increasing investment and speculative demand. If a herd of investors and speculators descends on the silver market, this could drive the shortfall between supply and demand even higher over the coming weeks and months.

A BRICS currency that undermines the U.S. dollar is bullish for silver

Today, central banks, governments, monetary authorities, and supranational institutions own gold as an integral part of their foreign exchange holdings. Gold ownership validates gold’s role in the international financial system. The official sector abandoned silver as a reserve asset because of its higher price volatility, but individual investors and traders continued to covet silver because of its historical role.

The bifurcation of the world’s nuclear powers, wars in Ukraine and the Middle East, and U.S. and European sanctions on Russia and China have caused trade issues. BRICS countries have been working to roll out a BRICS currency to provide an alternative to the world’s reserve currency, the U.S. dollar. A BRICS currency could be partially backed with gold, increasing gold’s role in the worldwide financial system. As gold’s role grows, history teaches that silver will go along for the ride. While governments are not likely to embrace silver holdings, the investment public will find silver more attractive as the U.S. dollar’s global role declines.

Consolidation around $30 could lead to a significant rally

Even the most aggressive bull markets rarely move in straight lines. Gold has been in a bullish trend since reaching rock bottom in 1999 at $252.50 per ounce. While the yellow metal continues to make higher all-time highs, a correction and consolidation period followed each new peak. Buying on those dips has been the optimal approach over the past quarter century.

Silver’s rise to an over-decade high was a significant event, and the correction to just below the price that was technical resistance at the February 2021 high should not come as a surprise. Silver’s penchant for volatility, which creates its speculative nature, makes corrections after rallies healthy events as market participants take profits, making them more likely to purchase silver on the dip.

A period of consolidation around the $30 per ounce level would create a new technical support base at the chart area that was formerly resistance.

Silver’s upside targets at the 2011 $49.52 high and the 1980 $50.36 record peak mean the metal has substantial upside room if the recent technical break ignites the metal. When technical and fundamental factors line up, the results can be explosive. Moreover, as the gold bull market continues, the historical line between gold and silver supports higher silver prices.

Buying silver on the dip- Leave room as picking bottoms is always dangerous

Silver’s past volatility suggests the metal can rise or fall to levels that defy rational, logical, and reasonable technical and fundamental analysis. Therefore, any risk position in silver requires a risk-reward plan and discipline to stick to the program. Picking tops or bottoms can be treacherous.

Meanwhile, the recent technical price action in the silver market suggests a significant bullish trend that challenges the 2011 and 1980 highs could develop.

If $30 becomes a pivot point for silver over the coming weeks, accumulating silver below $30 and trimming the long position above, leaving a core position, could be the optimal approach.

I am bullish on the prospects for silver prices and believe the metal is on its way to a new record high. However, the route to an all-time peak may be highly volatile. Silver is not for the faint of heart, but its volatility should create many trading opportunities over the coming weeks and months.

More Precious Metal News from Barchart

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.