DocuSign Inc. (DOCU) is a digital solutions company that specializes in managing agreements. The company creates, commits, and manages agreements and contracts with the help of its Intelligent Agreement Management (IAM) platform. It provides solutions such as eSignature, contract lifecycle management, document generation, and web forms.

Incorporated in 2003, and with a market cap of $10.47 billion, the San Francisco-based company's technology is now used in over 180 countries globally.

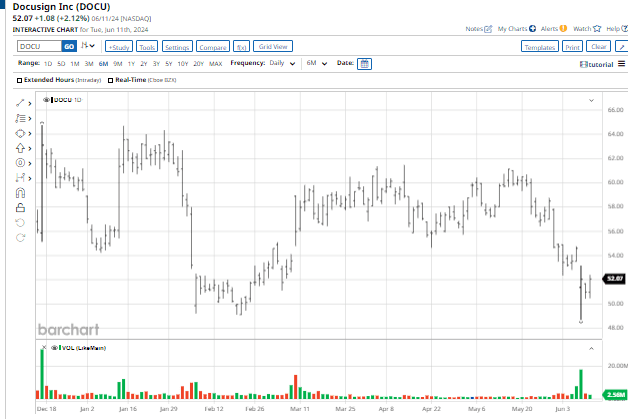

DocuSign stock is down 83% from its late 2021 highs, and the stock has tumbled another 14.5% on a YTD basis. On June 7, the shares fell nearly 5% in a single session as investors reacted to its fiscal Q1 earnings results.

DOCU Sells Off After Earnings

DocuSign reported its Q1 of 2025 results after the close on June 6, with earnings and revenue both topping expectations. Revenue of $710 million beat analysts’ estimate of $706.1 million, while adjusted earnings of $0.82 per share came in ahead of the $0.79 per share consensus.

Revenue from subscriptions totaled $691.5 million, while billing revenue came to $709.5 million - both higher, on a year over year basis. Professional services revenue dipped 18% to $18.2 million.

During the quarter, DocuSign generated $254.8 million of operating cash flow and $232.1 million in free cash flow. Management added $1 billion to its existing buyback authorization.

The company issued guidance for the current quarter that calls for revenue of $725 million to $729 million. DocuSign hiked its full-year guidance to a range between $2.92 billion and $2.93 billion.

How Did Analysts React?

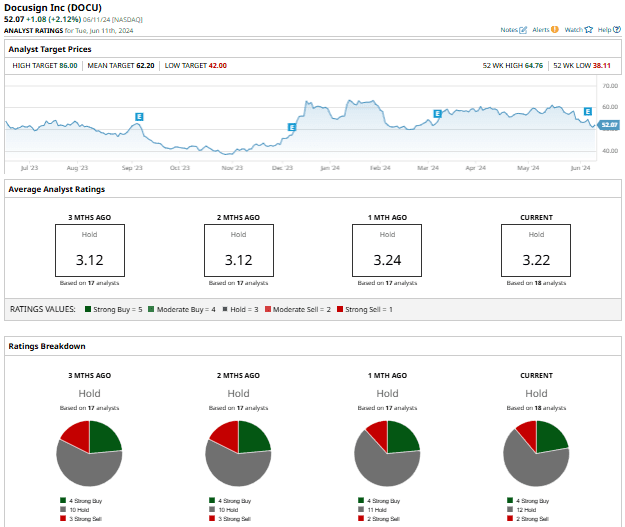

Analysts were dissatisfied with management’s guidance, leading to multiple price cuts as the group adjusted their growth expectations.

Analyst Rob Owens from Piper Sandler reiterated his “Neutral” rating on the stock but slashed his target from $65 to $60, noting the “lowest beat in the past 5+ years.” Similarly, RBC Capital Markets analyst Rishi Jaluria reiterated a “Sector Perform” rating while cutting his target from $59 to $52, and labeling the results as a “skinny beat.”

Additionally, JPMorgan’s Mark Murphy maintained an “Underweight” rating on the stock with a target of $50. The analyst noted subtle signs of stabilization while labeling some “modest improvement” similar to the first half of fiscal 2024.

Elsewhere, Needham and Oppenheimer maintained their “Hold” equivalent ratings, with both analysts suggesting DocuSign’s IAM upgrade will take time before bearing fruit.

Overall, analysts have a “Hold” rating on the stock. Among the 18 analysts tracking DOCU, 4 have a “Strong Buy” rating, 12 have a “Hold” rating, and 2 have a “Strong Sell” rating for the digital solutions provider.

The mean price target for DOCU now stands at $61.73, suggesting expected upside potential of 21.4%.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.