Over the past couple of years, artificial intelligence (AI) has shifted from a jargon-y buzzword often used in science fiction movies and tech conferences into a virtual money printer for well-positioned investors. With generative AI platforms like Microsoft (MSFT)-backed OpenAI's ChatGPT and Google's (GOOG) Gemini kickstarting the mainstream adoption of AI across the globe, it seems that no industry will remain untouched by the AI juggernaut in the coming years.

Projected to reach a market size of $2.74 trillion by 2032, AI is here to stay - and to power all of those AI applications across industries worldwide, perhaps no other component is as important as semiconductor chips.

Semiconductors are the brains of all AI models. AI requires massive data churning, and semiconductor chips - especially processors like CPUs and GPUs - can handle massive amounts of data and perform calculations in parallel (think of doing many sums at once), which is essential for training and running AI models.

That's why semiconductors have been called the “pick and shovel” plays of the AI revolution. With chips poised to reach a market size of $1.12 trillion by 2033 on their own, notable broker Bank of America recently raised the target prices of two top AI “mining” plays. Let's have a closer look.

#1. Arm Holdings

Founded in 1990, UK-based Arm Holdings (ARM) had a blockbuster debut on the markets last year, popping 25% on the very first day of trading.

Not a chip manufacturer itself, Arm designs the Arm architecture, a set of instructions that processors use to understand and execute software. It licenses this architecture to chip manufacturers like Qualcomm (QCOM), Samsung, and Nvidia (NVDA). Known for its energy efficiency, Arm also provides software tools and other intellectual property related to chip design. Its market cap currently stands at an impressive $168.46 billion.

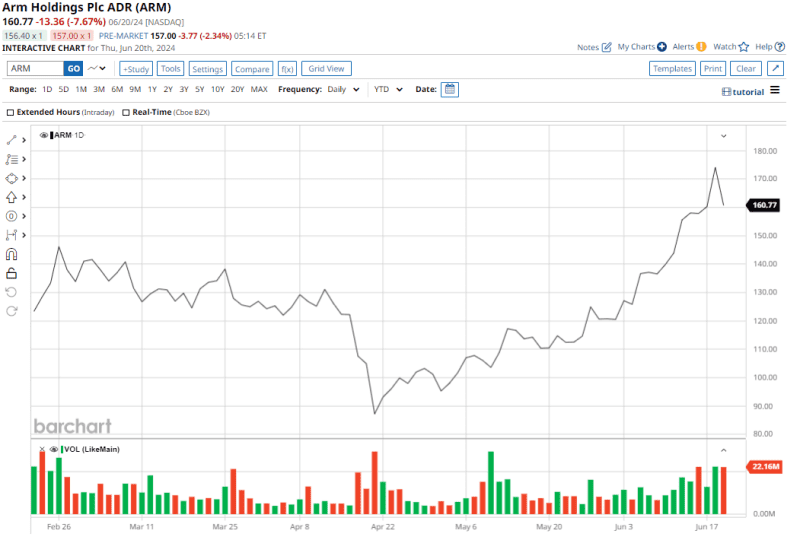

ARM stock has rallied 113% on a YTD basis.

Arm's numbers for the latest quarter were marked by significant growth in revenue and earnings. While revenues went up by 47% from the previous year to $928 million, EPS multiplied to $0.36 from $0.02 in the prior year. The company attributed the strong results to record royalty revenues and robust licensing revenues driven by multiple high-value agreements.

Net cash from operating activities increased by 38.1% from the prior year to $667 million, as the company exited the quarter with a healthy cash balance of $2.9 billion, much higher than its debt levels of $226 million.

Looking ahead, management's ambitions continue to soar, as the company aims to capture 50% of the PC market in the next five years. Their technology already powers all Mac PCs, capturing a significant 15% of the PC market. Now, they're pushing the envelope further with Microsoft and major manufacturers to bring Windows on Arm laptops to market. These laptops, powered by Qualcomm's Snapdragon processors, offer a glimpse into the future of Arm-based personal computing.

But Arm's ambitions don't stop there. Their CPUs are gaining traction in data centers, too. Cloud service providers are drawn to the energy efficiency and high core density of Arm CPUs, making them ideal for custom silicon solutions. Arm's Compute Subsystem (CSS) program empowers companies like Microsoft, Amazon (AMZN), and Google to design and manufacture their Arm-based chips. This bypasses traditional chip manufacturers, allowing Arm to capture a larger share of the value chain and increase revenue per unit.

Arm's partnerships with industry leaders paint a promising picture. Amazon's Graviton 4 chip, Nvidia's Grace CPU within the Blackwell super chip, Google's Axion chips for GCP, and Microsoft's Azure VMs powered by their Cobalt 100 Arm processor showcase the growing adoption of Arm technology across various sectors. These collaborations solidify Arm's position as a major player in the future of computing.

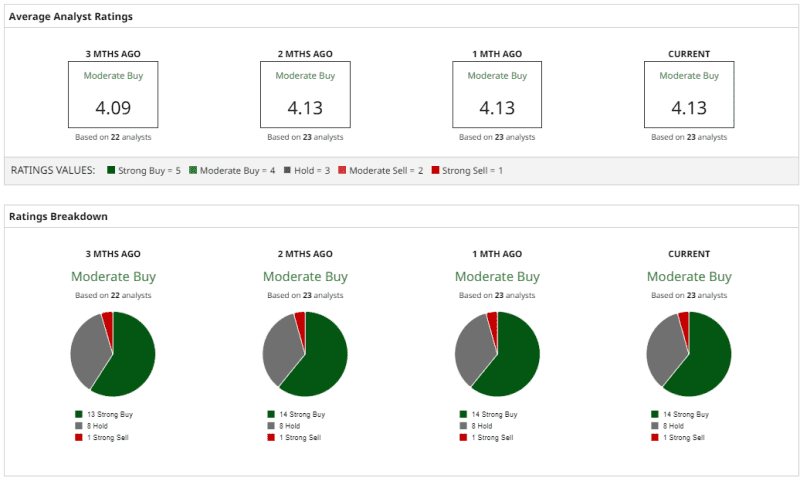

Overall, analysts have deemed the stock a “Moderate Buy,” with a high target price of $180. This indicates an upside potential of roughly 12.3% from current levels. Out of 23 analysts covering the stock, 14 have a “Strong Buy” rating, 8 have a “Hold” rating, and 1 has a “Strong Sell” rating.

#2. Micron Technology

Founded in 1978 and based out of Boise, Micron Technology (MU) is a legendary name in the semiconductor industry. It is one of the world's leading manufacturers of memory and storage technologies, including Dynamic Random-Access Memory (DRAM), NAND flash memory, NOR Flash memory and 3D XPoint memory (a high-performance storage solution). The company's products are used as essential components in various devices like leading-edge computing systems, consumer electronics, networking equipment and mobile devices. Micron currently commands a market cap of $159.6 billion.

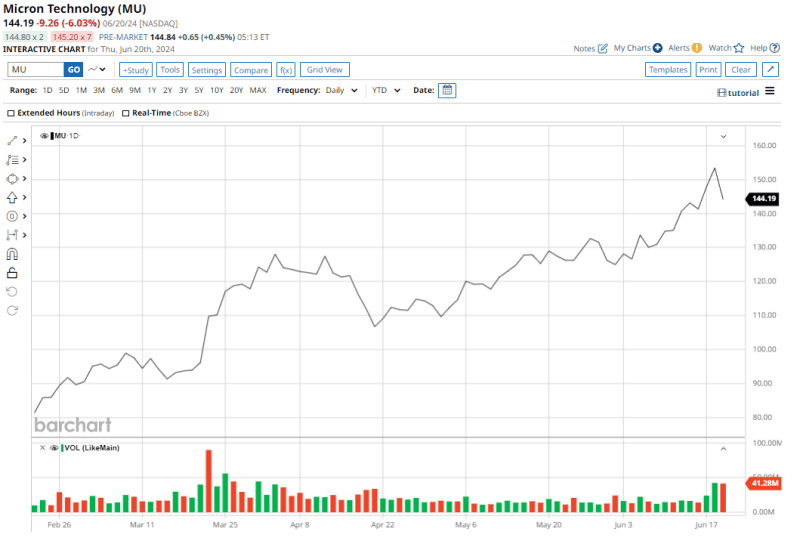

MU stock is up 63.5% on a YTD basis, and it also offers a modest dividend yield of 0.32%.

The company has been consistently narrowing its losses over the recent quarters, and swung to profitability in the latest one. In Q2 2024, Micron reported an EPS of $0.42, which compared favorably to a loss of $1.91 per share reported in the previous year, and also to the consensus estimate of a loss of $0.25 per share. Revenues also rose by 57.7% over the prior year to $5.82 billion.

Micron generated net cash from operating activities of $2.62 billion for the six months ended Feb. 29, up from $1.29 billion in the year-ago period. Overall, the company exited the quarter with a robust cash balance of $8.02 billion, much higher than its short-term debt levels of $1.58 billion. The company is set to report its Q3 earnings on June 26.

Fueled by the AI boom, Micron is experiencing a surge in demand for its memory solutions. Their cutting-edge DDR5 32Gb server DRAM is a prime example, with both 2024 and most of 2025's supply already snatched up by companies building next-generation AI applications.

Micron's dominance extends beyond servers. They're at the forefront of the AI PC and smartphone revolution. Their recently announced LPCAMM2 with LPDDR5X memory equips the Lenovo ThinkPad P1 Gen 7 Workstation for AI tasks, boasting significant power savings and a smaller footprint compared to traditional options.

And Micron isn't stopping there. They're offering gamers a taste of the future with next-generation GDDR7 graphics memory chips. These power-optimized 32Gb chips deliver 60% higher bandwidth and 50% greater power efficiency than their GDDR6 predecessors, translating to faster response times, smoother gameplay, and quicker processing for gamers.

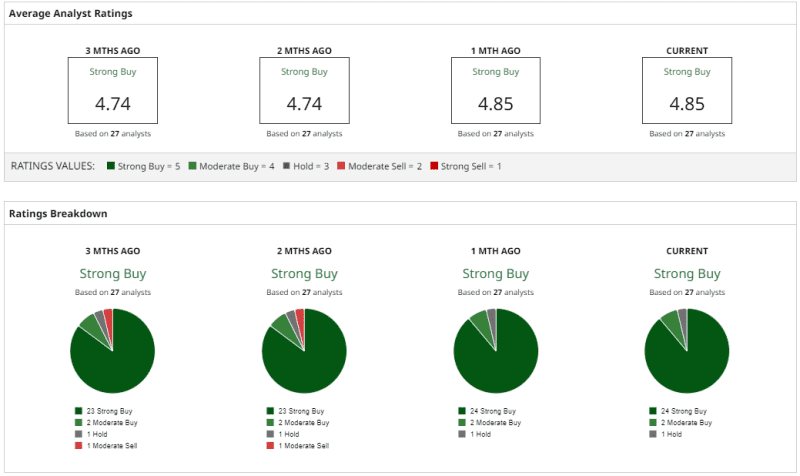

Overall, analysts have a consensus rating of “Strong Buy” for MU stock, with a high target price of $225, which denotes an upside potential of about 61% from current levels. Out of 27 analysts covering the stock, 24 have a “Strong Buy” rating, 2 have a “Moderate Buy” rating and 1 has a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.