Raspberry Pi’s shares have been a spectacular success since unconditional dealing on the stock market began on Friday (14 June).

Founded by Eben Upton in 2012 to make computing more accessible for youngsters, Raspberry Pi’s low-cost access to computing ignited the imagination of a generation.

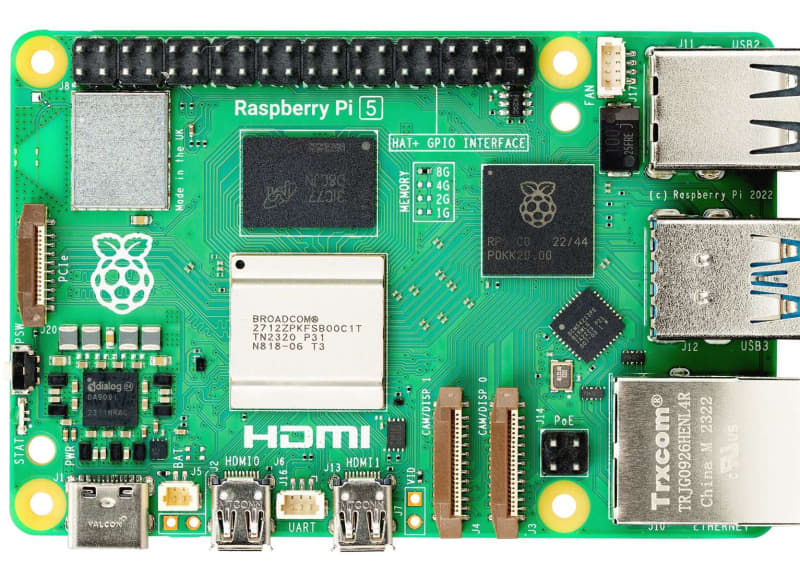

To date, it has sold more than 60 million SBCs (single board computers) and compute modules to more than 70 countries. Reported revenue was $265.8million in 2023, with operating profit of $37.5m.

Though best known for its credit card-sized computers that encourage children to develop their coding skills, the devices are also popular for use in the home, whether for domestic tasks - such as controlling heating - or retro gaming.

But that market accounts for 28 per cent of sales. The bulk of Raspberry Pi’s income comes from the industrial and embedded (I&E) sector, with applications including electric vehicle charging, robots, elevators, and sports performance tracking.

When trading began on the London Stock Exchange last week, shares were priced at 280p. The price peaked at 500p per share before settling at 420p per share at the end of last week.

By close of play Tuesday (18 June), the price was 440p - way above the initial public offering (IPO) and valuing the company at £751m.

“We’ve accomplished amazing things, as a company, as a Foundation, and as a broader movement,” said Ebon Upton, founder and CEO of the Raspberry Pi Foundation. “We’ve designed PCBs, written software, taped out chips, published magazines, filed patents, trained teachers, run after-school clubs, and seen our products taken to space, to the bottom of the ocean, and to the ends of the earth.”