Discount closeout retailer Ollie’s Bargain Outlet (OLLI) is a boring enterprise – let’s just get it out there. OLLI stock lacks the appeal of an innovative technology firm. It’s also not as exciting as other traditional sectors, such as precious metals or energy. However, Ollie’s is relevant at this juncture, extremely so based on present economic conditions.

Still, derivatives market traders don’t seem too impressed with the underlying concept. Sure, Ollie’s posted encouraging results for its first-quarter earnings report. But one of the issues is that OLLI stock has gained nearly 17% of equity value since the start of the year. That seems quite rich for, again, a boring entity.

With tech giants increasingly taking up investors’ attention, OLLI stock may be due for a pullback; hence, I’m not particularly surprised by the not-so-encouraging trading dynamics against it recently. Nevertheless, I believe walking the pessimistic path may not be the most prudent idea for the long run.

Diving Into the Unusual Options Activity for OLLI Stock

Following the close of the June 14 session, OLLI stock represented one of the highlights in Barchart’s screener for unusual stock options volume. This data interface identifies options trades that feature transaction volume that’s either higher or lower than usual. Primarily, the screener helps retail investors filter ideas that the smart money may be focusing on.

One of those is clearly OLLI stock. After Friday’s close, total volume hit 8,368 contracts versus an open interest reading of 25,669. Further, this print represented a 326.94% increase over the trailing one-month average metric. Call volume pinged at 6,331 contracts versus put volume of 2,037 contracts.

At a cursory glance, this pairing yielded a put/call ratio of 0.32. That’s seemingly “good” if you’re a bull: more traders are targeting call options than puts. However, it’s also important to realize that options can be bought or sold. And depending on which side of the ledger the transactional party falls under, the sentiment can shift from the face-value implication.

Sure enough, Barchart’s options flow screener – which filters exclusively for big block transactions likely placed by institutions – tells a more nuanced tale. This interface indicated that on the Friday session, net trade sentiment sat at $36,900 below breakeven, thus favoring the bears.

In terms of options with bearish sentiment, there were simply more transactions than the countering bullish variety. Also, the biggest premium among the pessimistic transactions stood at $11,400. That’s not much from a nominal standpoint. However, it easily exceeded the biggest premium on the optimistic side, which landed at only $5,600.

Technical Picture in Focus

Now, an options flow screener can only highlight potentially bullish or bearish-sentiment trades. It obviously doesn’t identify and interview the parties placing the trades. Therefore, it’s impossible to know with absolute certainty what the motivation behind the trades was, short of a comprehensive disclosure. That’s probably not going to happen.

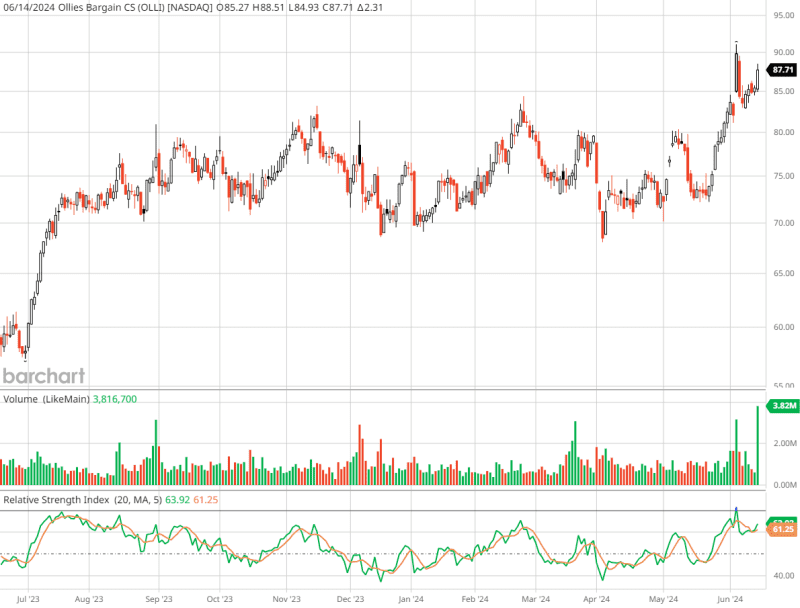

However, if I were to speculate, I’d say that the bearishness in OLLI stock stems from its recent positive performance. It’s not just about the aforementioned year-to-date print. Rather, in the trailing month, OLLI gained nearly 21%. It’s on the move, even beating out a hot player like Broadcom (AVGO) during the same period.

Broadcom recently split its shares so there’s a clear reason for the enthusiasm. OLLI stock gained because consumers are looking for discounts amid a tough economic environment. That’s great but it’s also not a particularly exciting narrative.

So, with a boring retailer running perhaps a little too hot, it may seem like a good time to bet against it. However, I’m hesitant because Friday’s big bump up in OLLI stock occurred on very high volume; in fact, the highest volume metric of the year so far.

When rising volume confirms a rising price, that’s not something to bet against unless there’s a compelling reason to do so.

Fundamentals Make Too Much Sense to Short

Finally, let’s discuss the real reason why betting against OLLI stock doesn’t seem prudent: the fundamentals for the upside narrative make sense.

To be sure, that doesn’t mean that Ollie’s won’t encounter some choppiness or even a near-term correction. It might happen. However, the longer-term storyline signals sustained relevance. In the Q1 disclosure, the retailer stated that same-store sales growth increased by 3%. To Barchart content partner The Motley Fool’s point, consumers appear eager to grab bargain prices whenever they can.

Plus, with the May jobs report coming in hotter than expected, the latest results in the labor market has the Federal Reserve holding off on interest rate cuts. That makes sense because more dollars chasing after fewer goods is inflationary. Such a circumstance will likely add pressure to consumer prices, making OLLI stock more relevant, not less.

Again, without a compelling reason to short a security, you should probably stay on the sidelines. With Ollie’s Bargain Outlet, this business appears more of a long-term buy than anything else.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.