The energy sector is undergoing a significant transformation, with natural gas (NGN24) emerging as a key player in the global shift towards cleaner energy sources. The World Economic Forum's Energy Transition Index for 2024, released on June 19, revealed that while progress continues, the overall pace of the green energy transition has slowed amid stubbornly high inflation and Russia's ongoing conflict in Ukraine, which has increased European reliance on coal to replace gas from Moscow.

However, the U.S. Energy Information Administration projects that both U.S. natural gas production and liquefied natural gas (LNG) exports will likely grow through 2050, as it remains a key bridge between traditional fossil fuels and cleaner, lower carbon sources of energy. As a major player in the domestic natural gas industry, Williams Companies (WMB) is well-positioned to benefit from this growing demand. The company's extensive network of pipelines spans over 33,000 miles across 25 states, handling approximately one-third of the nation's natural gas volumes.

In fact, Argus Research recently upgraded WMB to a “Buy” rating with a price target of $47, citing a bullish outlook on natural gas prices and the company's strategic position in the energy transition. Plus, the brokerage firm considers WMB's dividend payout of over 4% to be safe and reliable, making it an attractive option for income generation. Here's a closer look for prospective investors.

A Closer Look at WMB's Performance

Valued at $51.26 billion by market cap, Williams Companies (WMB) provides essential midstream services like transportation, storage, and processing for natural gas. Their extensive pipeline network connects producers to consumers across the U.S.

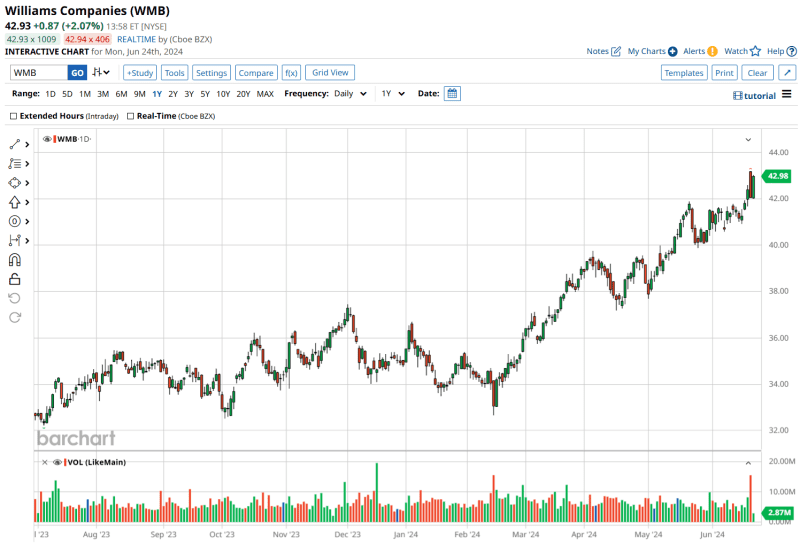

Over the past year, WMB stock has delivered a healthy 40.8% gain, while the Energy Select Sector SPDR Fund (XLE) has added just over 18% in the same time frame. The recent announcement of their first-quarter earnings in May helped to keep the positive momentum going, leading to a 23.9% return on a YTD basis.

For Q1, WMB reported an adjusted net income of $719 million, or $0.59 per diluted share, up from $684 million, or $0.56 per share, in the same period last year. This growth is largely due to higher earnings in the Transmission & Gulf of Mexico division, driven by recent expansion projects, acquisitions, and stronger storage fees. Revenue of $2.77 billion topped analysts' expectations.

From a valuation perspective, Williams Companies carries a forward price-to-earnings (P/E) ratio of 22.69. That's richer than some of its industry peers, though WMB is also projected for above-average earnings growth of 6% to $2.03 per share by fiscal 2025.

WMB is also known for its attractive dividend yield. The company has been paying dividends to shareholders for 51 years straight, which is pretty impressive.

Management recently announced a quarterly cash dividend of $0.475 per share, payable on June 24 to shareholders of record as of June 7. That works out to an annualized dividend per share of $1.90, which translates to a dividend yield of 4.52%, based on the current stock price.

What's Driving Growth at Williams

Earlier this year, Williams Companies closed a deal to acquire natural gas storage assets from Hartree Partners LP for $1.95 billion. This includes six underground storage facilities with a total capacity of 115 billion cubic feet (Bcf), plus 230 miles of gas transmission pipeline and 30 pipeline interconnects - including connections to Transco, the biggest natural gas transmission pipeline in the country. This acquisition is a big deal for WMB, positioning them to capitalize on the growing demand for natural gas.

On top of that, WMB started building two new projects: Transco's Southside Reliability Enhancement and Southeast Energy Connector. These projects aim to make natural gas service more reliable and flexible for customers in North Carolina and South Carolina, and expand Transco's capacity to meet growing demand in the southeastern U.S. The Southside Reliability Enhancement project should be up and running by late 2024, while the Southeast Energy Connector is set to finish in 2025. These projects will not only bring in more revenue through new transportation contracts, but should also strengthen WMB's position in the Southeast.

Analysts Weigh In on WMB's Future

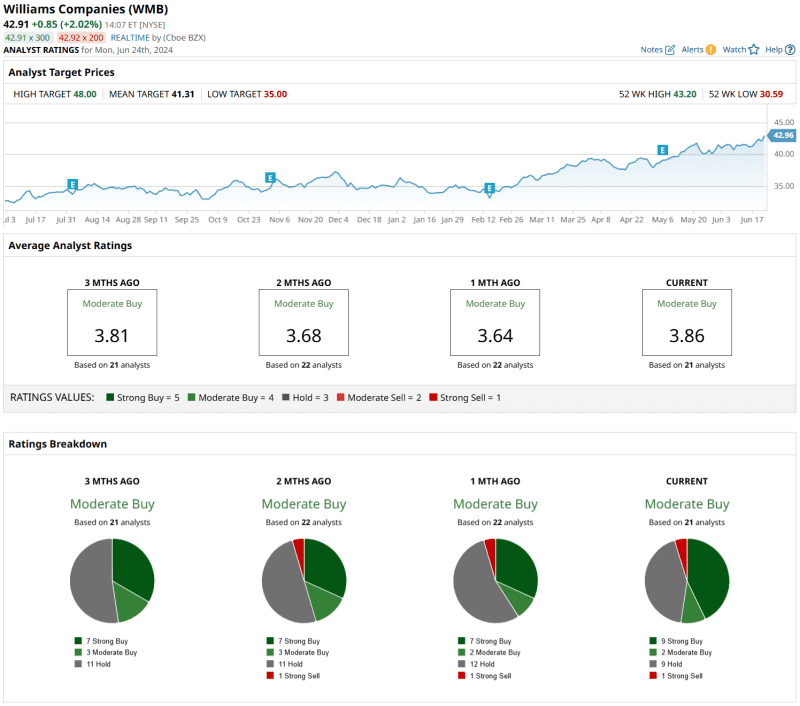

Out of 21 analysts, the consensus rating on WMB stock is a "Moderate Buy." This includes 9 "Strong Buy" recommendations, 2 "Moderate Buy" suggestions, 9 "Hold" advisories, and 1 "Strong Sell" vote.

The average target price for WMB is $41.31, which is a discount to Monday's closing price. However, Argus has a price target of $47, implying potential upside of about 9%.

The brokerage firm also raised its 2024 EPS estimate for Williams to $1.96, up from $1.86 previously, to reflect the company's better-than-expected Q1 results.

Notably, institutional investors are also bullish on Williams Companies, with 86.44% of the stock owned by institutions. Major shareholders include Vanguard Group, BlackRock (BLK), and State Street (STT), among others.

The Bottom Line on WMB Stock

In conclusion, Williams Companies (WMB) presents a compelling investment opportunity, offering a robust dividend yield and strong exposure to the in-demand natural gas industry. With its extensive natural gas infrastructure, strategic acquisitions, and commitment to sustainability, WMB looks well-positioned for long-term growth and income generation.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.