In a May 9 Barchart article on the sugar futures market, I wrote:

Even the most aggressive bull markets rarely move in straight lines, suffering periodic corrections. Sugar’s long-term trend remains high. If the sweet commodity can hold above technical support levels, the recent bearish price action could be a sweet opportunity to load up on the soft commodity that is a food and an energy ingredient.

Nearby July world sugar futures were at the 19.60 cents per pound level on May 8, after falling to an 18.97 cents low on April 25. The bearish price action continued in May, sending the sweet commodity to a lower low. Sugar remains in a bearish trend in early June, but the price’s technical resistance levels are declining, increasing the odds of a recovery.

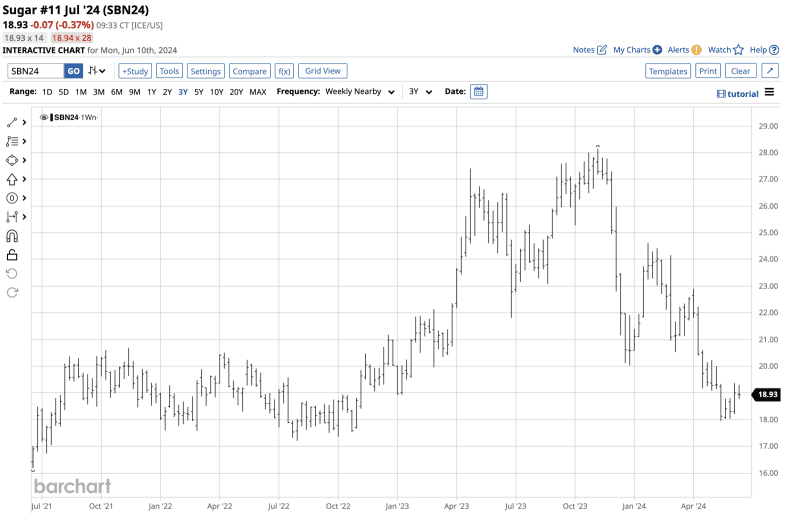

Sugar’s price continues to fall

World sugar futures on ICE have made lower highs and lower lows since trading at a multi-year high of 28.14 cents per pound in November 2023.

The three-year chart shows the bearish trend that reached its most recent 17.95 low in mid-May 2024. At below the 19 cents level, sugar futures remain a lot closer to the low than the November 2023 high.

The August 2022 low is critical support- The long-term bull market remains intact

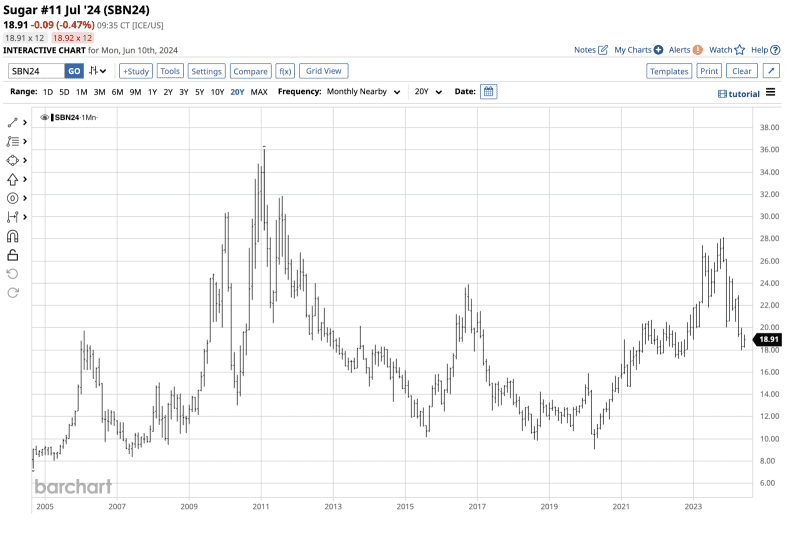

The longer-term world sugar futures chart highlights that the current correction threatens the bullish trend since the April 2020 low.

As the twenty-year chart illustrates, sugar futures more than tripled from the April 2020 low through the November 2023 high, the highest price since September 2011. The current price level remains more than double the April 2020 9.05 cents low, the lowest price since June 2007.

Technical support for the longer-term bullish trend is at the August 2022 17.20 cents low. A move below this level would negate the soft commodity’s bullish path of least resistance.

Soft commodities are not following sugar

Since the end of Q1, sugar, cocoa, and cotton have been the three soft commodities that have declined, while coffee and FCOJ futures have soared. Meanwhile, cocoa futures reached a record high in Q2 before correcting. On June 7, the soft commodities have posted the following Q2 results:

- Sugar: At 18.91 cents per pound, sugar futures were 16% lower than the Q1 22.52 closing price.

- Coffee: At $2.2230 per pound, Arabica coffee futures were 17.7% higher than the Q1 $1.8885 closing level.

- Cocoa: At $9,839 per ton, nearby cocoa futures moved 0.75% higher than the Q1 $9,766 closing price

- Cotton: At 71.64 cents per pound, nearby cotton futures were 27.6% lower than the Q1 91.38 cents closing level.

- FCOJ: At $4.1815 per pound, OJ futures were 15.1% higher than the Q1 $3.6325 closing price.

While cocoa prices are only marginally higher since the end of Q1, they traded to a record $12,261 per ton in April before turning lower. Soft commodities were the best-performing sector of the asset class in 2023 and Q1 2024. Sugar and cotton have been the laggards in the sector over the past mponths, and the laggards often become the leaders in subsequent quarters.

Futures or the CANE ETF are the only products for sugar exposure

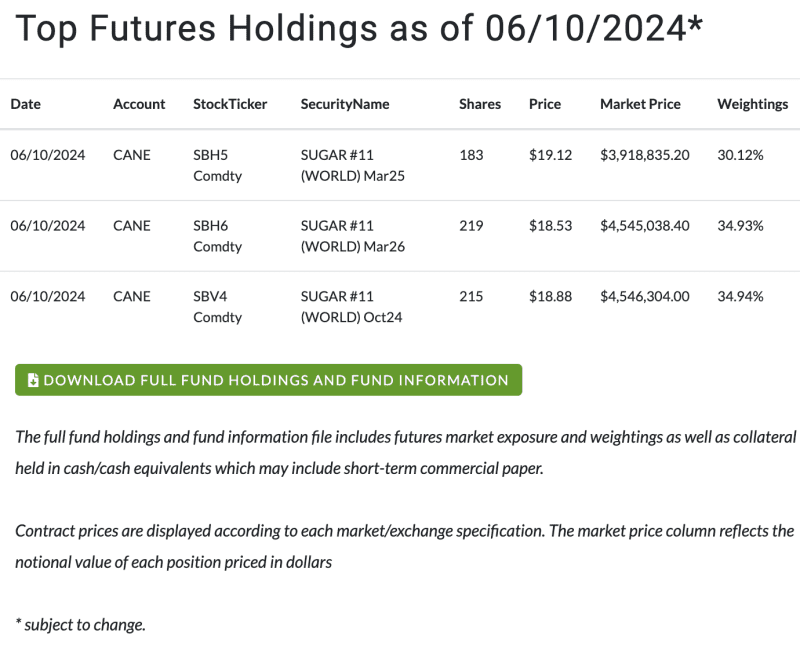

No liquid ETF or ETN products track coffee, cocoa, cotton, or FCOJ futures prices. Exposure to these soft commodities is only available through the futures and futures options markets. While the most direct route for a risk position in world sugar is through the ICE futures and futures options, the Teucrium Sugar ETF product (CANE) does an excellent job tracking a portfolio of three actively traded ICE sugar futures contracts sans the nearby contract. CANE owns three sugar futures to minimize roll risks.

At $11.52 per share, CANE had around $13.011 million in assets under management. CANE trades an average of 42,213 contracts daily and charges a 0.22% management fee. CANE’s holdings often lead to deviations from the nearby active month sugar futures contract, as deferred months can experience different price variances. Sugar time spreads or market structure can be highly volatile, reflecting supply and demand fundamentals and seasonality.

The most recent short-term rally in July ICE sugar futures took the price 5.4% higher from 18.97 on April 25, 2024, to 20.00 cents on May 7. The price then dropped 10.3% to a 17.95 cents low on May 16.

Over the same period, CANE rose 7% from $11.70 to $12.52 and fell 10.7% to $11.18 per share. While CANE does not mirror the nearby contract, the ETF tends to move higher and lower with the price. While July is the current actively traded sugar futures month, CANE owns the following contracts:

Source: Teucrium

The chart shows that CANE owns sugar futures for October 2024, March 2025, and March 2026 delivery.

The case for higher sugar prices after the sweet commodity finds a bottom

If sugar futures can hold above the critical 17.20 cents technical support level, the odds of recovery are high. Sugar has a unique relationship with crude oil and gasoline prices as it is the primary ingredient in Brazilian ethanol production. Brazil is the world’s leading producer and exporter of free-market world sugar. Higher traditional energy prices support more domestic sugar consumption, leaving less available for exports.

Crude oil and gasoline prices have corrected lower, weighing on sugar. However, any recovery in the energy commodity could push sugar higher.

Meanwhile, sugar is an agricultural product, so the weather conditions in Brazil, India, and other leading sugarcane and sugar beet growing areas can influence prices. Moreover, inflationary pressures have pushed production prices higher, putting upward pressure on all agricultural products.

Sugar is searching for a bottom, with the most recent low at just below 18 cents per pound. A bottom above the 17.20 technical support will leave the bullish trend since 2020 intact. The odds favor a higher low and recovery in sugar futures over the coming weeks and months.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.