Here’s a question for Siri: Can artificial intelligence revive iPhone sales?

That’s open to debate. But for investors hungry for anything AI-related, the answer is yes. Apple (AAPL) shares hit a new high just two days after the company unveiled its long-awaited AI strategy. The stock shot up after its OpenAI partnership announcement raised hopes of a new iPhone "super cycle" driven by consumers upgrading for access to new AI features.

Apple stock’s quick 10% gain added more than $300 billion to the company’s market capitalization. It even briefly overtook Microsoft (MSFT) again to become the world’s most valuable company, though they've both since been supplanted by Nvidia (NVDA).

Nevertheless, at Apple’s flagship annual developer event on June 10, some were disappointed. That’s because the focus of the event was solely on Apple.

Apple Intelligence

The company’s message was twofold: first, that the partnership with OpenAI was merely the first of many. Second, while the first wave of generative AI centered on artificial intelligence (AI) that understands the broader world, it is Apple that is uniquely positioned to offer generative AI that understands you through its “Apple Intelligence.”

That translates to Apple’s own generative AI models always receiving top billing. “Apple Intelligence” is the company’s catch-all term for a suite of models, built and trained by Apple, that will be embedded into its new operating systems - iOS 18, iPadOS18, and macOS Sequoia.

Apple, though, has not built generative models of the size and complexity offered by the likes of OpenAI. It has opted instead to act as a gateway to other products on the market that can do the things Apple cannot. Its on-device foundational model has 3 billion parameters. OpenAI’s GPT-4o and Google’s Gemini Pro are estimated to have more than a trillion.

Thus, you have the partnership with OpenAI - the first of many.

The AI capabilities will only be available on the newest iPhone and Macs that are run by the A17 Pro and M-series chips. Its latest A17 chip was the first 3 nanometer chip used in a smartphone. This chip has improved the capability of iPhones significantly – doubling the processing power of the previous generation to 35 trillion operations per second.

Morgan Stanley (MS) estimates that just 8% of iPhone and iPad users have the latest models, which means there should be a lot of catch-up spending. Historically, accelerating iPhone replacement cycles drive Apple stock outperformance.

As happens quite often, the market may be getting ahead of itself. Apple Intelligence doesn’t look groundbreaking. Some of the features that will be rolled out this autumn — automatic edits and suggestions when writing an email or text, and using AI to better organize inboxes — already exist in Gmail, from rival Alphabet (GOOGL).

Can Apple Catch Up?

Keep in mind, too, that Apple rivals - Samsung, Google, and a host of Chinese device makers - are already selling phones with AI-powered features.

Google’s launch of the Pixel 8 smartphone in October and Samsung’s Android-based S24 in January — both powered by Google’s Gemini family of AI models — have introduced a new concept into the industry lexicon: “the AI smartphone.”

This is already a crucial battleground in the global AI race. Technology market research firm Counterpoint estimates that “AI smartphones” will make up 43% of worldwide smartphone shipments by 2027, with 1 billion devices in use.

Maybe that’s why the International Data Corporation (IDC) is expecting 4.8% year-on-year growth in 2024 for sales of Android smartphones, but just 0.7% for Apple.

And in the “AI PC” segment, rivals like Microsoft, Qualcomm (QCOM), and Advanced Micro Devices (AMD) have staked a similar claim to early leadership.

Qualcomm CEO Cristiano Amon said on June 6 that the PC industry was being reborn, with the AI PC being the most important development since Microsoft’s Windows 95 operating system.

Microsoft kick-started the AI PC race when it unveiled a series of AI-enabled personal computers in May. The devices will be equipped with Copilot, Microsoft’s flagship AI assistant.

Apple has a history of being late to a particular technology trend, but then becoming a major player. Nevertheless, I prefer to own another very successful company - Microsoft - as I expect iPhone sales to continue to disappoint.

Why Microsoft Stock?

The company continues to pursue long-term growth through its AI and cloud investments. Although not immune from macroeconomic weakness, Microsoft has about as diversified and strong a set of assets as any company in the technology industry. The company is one of just a few with a complete, integrated product set of products aimed at enterprise efficiency, cloud transformation, and business intelligence. It also has a large and loyal customer base, a large cash cushion, and a rock-solid balance sheet.

Microsoft has huge AI opportunities as well as its ongoing cloud transition, with strong traction for cloud versions of Office, Dynamics, Teams, and Azure infrastructure cloud services. Sales from all “cloud-based” businesses are now over two-thirds of total sales.

Of course, AI and its Azure cloud business are strongly linked. Artificial intelligence contributed 700 basis points to Azure growth in the latest quarter. And this growth could have been even greater if Microsoft wasn’t facing capacity constraints. On the company’s earnings call, CFO Amy Hood said, “Currently, near-term AI demand is a bit higher than our available capacity.”

Microsoft took an early lead in the race to dominate generative AI following its $13 billion investment in OpenAI, and this year, the company invested in the European AI start-up Mistral AI and hired the bulk of the staff of rival AI start-up, Inflection. Microsoft invested into Mistral at a valuation of $2.1 billion in February. Its current valuation is up to $6 billion.

Microsoft’s early lead in AI is a big factor behind Azure’s current growth rate of 31%, nearly double the 17% of the AWS division of Amazon (AMZN).

I find myself in agreement with Brad Sills, research analyst at Bank of America (BAC). He summed it up nicely by saying that Microsoft’s Azure offering “is the only software business that is benefiting from AI at this point in the cycle. Microsoft remains ahead of the curve in this massive new cycle.”

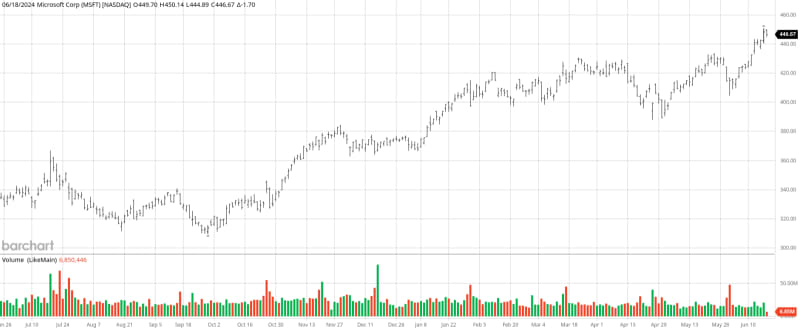

I expect Microsoft to remain the leader in AI for the foreseeable future. MSFT stock is a buy anywhere near the current price of $446.

On the date of publication, Tony Daltorio did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.