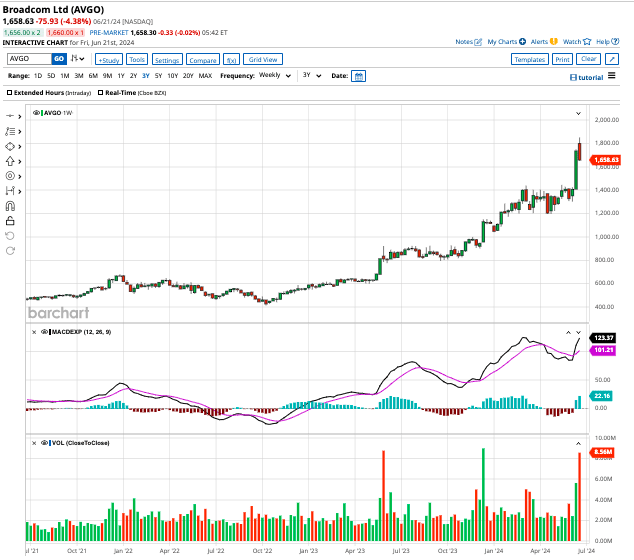

Broadcom (AVGO) has been on an absolute tear since its IPO (initial public offering) in August 2009. In the last 15 years, the tech stock has returned close to 10,000% to shareholders. If we adjust for dividend reinvestments, cumulative returns are much higher at 14,000%, which is exceptional.

Valued at a market cap of $772 billion, Broadcom stock currently trades at $1,608 per share at the time of writing. Let’s see if the stock can touch $2,000 per share.

JPMorgan is Bullish on Broadcom Stock

Broadcom is an enterprise-facing tech giant that offers a wide range of products and services worldwide. It enjoys a leading position in markets such as data centers and AI Ethernet switching, which, according to JPMorgan (JPM), is valued between $5 billion and $7 billion.

Harlan Sur, an analyst at JPMorgan, explains that Broadcom’s dominance in this segment can be attributed to its innovation. This allows it to maintain a market-leading share, despite competition from the likes of Nvidia (NVDA), Marvell Technology (MRVL), and Cisco (CSCO).

The analyst expects Broadcom to maintain its leadership position, as it will soon begin shipping its 3nm Tomahawk chipsets, which support the AI clusters used by companies such as Alphabet (GOOG) (GOOGL), Amazon (AMZN), and Meta (META). Broadcom’s investments in research and development should create entry barriers to competitors, making it a top investment choice in 2024.

According to Sur, Broadcom’s AI-based networking sales should triple to $3 billion in 2024 and grow by 50% in 2025. Sur has a target price of $2,000 for AVGO stock, indicating an upside potential of almost 30% from current levels.

However, investors should note that Broadcom has announced a 10-for-1 stock split, which should take effect next month. That would mean Broadcom’s split-adjusted stock price will decline from $1,608 to $160.80. In turn, the number of outstanding shares would increase by a similar factor, keeping the valuation effectively unchanged.

Broadcom’s Impressive Performance

Broadcom has expanded at an enviable pace in the last decade. In 2016, Singapore-based Avago Tech acquired Broadcom for $37 billion, and the combined entity inherited the Broadcom brand name. In 2018, it acquired CA Technologies for $19 billion, entering the software infrastructure segment. A year later, Broadcom acquired Symantec’s enterprise security business for $11 billion, and more recently, closed its big-ticket acquisition of VMware for $69 billion.

Despite its massive size, Broadcom increased its sales by 43% to $12.49 billion in fiscal Q2 of 2024 (ended in April). After adjusting for the VMware acquisition, its organic growth of 12% is still quite impressive.

In fiscal Q2, Broadcom generated 58% of its sales from the semiconductor business, and the rest from software services. It aims to increase its software sales and reduce dependence on the cyclical semiconductor business over time.

Between fiscal 2016 and fiscal 2023, Broadcom has increased its sales by 15% annually. In this period, its adjusted gross margins have improved to 74.7%, up from 60.5%, while adjusted earnings have grown by 21% annually.

Wall Street expects adjusted earnings to grow by 12% in fiscal 2024, while sales growth is pegged higher, at 44%. Broadcom's earnings growth is forecast to accelerate to 26% in fiscal 2025, as it should benefit from synergies and cost savings associated with the VMware deal. So, priced at 28x next year’s earnings, AVGO stock is not too expensive.

What is the Target Price for AVGO Stock?

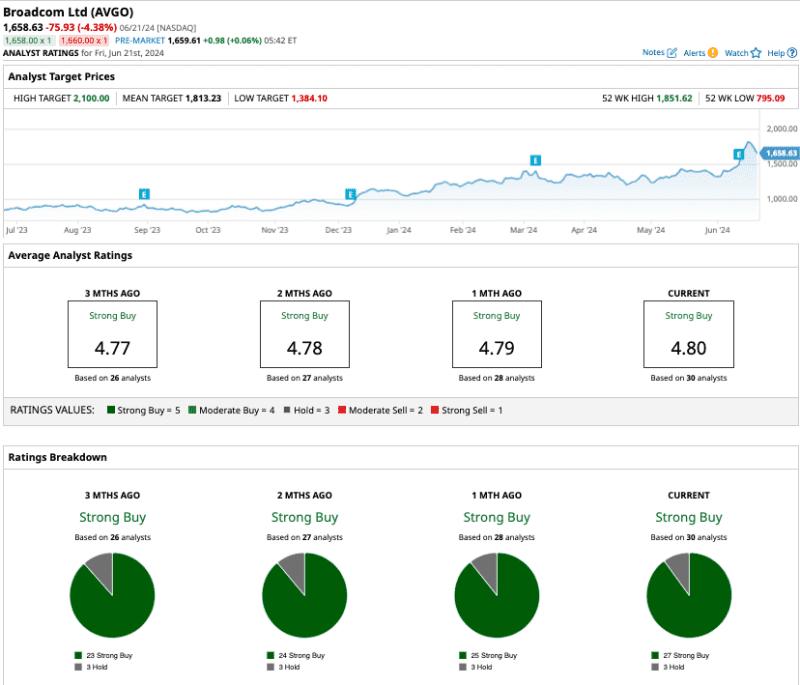

Out of the 30 analysts tracking AVGO stock, 27 recommend “strong buy” and three recommend “hold.”

The average target price for AVGO stock is $1,813.23, about 12.8% higher than the current trading price. The Street-high target stands at $2,100, a premium of roughly 30%.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.