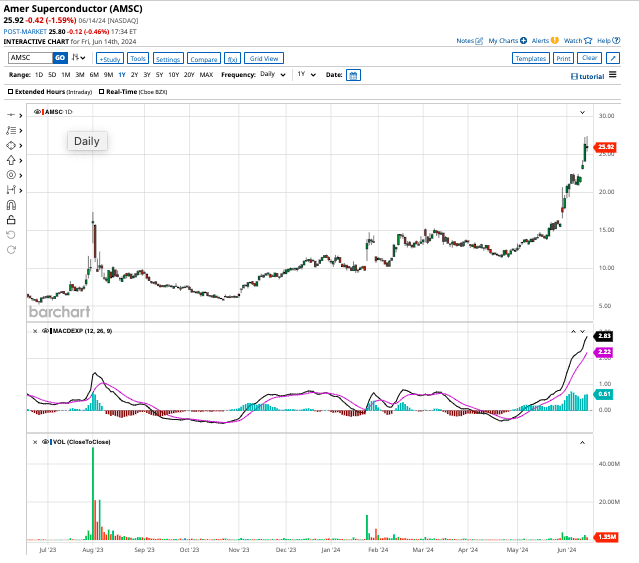

Valued at $959 million by market cap, American Superconductor (AMSC) is a clean energy stock that has already surged over 132% in 2024. Part of a rapidly expanding addressable market, American Superconductor operates in the wind energy segment. Its Windtec Solutions allows AMSC to enable manufacturers to launch wind turbines profitability. Moreover, its Gridtec Solutions provides engineering planning services and advanced grid systems that optimize network reliability, efficiency, and performance.

American Semiconductor’s solutions are now powering gigawatts of renewable energy while enhancing the performance of power networks in over 12 countries. Let’s see if American Superconductor stock is a good buy right now.

AMSC Bags Big-Ticket Deal

Last week, AMSC stock gained over 7% in a single trading session after it announced a $75 million contract with Irving Shipbuilding, a Canada-based shipbuilder that has constructed over 80% of the country’s navy at sea.

AMSC will provide ship protection systems hardware and engineering work to support the Royal Canadian Navy. The scope of the contract might include integration and commissioning of the system, and the first ship protection system is expected to be delivered in 2026.

The company's ship protection system will be integrated into the Canadian Surface Combatant Ships, and CEO Daniel P. McGahn stated, “We look forward to working with Irving Shipbuilding Inc. and the Royal Canadian Navy during the expected insertion of our Ship Protection Systems into the CSC ships and look ahead to expanding our work with allied Navies.”

How Did AMSC Perform in Fiscal 2023?

In fiscal Q4 of 2023 (which ended in March), AMSC reported revenue of $42 million, up from $31.7 million in the year-ago period. The yearly increase was attributed to higher grid segment sales, driven by strong new energy power system sales and higher wind segment revenue. Its sales in fiscal 2023 stood at $145.6 million, up from $106 million in 2022.

AMSC’s stellar revenue growth should allow it to report consistent profits. In fiscal 2023, it reported an adjusted income of $0.6 million, or $0.02 per share, compared to a loss of $28.8 million, or $1.03 per share, in 2022.

The clean energy company ended Q4 with $39 million in orders and a backlog of $140 million. Its diverse order bookings, strong balance sheet, and improved operating efficiency have laid the groundwork for steady long-term growth.

In fiscal Q1 of 2024, AMSC expects sales to range between $38 million and $42 million, with an operating cash flow of $2 million. Analysts tracking American Superconductor expect sales to rise by 8.5% to $158 million in fiscal 2024, and by 12.4% to $177.6 million in fiscal 2026. Its adjusted earnings per share are forecast to expand from $0.02 per share in fiscal 2023 to $0.10 per share in 2024, and $0.26 per share in 2025.

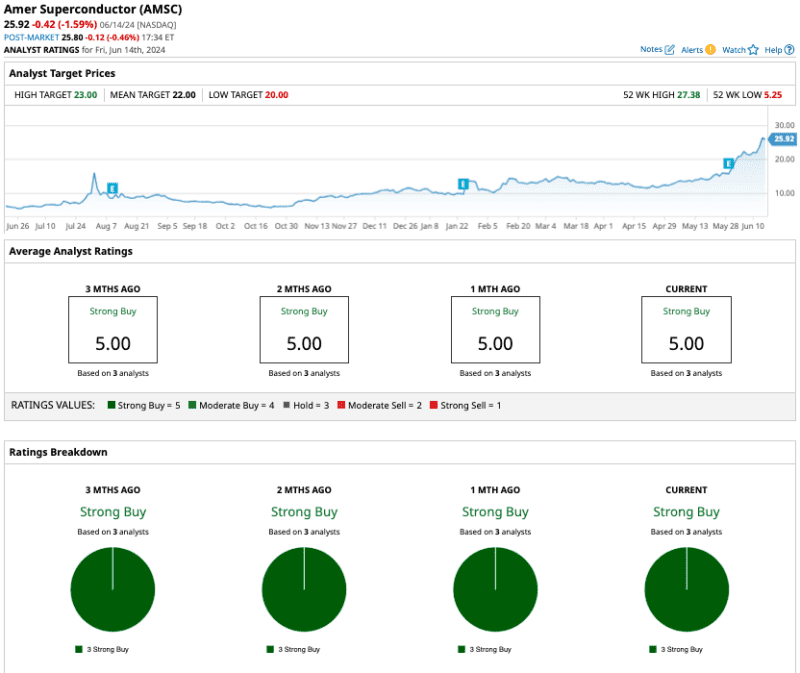

Each of the three analysts covering AMSC stock have a “strong buy” recommendation. The average 12-month target price is $22, which is lower than the current target price of $25.92.

Priced at 6x forward sales, AMSC stock might seem expensive. However, its widening profit margins allow it to command a premium valuation.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.