By Odil Musaev Managing Director of Investment Banking boutique Alkes Research in tashkent

Since the start of the ‘new economy’ era, the 21st century, the financial markets in the developed economies have undergone multiple evolution cycles, eventually maturing to the point of efficient ‘easy money’ financial capital allocation for market participants. This has resulted in decreased cost of capital as the available capital became abundant, accompanied by increasing yield competition among financial instruments, leading investors to engage in search-for-yield to maximise their returns.

The increased interconnectedness of countries has ultimately led investors to pursue investment opportunities in emerging economies with the hope of high return expectations, thereby providing new capital and types of financial instruments. Considering the implications of capital allocation in developing economies, what is frequently acknowledged among those developed economy investors is related to the phenomenon that they often prefer to realise their return cash flows in their home currencies.

In the ‘new economy’ era, the home currency, or the currency most investors would like to see in potential investment opportunities, is the US dollar, followed by the euro and the British pound. While there are indeed positive aspects of hard-currency-denominated bond investments from the investor's perspective, the interest rate differentials between the currencies of the investor and the emerging market issuer also create a win-win situation for both parties. This differential can be explained by the fact that economic growth in developed economies tends to be comparatively lower as opposed to developing economies.

By observing those dynamics, the foreign currency-denominated bonds by issuers in the frontier markets have already started to become interesting for investors in developed markets where the cost of capital is relatively lower, and the interest rate environments are more stable with predictive monetary policies, which is not always observed in developing economies. Consistent with this trend, capital raising through foreign-denominated fixed-income securities is indeed observed in one of the frontier markets, Uzbekistan.

Success in the global bond market, once again

Recently Uzbekistan has once again successfully placed bonds worth $1.5bn on the global financial market. For the first time, the issue of sovereign bonds was conducted simultaneously in three currencies – US dollars, euro and Uzbek sum. The longest-term placement was $600mn with a maturity of seven years. The other two placements were €600mn and UZS3 trillion for three years. At the same time, the total volume of bids amounted to $5.5bn, including $3bn for US dollar-denominated bonds, as well as €2bn for euro-denominated bonds and UZS4 trillion. Coupon rates amounted to 6.9% for the dollar-denominated bonds, 5.375% for the euro-denominated bonds and 16.625% for UZS-denominated bonds. The bonds were purchased by large institutional investors from all over the world. This landmark offering confirms the high interest of the global investment community in the economic prospects of one of the most dynamically developing countries in the world.

Proceeds from these international bonds are used to finance the Sustainable Development Goals and cover the state budget deficit, which reached record levels last year.

As noted in a recently published report by S&P Global Ratings, Uzbekistan's economic growth is largely driven by investment: last year, the investment-to-GDP ratio was one of the highest in the world at around 43%. The agency also highlighted that Uzbekistan's net public debt remains moderate in global comparison as positive: it may reach 31.7% of GDP by the end of 2024. S&P affirmed Uzbekistan's foreign and local currency sovereign credit rating at BB-/B with a stable outlook, and also noted the expectations for strong annual economic growth exceeding 5% on average until 2027 in its report.

Deafeningly silent domestic debt market

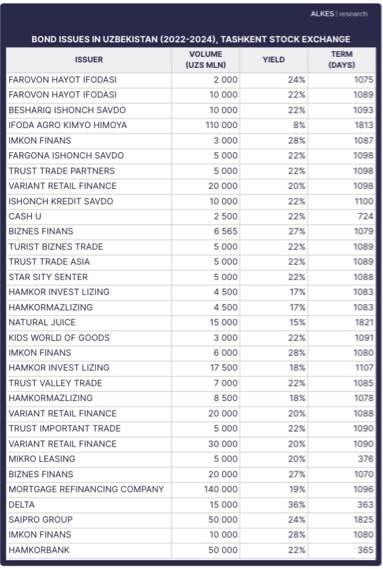

Despite Uzbekistan's annual success in winning the confidence of international investors and its growing presence in global capital markets, the country's domestic bond market has not yet achieved outstanding results. The government, together with the regulator and the local investment banking community, is making every effort to develop the domestic securities market. These consistent steps have led to significant improvements: a roadmap for capital market development has been adopted and is being implemented, a record three IPOs were held on the local stock exchange last year, the number of active retail investors has grown by hundreds of times, investment technologies are being actively developed, and work is underway to establish correspondent relations with global custodians. Nevertheless, there are no significant shifts in the bond market, despite the seemingly very attractive yields, which fluctuate around 24-30% per annum (in Uzbek sum). The total volume of registered issues at the Tashkent Stock Exchange (including the OTC market) is about UZS500bn, or about $40mn (Table 1). This is certainly not comparable to international issues and does not reflect the prospects of the domestic corporate debt market of the country's economy with a GDP of almost $100bn.

One of the fundamental reasons for the lack of interest among local investors (and consequently potential issuers) in public corporate debt is the high rates on bank deposits in national currency, reaching 25-27% per annum (5-8% for deposits in US dollars) for individuals and fully guaranteed by the state. Foreign investors are traditionally cautious about fixed-income instruments denominated in national currencies. For businesses, the current Prime Lending Rate today is about 23-24% for the Uzbek sum bank loans, and about 9-12% for loans in US dollars. Private banks say lending rates are as high as 26% in sums and 14% in dollars. In addition, obtaining a loan from a bank implies the availability of collateral at a discount to its market value. Therefore raising funds through bond issuance potentially has a number of advantages for both the issuer and the investor, for example: tax benefits on coupon income, flexibility in structuring payments, absence of collateral requirements and potentially greater liquidity. However, there is no tangible investor interest: local investors do not see a sufficient risk premium compared to local bank deposits, and international investors do not want to bear currency risk on top of their existing country risk.

Perhaps foreign currency-denominated bonds could be a considerable alternative to bypass the high-interest rate environment in the country and, at the same time, attract new flows of foreign capital into the country. For the local entrepreneurs, raising business finance in foreign currency is a common practice. Such loans account for a significant part – almost half of the total loans allocated to the economy. (Graph 1). In turn, the population of Uzbekistan willingly keeps its savings in US dollars – according to the Central Bank of Uzbekistan, about one-third of all deposits of legal entities and citizens are kept in hard currency, and unofficial statistics speak about, according to various estimates, $5-10bn stored ‘under the mattress’.

In addition, banks, which are not traditionally active participants in the stock market in Uzbekistan, may gradually become one of the key buy-side players in the debt market. Given the current tax incentives on coupon yields, buying bonds may be more favourable than issuing similar loans. Banks can also restructure their current loan portfolios in foreign currencies by taking advantage of tax incentives, which will allow them to increase their own margins and reduce the cost of financing for their borrowing corporate clients.

Proven by emerging markets experience

According to the IMF, the share of bonds denominated in foreign currencies in the capital markets of developing countries was 13.5% in 2018, up from 11.7% in 2011. In neighbouring Kazakhstan 98.4% of mutual fund assets consist of securities denominated in foreign currencies. In Russia, bonds in foreign currencies account for 10.2% of the market, and in Georgia, 25%. US dollar-denominated bonds issued by Chinese companies (commonly referred to as Kungfu Bonds) account for 70% of the entire Asian corporate US dollar-denominated bond market (excluding Japan), and their issuance amounted to $224bn in 2017, showing rapid annual growth (the Kungfu bond market amounted to $89.9bn in 2014).

It is important to note that in countries where issuing corporate public debt in foreign currencies is allowed, the stock exchanges are successfully developing. Clearly foreign currency-denominated bonds have opened up emerging markets to a wider range of potential investors and, as a result, have helped to reduce the cost of raising finance for the economy and increased the efficiency of domestic corporate debt markets. As stated in the Credit Suisse paper, a robust corporate bond market is in the interest of emerging economies as it helps reduce reliance on bank financing and leads to improved diversification of funding sources.

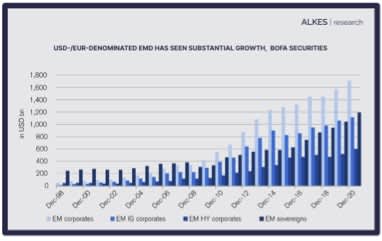

Analysis conducted by Bank of America Securities shows that over the past 20 years there has been a significant increase in the issuance of both corporate and sovereign bonds denominated in hard currencies in emerging markets (Graph 2).

Thus it can be said that the emerging and developing market issuers are indeed the source of ‘search-for-yield’ opportunities, with relatively higher investment returns, accompanied by risk premiums, which still would be quite considerate from the issuer's point of view.

Let's list the potential benefits

Here is a partial list, tested in other emerging markets, of the benefits of issuing hard currency-denominated bonds:

\- Issuing bonds in foreign currency will attract additional funds into the economy by attracting the capital of both foreign investors and savings of local investors;

\- Foreign investment in foreign currency corporate bonds will improve the country's balance of payments and increase its foreign exchange reserves. When purchasing foreign currency corporate bonds, foreign investors transfer foreign currency into Uzbekistan, which increases its supply in the market and strengthens the Uzbek sum against foreign currencies;

\- The introduction of foreign currency-denominated debt will significantly contribute to the development of the stock exchange, and the capital market as a whole, by attracting more investors and increasing the liquidity of securities;

\- Compared to bank lending, a bonded loan is more attractive both for the issuer (allows raising funds at a lower rate) and for the investor (providing a higher yield);

\- The issuance of foreign currency bonds will reduce the dependence of borrowers on bank financing, which in turn will create competition between bank loans and bonded loans;

\- Investors in local currency securities are often unwilling to bear currency risks over a long period, so issuing hard currency bonds will allow issuers to raise longer term funding;

\- The successful issuance of foreign-currency-denominated bonds increases a country's visibility and reputation in global financial markets, which helps attract foreign investment and improves access to capital.

Step-by-step risk management

Currency fluctuations are a key risk for potential borrowers. However, as mentioned above, local businesses have a long and successful history of lending in foreign currency and are well aware of devaluation risks. Another important aspect is that the public market inherently requires more transparency and accountability. Therefore the gradual liberalisation of requirements for issuers and test offerings of quality companies with clear dollar proceeds may become the first steps towards the creation of a well-integrated and sustainable capital market in Uzbekistan and could become one of the key elements for attracting foreign investment in the fast-growing economy.