In an August 2023 Barchart article, I asked if coal prices were setting up for an end-of-year rebound last year. The rebound never came, and coal prices are nearly unchanged in June 2024 compared to last August.

Last August, the three fossil fuels, coal, crude oil, and natural gas, were considerably lower than the 2022 highs, but were higher than the current prices. I concluded:

Nearby NYMEX crude oil futures for October delivery were sitting near $80 per barrel on August 25, with October Brent futures at the $84.50 level. U.S. NYMEX natural gas prices were below $3, with European prices closer to the recent lows than the 2022 high.

ICE Rotterdam and Newcastle coal futures, like natural gas, are closer to the low than the 2022 record peaks.

The energy markets have become complacent after facing multi-year highs in oil and U.S. natural gas and record highs in coal and European natural gas in 2022. Economic weakness in China has weighed on traditional energy prices and kept them under control.

Meanwhile, the war in Ukraine and Russia’s use of energy as an economic weapon are reasons to maintain vigilance. The geopolitical landscape remains a clear and present danger that could cause traditional energy prices to spike higher. A recovery in China and a cold winter in Europe could create another perfect bullish storm for coal over the coming months.

Oil, gas, and coal prices were steady in June 2024, but the geopolitical landscape remains a hornet’s nest of problems that could cause increase hydrocarbon prices.

Crude oil has declined, while natural gas prices close to unchanged since August 2023

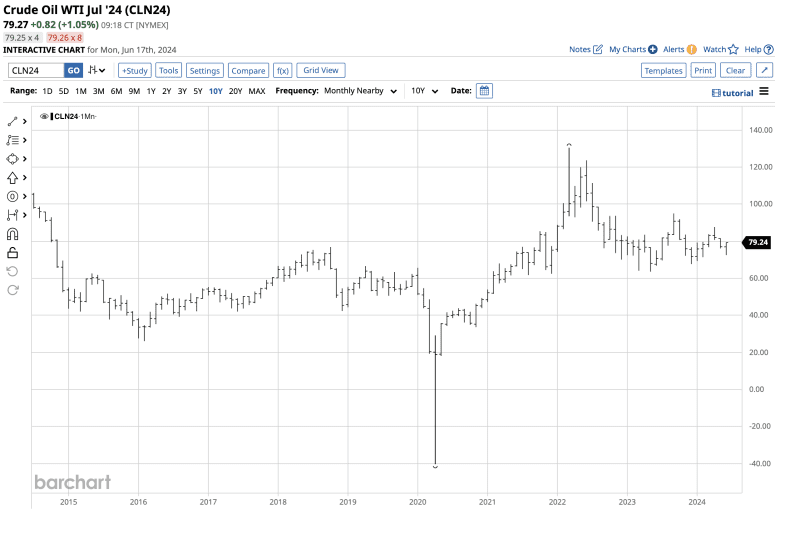

In August 2023, the continuous NYMEX crude oil contract traded in a range of $77.59 to $84.89 per barrel.

The chart highlights that the active month July NYMEX WTI crude oil futures at $79.27 per barrel are below the $80 per barrel level. But within the August 2023 range.

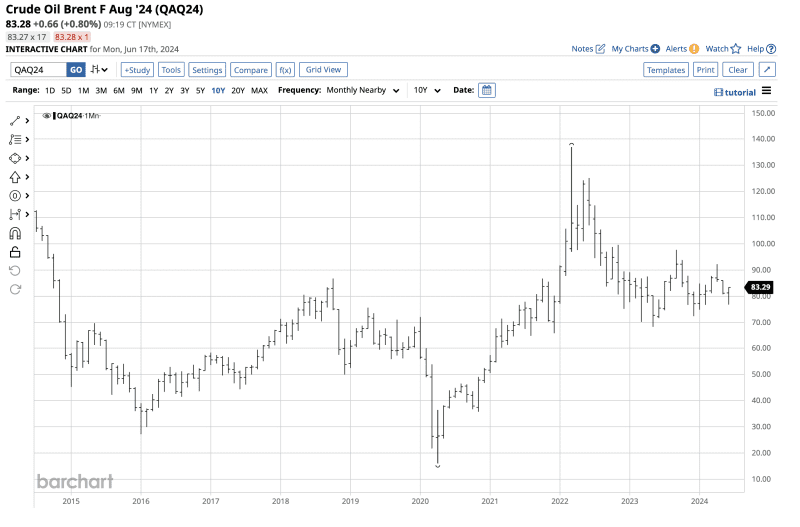

Brent crude oil futures for August delivery at $83.28 per barrel were within the August 2023 $81.97 to $88.10 trading range.

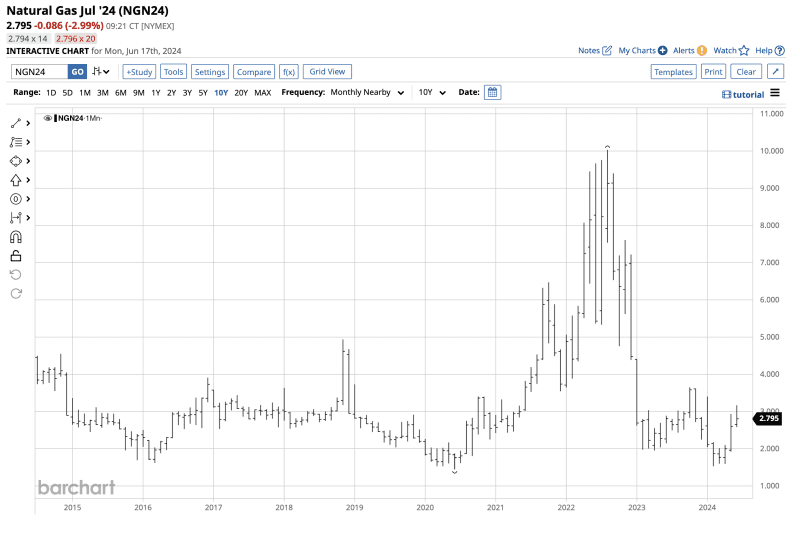

In August 2023, natural gas futures on the CME’s NYMEX division traded in a $2.425 to $3.018 per MMBtu range.

At the $2.795 level, nearby natural gas futures for July delivery are trading within the August 2023 range.

Rotterdam coal prices are within the trading range

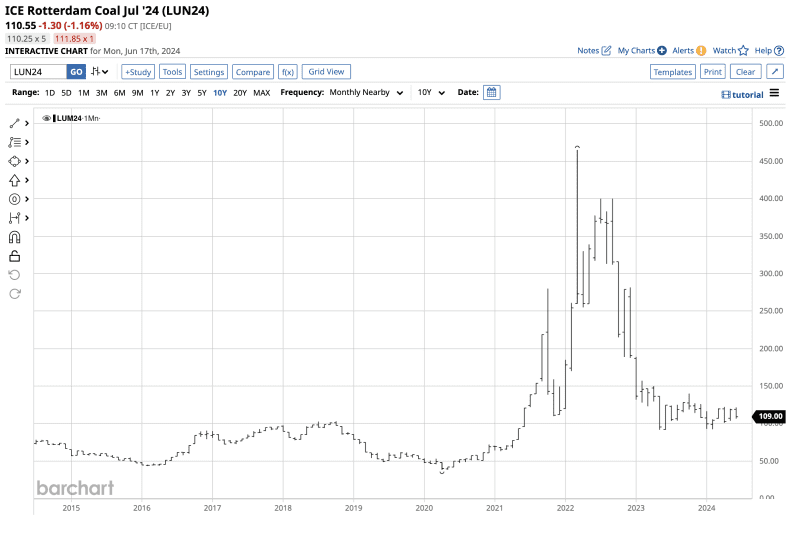

In August 2023, coal for delivery in Rotterdam, the Netherlands, cost $122.70 per ton.

The chart highlights that at $110.55, Rotterdam coal prices are within the August 2023 trading range of $104 to $125 per ton.

After rising to a record high in 2022, Rotterdam coal prices have consolidated in a narrow range over the past year.

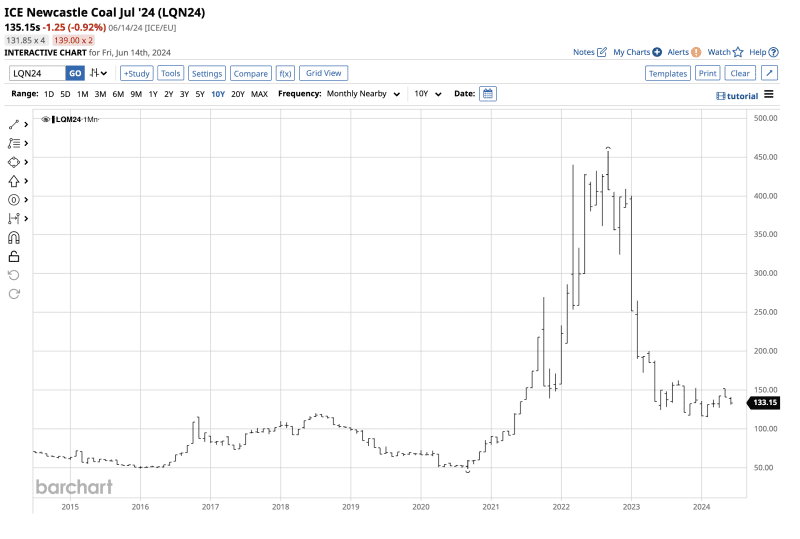

Newcastle coal is also within the August 2023 range

ICE coal futures for delivery in Newcastle, Australia were at the $158.50 per ton level in August 2023 and traded in a $133.50 to $159.75 trading range.

At the $135.15 per ton level in June 2024, Newcastle coal remains within the August 2024 trading range, albeit close to the band’s low end.

China and India continue to rely on coal

Under the Biden administration, the United States, along with Europe, has been at the forefront of addressing climate change by supporting alternative and renewable fuels while inhibiting the production and consumption of fossil fuels. Coal has been a four-letter word for environmentalists for decades.

Meanwhile, the world’s most populous countries, India and China, with over one-third of our planet’s population, continue to rely on coal for power generation. Australia is second only to Indonesia in coal exports. Australia’s location makes the country a leading supplier to Indian and Chinese coal consumers.

China’s weak economy has weighed on raw material demand. However, when China emerges from its financial malaise, and as India grows, coal demand will likely increase, causing prices to rise.

Coal is on the November ballot in the United States

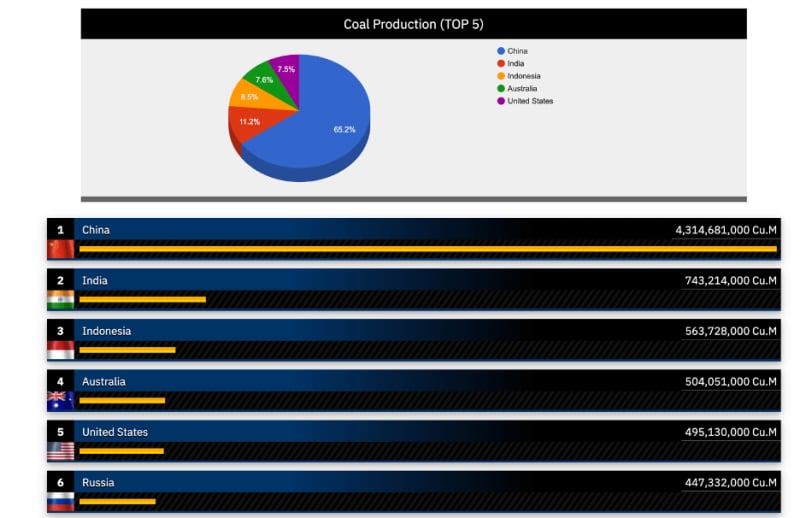

The top six coal-producing countries in 2024 are:

While the current United States administration has been a global leader in addressing climate change, the U.S. remains the fifth-leading coal-producing country. Of the six top producers, China, India, Indonesia, and Russia have not set significant decarbonization targets.

Coal and fossil fuels are on the ballot in the November U.S. presidential election. The incumbent administration favors continuing decarbonization, while the Republican challenger supports a “drill-baby-drill,” “frack-baby-frack,” and “mine-baby-mine” energy policy, supporting U.S. crude oil, natural gas, and coal production to achieve energy independence. Moreover, the opposition party wants to make the U.S. the world’s traditional energy supermarket, exporting to nations worldwide to increase revenues and reduce the national debt. Therefore, the outcome of the November contest will determine the fundamental equation for fossil fuels.

As the war in Ukraine continues, the conflict in the Middle East threatens to escalate. The bifurcation of the world’s nuclear powers can distort energy prices as tariffs and embargos create trade roadblocks. Coal prices have been consolidating over the past year, but the current economic and geopolitical landscapes suggest that when prices break out of the tight trading band, they will likely move higher.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.